Interest On Ppf Exempt Under Section

Can the amount of interest is eligible as new investment in ppf and can we able to claim it under 80c deduction.

Interest on ppf exempt under section. But if employee withdraw the amount from ppf account before the 5 years then it will be taxable therefore reliance has deduct the tds on such amount. Tax benefits under section 80c. In itr 1 for ay 2018 19 you have to.

Interest from ppf is tax exempt. As interest on ppf is exempt from tax hence no need to deduct the tds. Both the interest earned as well as the withdrawals from ppf are tax free.

Go to tax paid and verification tab. Go to the exempted income schedule as section 10 11 is not mentioned on the face of the schedule. When it comes to ppf tax benefits the investment amount is eligible for tax deductions under section 80c of the income tax act the interest earned is also tax free and so is the maturity amount.

Income tax returns itr filing. But on nsc it is taxable deduction under section 80c of the income tax act 1961 act can be claimed to the extent of rs 1 50 000 cumulatively for the items specified in that regard. Exempt income comes in many forms such as the interest received through agricultural means interest received through ppf long term capital gains earned through shares and stocks and much more.

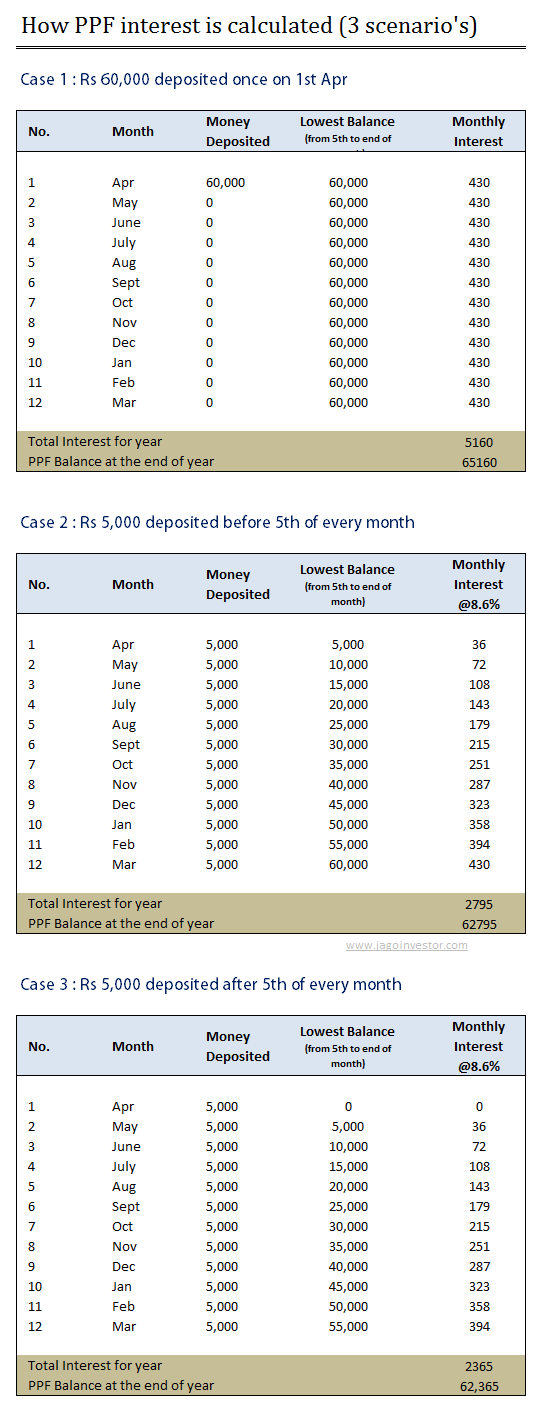

Interest earned on the public provident fund is tax free. Also every month the interest received is compounded annually in ppf. So ppf comes under the rare eee or exempt exempt exempt category of investments in india.

It is important to note that a ppf account cannot be closed before maturity. A sum of rs 1 5 lakhs invested every year qualifies for tax benefits. Public provident fund ppf ppf falls under the exempt exempt exempt eee category and the interest earned from ppf is fully exempted from tax without any limits.