Qualified Leasehold Improvements Section 179

Improvements must be placed into service after the building s date of service and explicitly exclude expansion of the building elevators and escalators and.

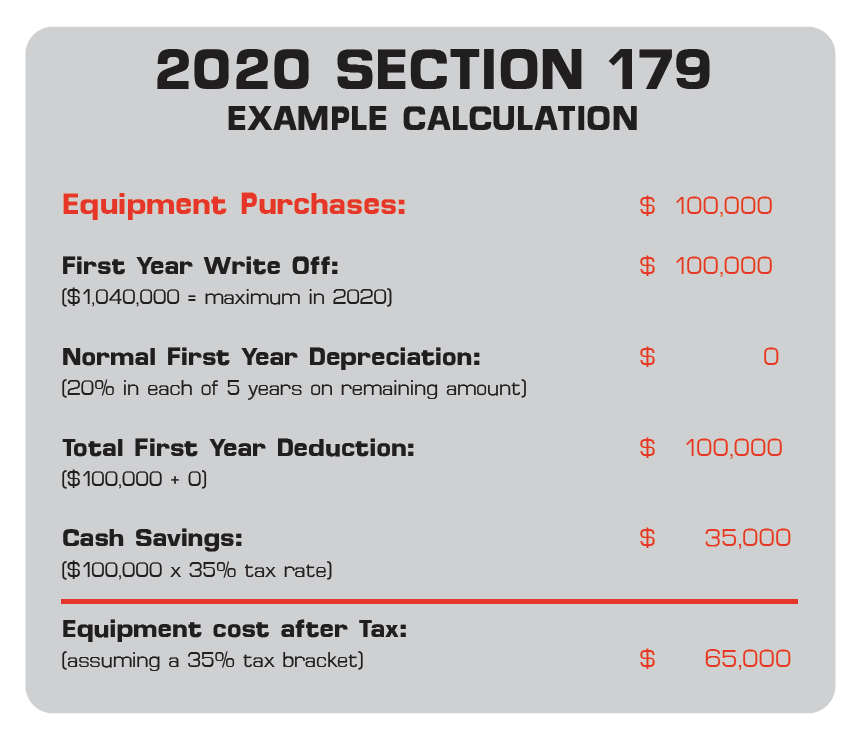

Qualified leasehold improvements section 179. You can carry over to 2020 a 2019 deduction attributable to qualified section 179 real property that you placed in service during the tax year and that you elected to expense but were unable to take because of the business income limitation. However section 179 begins to phase out when you place in service assets valued in excess of 2 000 000 in a single tax year. For real estate qualified improvement property that was acquired and placed in service between september 28 2017 and december 31 2017 100 first year bonus depreciation was allowed.

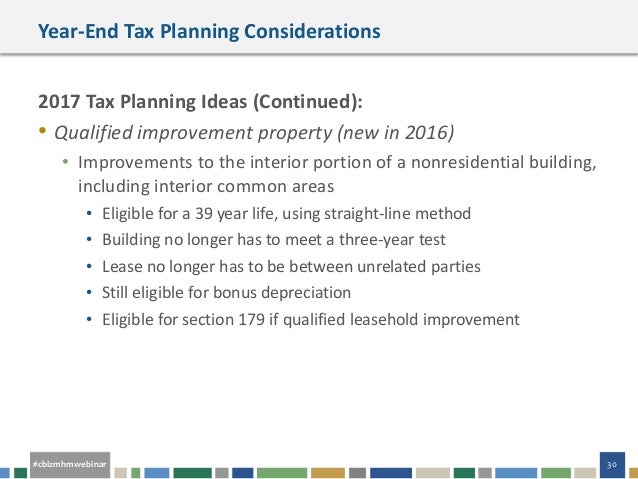

Section 179 historically was only applicable to tangible personal property not real property. Currently all qualified leasehold improvements are included in this phase out calculation which could eliminate section 179 eligibility depending on the value of the assets your business places in service in a year. Bonus depreciation on and section 179 expensing of qualified leasehold improvement property there is another benefit related to qlhi it is eligible for bonus depreciation under irs code section 168 k 2 a i ii whereas the asset would be ineligible for bonus under its former 39 year life except for special carve outs such as liberty zone.

What if you spent 750 000 on leasehold improvements this year for one of your retail strip plazas. Due to the intricacies of the law as to what types of property qualify i have laid out specific guidelines to assist in determining the. Qualified improvement property which means any improvement to a building s interior.

Qualified improvement property qip is a term found in the internal revenue code section 168 and encompasses any improvements made to the interior of a commercial real property. The limit for 2016 is 500 000 and will be adjusted for inflation going forward. Qualified leasehold improvements can be expensed up to 250 000 for tax years beginning in 2010 and 2011.

You can generally expense qualified improvements under section 179 as opposed to depreciating them. The tcja permanently increases the maximum section 179 deduction to 1 million up from 510 000 for tax years beginning in. The new roof will be capitalized on your depreciation schedule and expensed under section 179 provision and the old roof is removed.

Yes if you meet the other section 179 limitations for income and total section 179 property pis for the year. Section 179 the path act permanently restored section 179 expensing. Special rules for qualified section 179 real property.