Irs Section 83 B Election

1954 may be made notwithstanding paragraph 2 of such section 83 b with the income tax return for any taxable year ending.

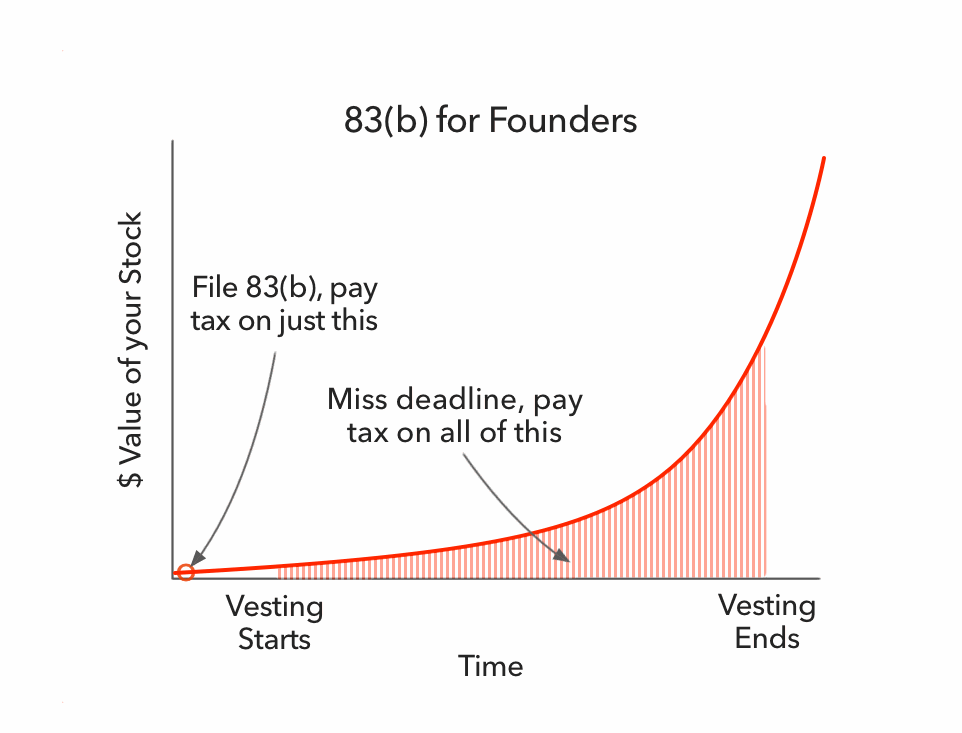

Irs section 83 b election. This page replaces treasury notice 2003 19. Under section 83 of the internal revenue code the founder employee would not recognize income the difference between fair market value and the price paid until the stock vests. In this example you timely file a section 83 b election within 30 days of the restricted stock grant when your shares are worth 1 000.

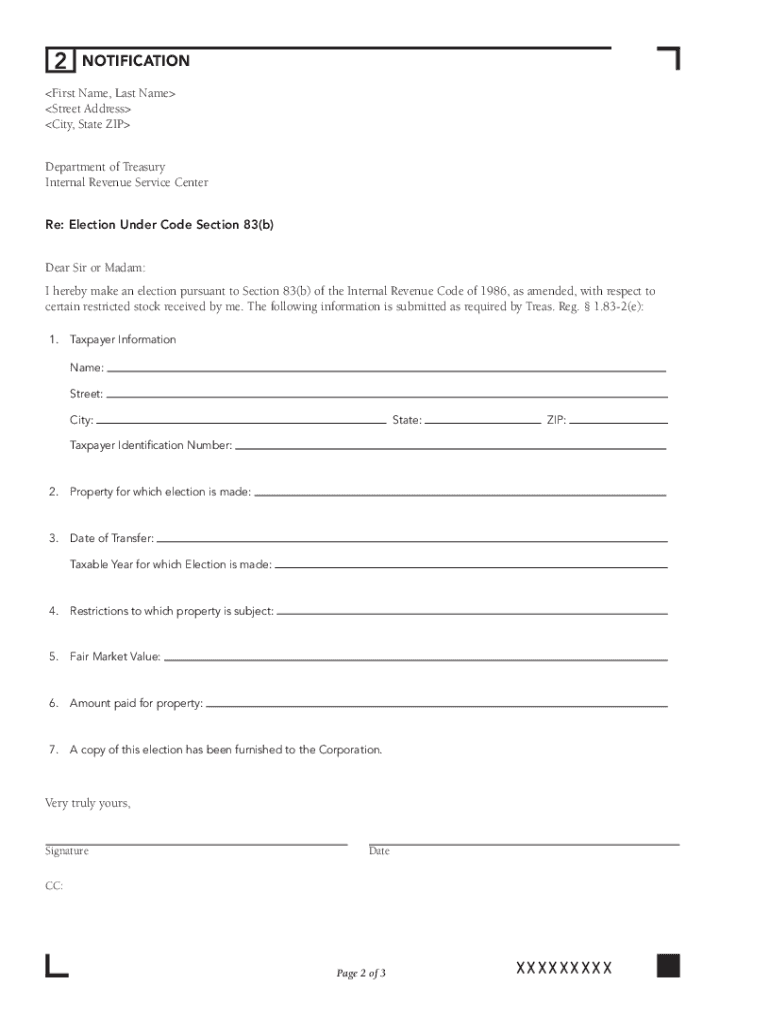

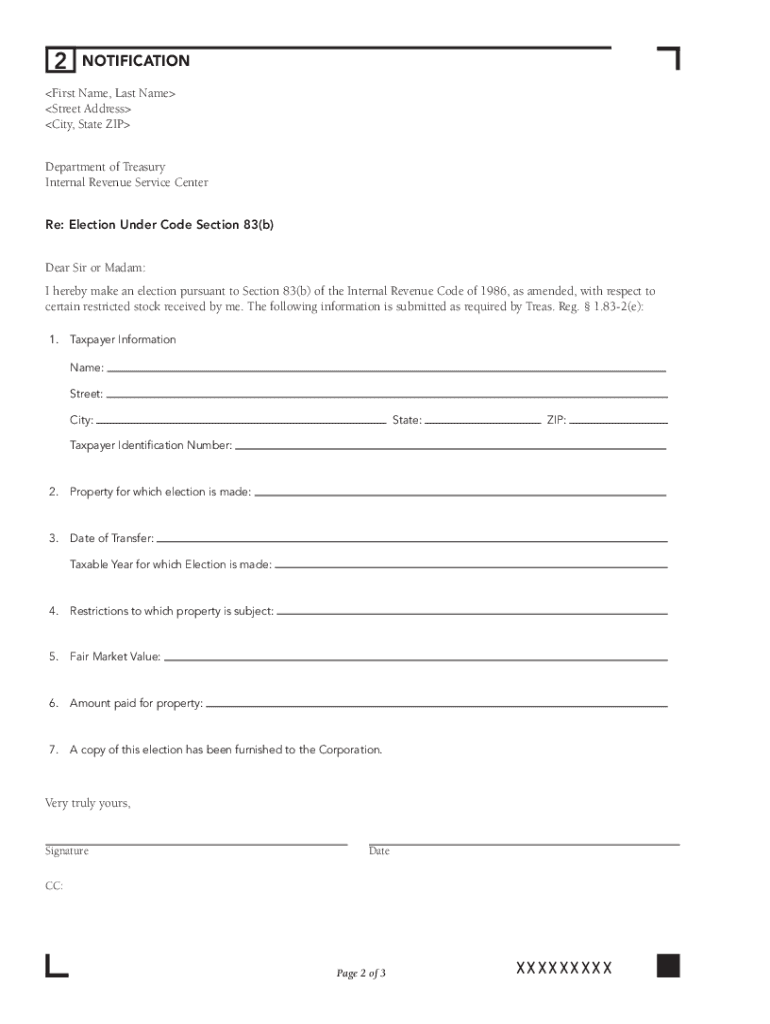

I hereby make an election pursuant to section 83 b of the internal revenue code of 1986 as amended with respect to certain restricted stock received by me. You must file your 83 b election with the irs within 30 days of receiving your stock grant or stock options. Under section 83 b the employee in our example is permitted to make a so called section 83 b election if the election is made the employee will be required to recognize as income the fair market value of all of the granted shares as of.

Purpose this revenue procedure contains sample language that may be used but is not required to be used for making an election under 83 b of the internal revenue code. By filing an election with the irs pursuant to section 83 b of the tax code. What is 83 b election.

However if a founder employee makes a voluntary section 83 b election the founder employee recognizes income upon the purchase of the stock. Additionally this revenue procedure provides examples of the income tax. Code of federal regulations cfr citations are in numerical order cfr citation required document.

There are a few things that employees and tax advisers must be aware of. It provides a quick guide listing information for the location to send certain elections statements returns and other documents. Internal revenue service center re.

This election is called the section 83 b election election. The filing is officially deemed to have been made on the date the 83 b is mailed from the post office. Election to include in gross income in year of transfer.