Internal Revenue Code Irc Section 6050w

The new reporting requirements are in section 6050w of the internal revenue code the code which was added by section 3091 of the housing assistance tax act of 2008 div.

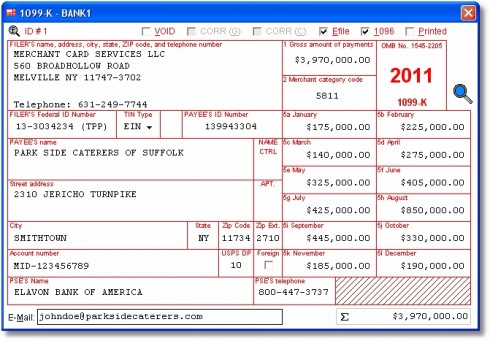

Internal revenue code irc section 6050w. 6050w a 2 the gross amount of the reportable payment transactions with respect to each such participating payee. Us irc section 6050w as a united states us based merchant acquiring entity american express must comply with all us internal revenue service irs regulations and legislation including the new internal revenue code irc section 6050w. E exception for de minimis payments by third party settlement organizations.

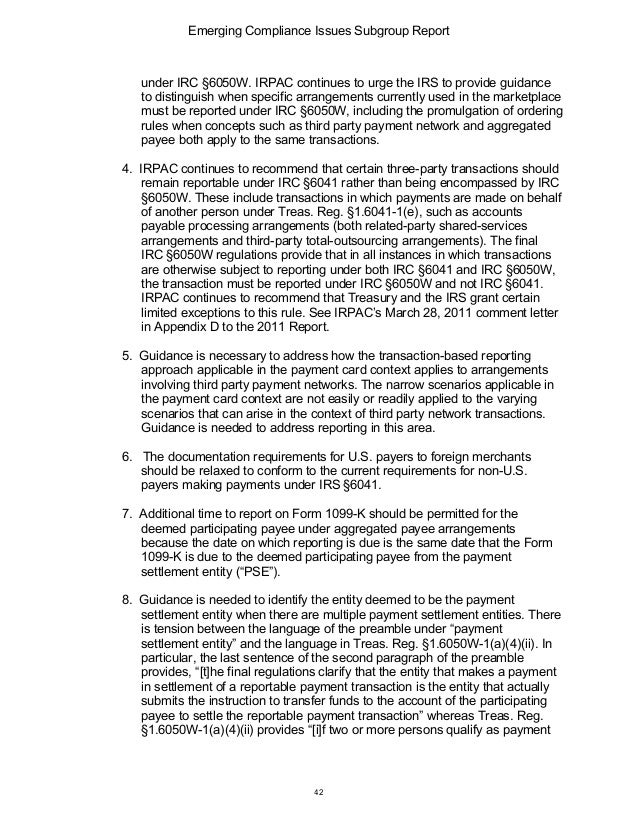

In the case of an entity referred to in section 6050p c 1 b of the internal revenue code of 1986 as added by this section the amendments made by this section shall apply to discharges of indebtedness after the date of the enactment of this act aug. Internal revenue code section 6050w returns relating to payments made in settlement of payment card and third party network transactions a in general. The final regulations under section 6050w the new payment card reporting requirements provide that payment card and third party network transactions that otherwise would be reportable both under section 6041 or 6041a a and under section 6050w must be reported under section 6050w and not under section 6041 or 6041a a.

Under recently enacted federal law section 6050w of the u s. As a result of these new requirements merchants must provide their valid tax identification number tin and tax filing name. The housing assistance tax act of 2008 included the enactment of section 6050w of the internal revenue code an important new measure that requires companies like first data to report the gross amounts of their merchant customers payment card transactions to the internal revenue service irs.

Internal revenue code requires all merchant acquiring entities including electronic merchant systems to report the gross amount of each merchant s payment card transactions on form 1099 k to the internal revenue service irs annually. Section 6050w requires information returns to be made for each calendar year by. Internal revenue code section 6050w e returns relating to payments made in settlement of payment card and third party network transactions.