Irs Code Section 152

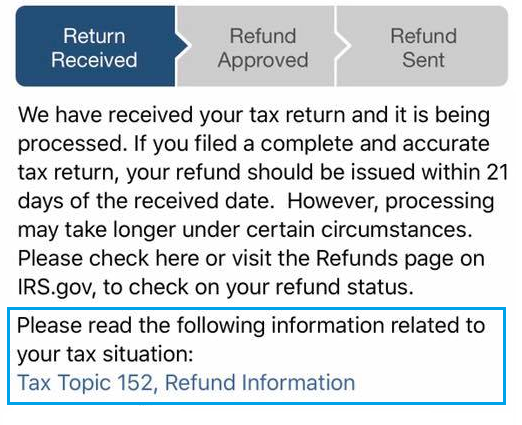

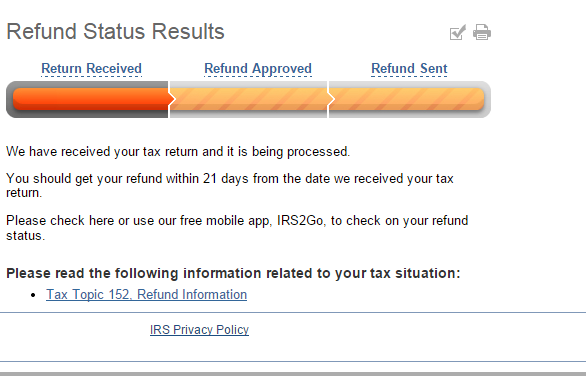

However it s possible that some tax returns may require further review and could take longer.

Irs code section 152. Purpose this notice provides guidance under section 152 d of the internal revenue code for determining whether an individual is a qualifying relative for whom the taxpayer may claim a dependency exemption deduction under section 151 c. Less than 21 days. 152 b 2 married dependents.

Refund timing the irs issues more than 9 out of 10 refunds in the normal time frame. B exceptions for purposes of this section 1 dependents ineligible if an individual is a dependent of a taxpayer for any taxable year of such taxpayer beginning in a calendar year such individual shall be treated as having no dependents for any taxable year of such individual beginning in such calendar year. Read the code on findlaw.

152 b 1 dependents ineligible if an individual is a dependent of a taxpayer for any taxable year of such taxpayer beginning in a calendar year such individual shall be treated as having no dependents for any taxable year of such individual beginning in such calendar year. A in general for purposes of this subtitle the term dependent means 1 a qualifying child or 2 a qualifying relative. Internal revenue code 26 usca section 152.

For purposes of this section 1 dependents ineligible if an individual is a dependent of a taxpayer for any taxable year of such taxpayer beginning in a calendar year such individual shall be treated as having no dependents for any taxable year of such individual beginning in such calendar year. Section 152 d 1 d provides that an individual is not a qualifying relative of the taxpayer if the individual is a qualifying child of any other taxpayer.