Irs Section 83 B

In the past the taxpayer was also required to attach and submit a copy of the 83 b election with the taxpayer s income tax return for the year in which the property was granted.

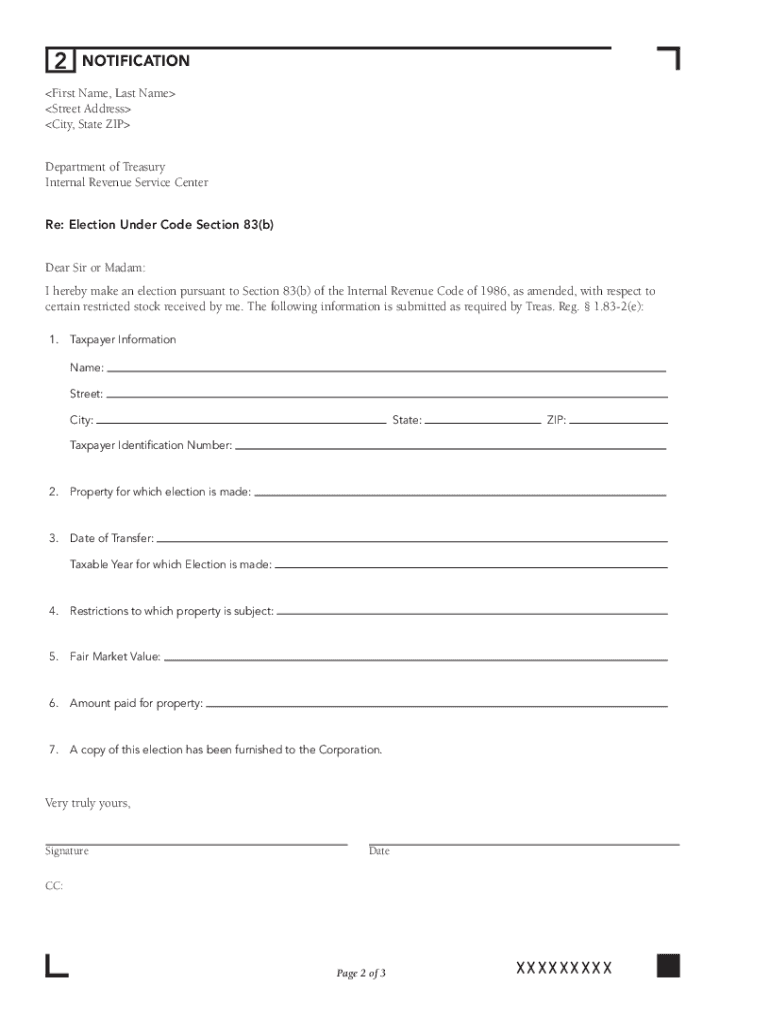

Irs section 83 b. What is 83 b election. Election under code section 83 b dear sir or madam. The 83 b election is a provision under the internal revenue code irc that gives an employee or startup founder the option to pay taxes on the total fair market value.

In accordance with treas. Mail a copy of the completed form to your employer. You should contact your tax professional to review your section 83 b election before filing with the irs.

1 83 2 c the taxpayer must file a written statement of the election with the irs no later than 30 days after the date of transfer. Internal revenue service center re. I hereby make an election pursuant to section 83 b of the internal revenue code of 1986 as amended with respect to certain restricted stock received by me.

Instructions for filing a section 83 b election. It provides a quick guide listing information for the location to send certain elections statements returns and other documents. This page replaces treasury notice 2003 19.

The table below shows where to send these items. Code of federal regulations cfr citations are in numerical order cfr citation required document. Complete the irs 83 b form that has been provided to.

1954 may be made notwithstanding paragraph 2 of such section 83 b with the income tax return for any taxable year ending. Mail the completed form to the irs within 30 days of your award date mail to the irs service center where you file your taxes. 04 under 83 e 3 and 1 83 7 b 83 does not apply to the transfer of an.