Investment Advisers Act Section 206

A policies and procedures.

Investment advisers act section 206. Section 206 3 prohibits any investment adviser from engaging in or effecting a transaction on behalf of a client while acting either as principal for its own account or as broker for a person other than the client without disclosing in writing to the client before the completion of the transaction the adviser s role in the. Section 206 prohibited transactions by investment advisers. The securities and exchange commission commission is publishing two interpretive positions under section 206 3 of the investment advisers act of 1940.

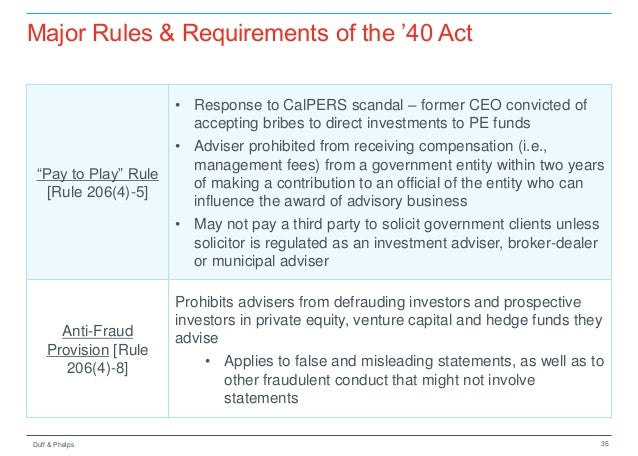

275 206 4 1 advertisements by investment advisers. 80b 3 it shall be unlawful within the meaning of section 206 of the act 15 u s c. 17 cfr 275 206 4 3 cash payments for client solicitations.

A it shall constitute a fraudulent deceptive or manipulative act practice or course of business within the meaning of section 206 4 of the act 15 u s c. 80b 3 directly or indirectly to publish circulate or distribute any advertisement. 275 206 4 3 cash payments for client solicitations.

Cash payments for client solicitations. District court in atlanta georgia charges lca and linder with violating the antifraud provisions of sections 206 1 206 2 and 207 of the investment advisers act of 1940. If you are an investment adviser registered or required to be registered under section 203 of the investment advisers act of 1940 15 u s c.

A it shall be unlawful for any investment adviser required to be registered pursuant to section 203 of the act to pay a cash fee directly or indirectly to a solicitor with respect to solicitation activities unless. The sec s complaint filed in u s. It shall be unlawful for any investment adviser by use of the mails or any means or instrumentality of interstate commerce directly or indirectly 1 to employ any device scheme or artifice to defraud any client or prospective client.

80b 6 4 for any investment adviser registered or required to be registered under section 203 of the act 15 u s c. The custody rule provides that it is a fraudulent deceptive or manipulative act practice or course of business within the meaning of section 206 4 of the advisers act for an investment adviser that is registered or required to be registered under the advisers act to have custody of client funds or securities unless they are maintained in accordance with the requirements of the custody rule.