Nonrecaptured Section 1231 Losses

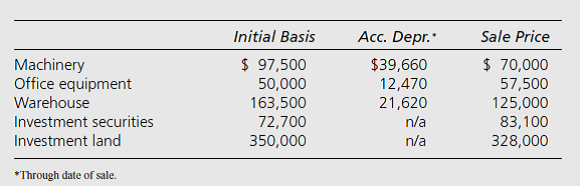

Section 1231 gains are given long term capital gain treatment and subsequently reported on schedule d.

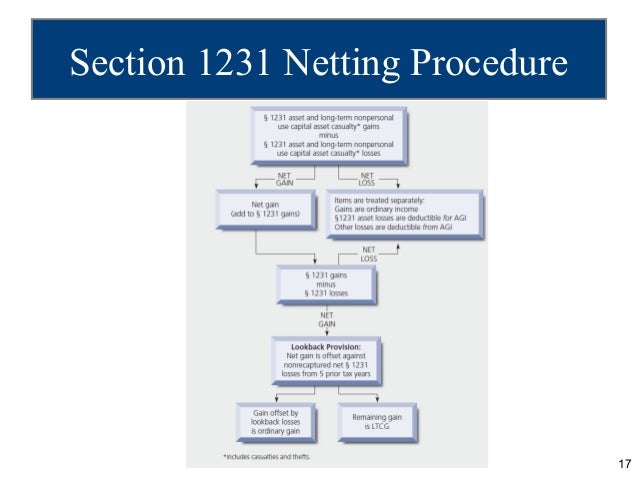

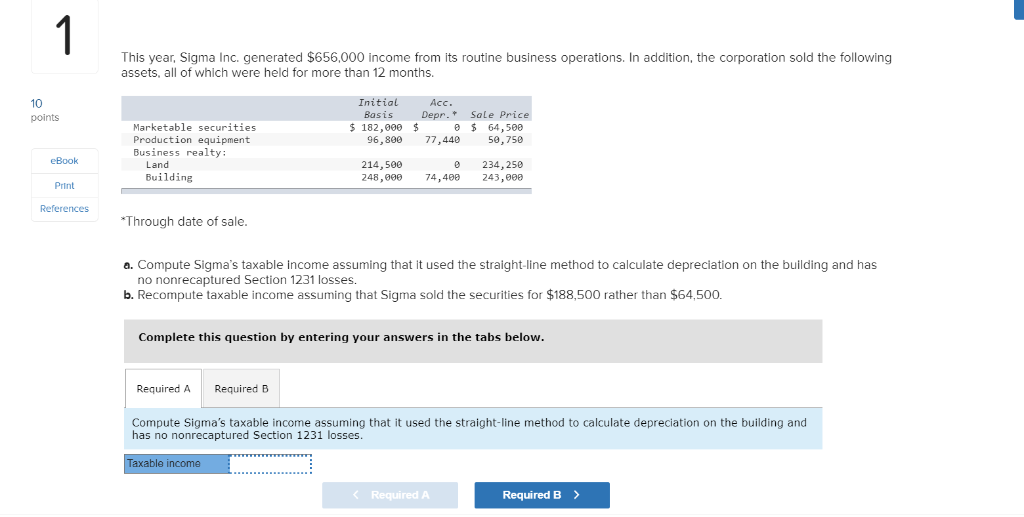

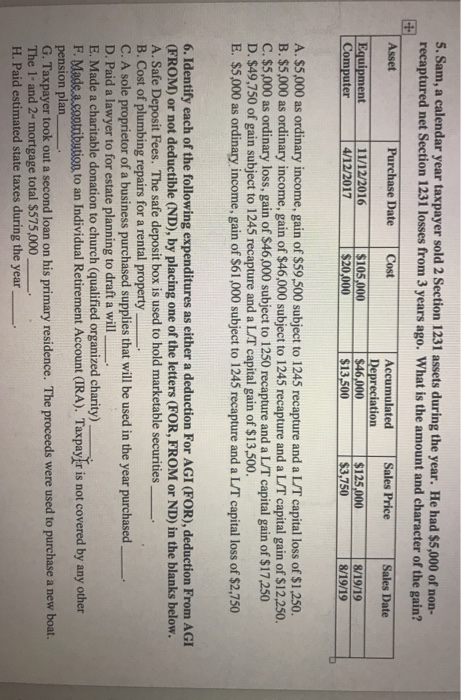

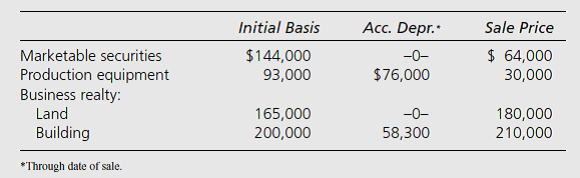

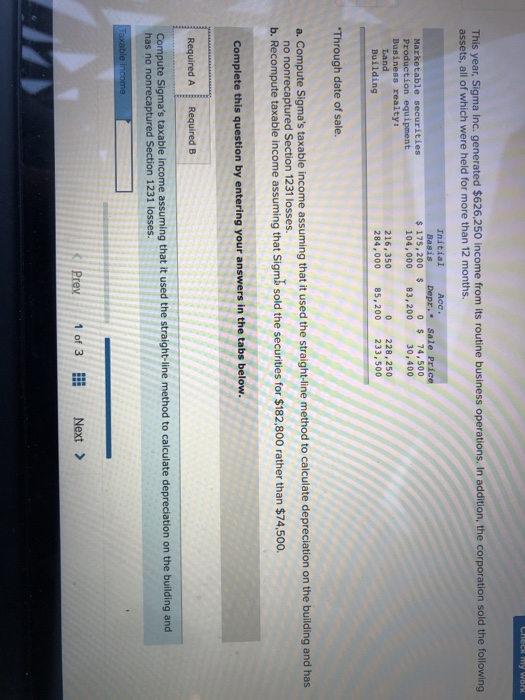

Nonrecaptured section 1231 losses. An equivalent amount of current year net section 1231 gains will be taxed as ordinary income. If there are no sec 1231 gains to offset them in the next 5 years what happens to those losses. Their treatment as ordinary or capital depends on whether you have a net gain or a net loss from all your section 1231 transactions.

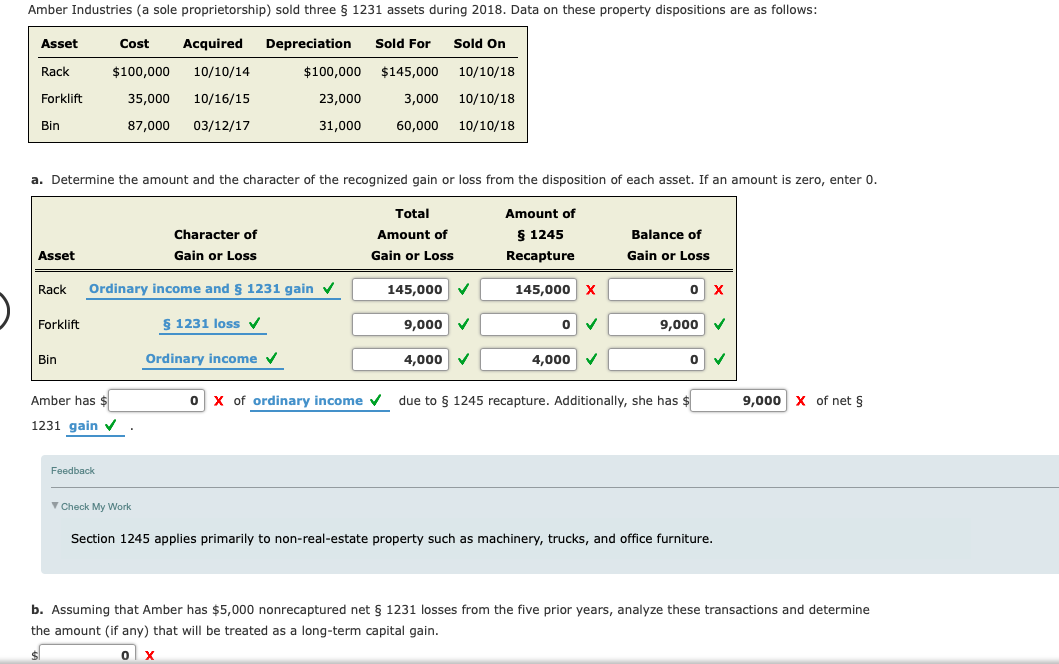

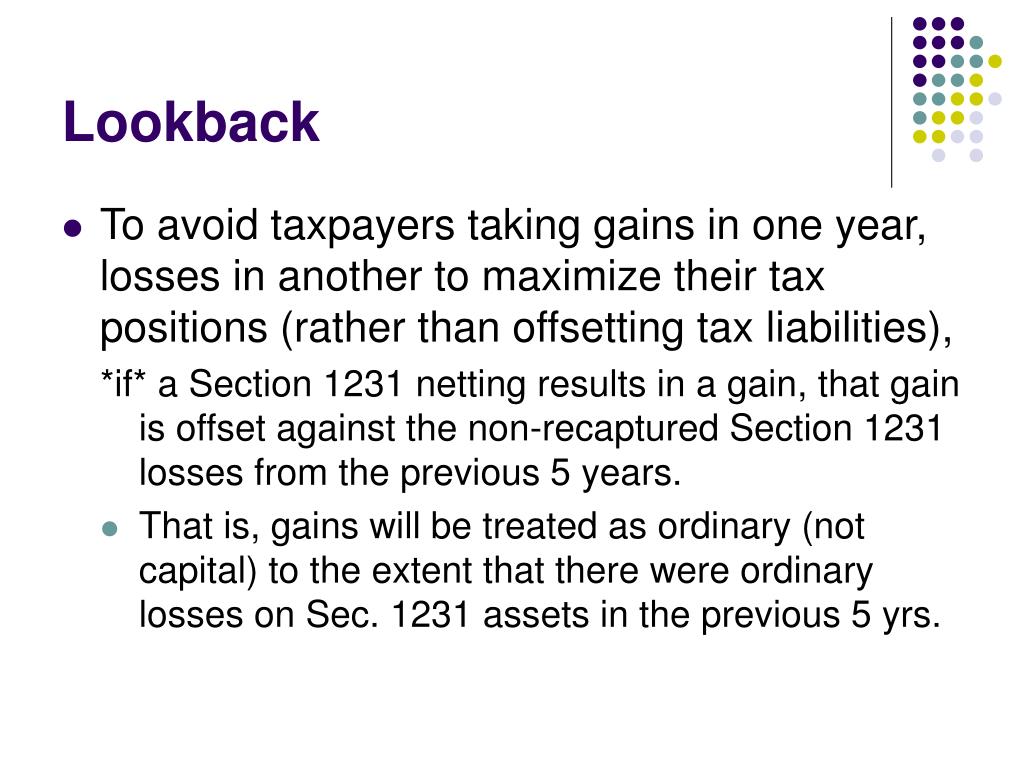

The reason nonrecaptured section 1231 losses must be recaptured over a five year period is to prevent gain and loss manipulation from year to year. For example if a taxpayer could anticipate when a gain or loss will be realized on the sale of section 1231 property such sales could be timed to take gains in one year and losses in a different year. The amount of net 1231 losses on the carryover report is the nonrecaptured section 1231 losses.

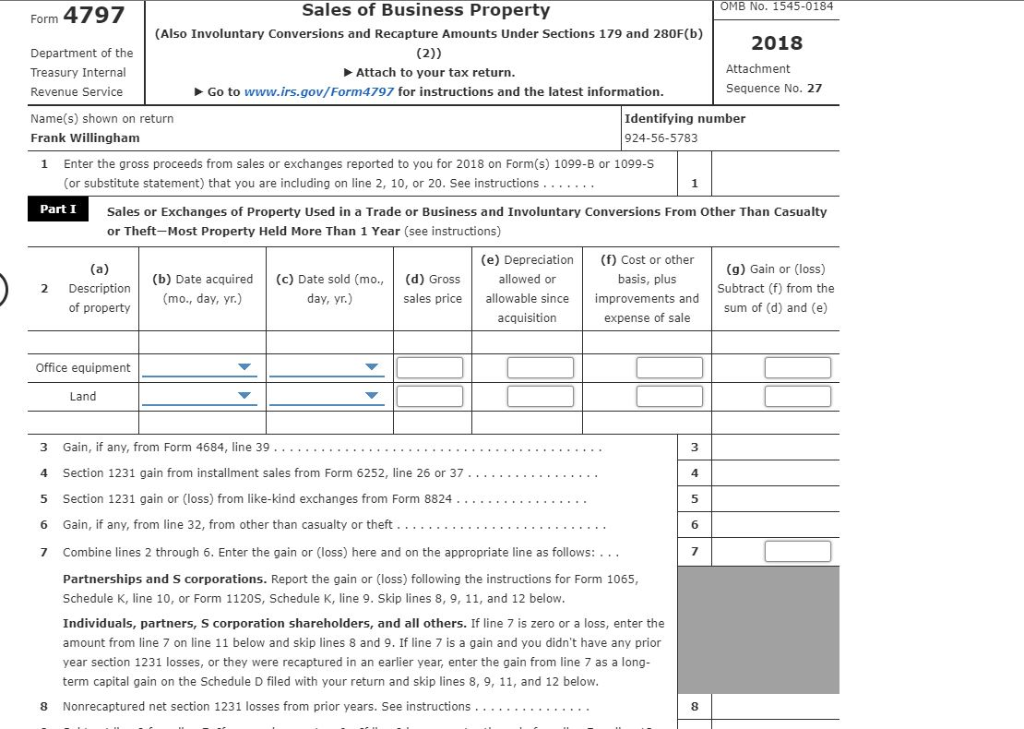

To determine the treatment of section 1231 gains and losses combine all your section 1231 gains and losses for the year. Per form 4797 line 8 instructions part or all of the client s section 1231 gains on line 7 may be taxed as ordinary income instead of receiving long term capital gain treatment. If you have a net section 1231 loss it is ordinary loss.

Treatment as ordinary or capital. Section 1231 losses are treated as ordinary losses and reduce other ordinary income. If you have a net section 1231 gain it is ordinary income up to the amount of your nonrecaptured section 1231 losses from previous years.

On the carryover report there are nonrecaptured sec 1231 losses. Property deducted under the de minimis safe harbor for tangible property. The entire disposition is outlined on form 4797 part i.

These losses are applied against your net section 1231 gain beginning with the earliest loss in the 5 year period until the section 1231 loss is applied against a net section 1231 gain it is a nonrecaptured section 1231 loss that the software tracks for five years. Worksheets wks carry and wks 1231 c are part of that tracking process. Section 1231 gains and losses.