Irc Section 47

For more detailed codes research information including annotations and citations please visit westlaw.

Irc section 47. 1 irc 42 low income housing credit revision date august 11 2015. Internal revenue code section 47 c 2. 47 a 1 in general for purposes of section 46 for any taxable year during the 5 year period beginning in the taxable year in which a qualified rehabilitated building is placed in service the rehabilitation credit for such year is an amount equal to the ratable share for such year.

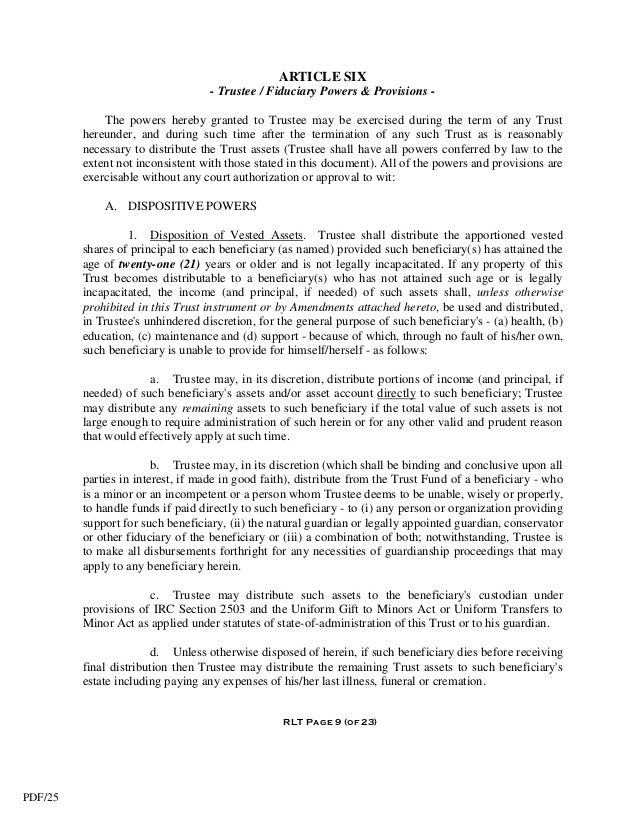

The preceding sentence shall not apply to any expenditure to the extent the alter native depreciation system of section 168 g applies to such expenditure by rea son of subparagraph b or c of section 168 g 1. For qualified rehabilitation credits determined under internal revenue code section 47 attributable to qualified rehabilitation expenses properly taken into account for periods after december 31 2007 the alternative tax rules are not applicable. Subsection n of section 48 relating to requirements for allowance of employee plan percentage is hereby repealed.

Internal revenue code 47. A section 47 enquiry is carried out by undertaking or continuing with an assessment in accordance with the guidance set out in this chapter and following the principles and parameters of a good assessment as set out in the assessments procedure. Ii cost of acquisition.

Rehabilitation credit on westlaw findlaw codes are provided courtesy of thomson reuters westlaw the industry leading online legal research system. Local authority social workers have a statutory duty to lead section 47 enquiries. Internal revenue code section 47 c 2 c.

Thus a taxpayer may use the rehabilitation tax credit to offset his regular tax liability. Except that paragraph 4 of section 48 n of the internal revenue code of 1986 formerly i r c. With respect to which the 24 month period selected by the taxpayer under clause i of section 47 c 1 b of the internal revenue code as amended by subsection b or the 60 month period applicable under clause ii of such section begins not later than 180 days after the date of the enactment of this act dec.

47 a 2 ratable share.