Sarbanes Oxley Section 203

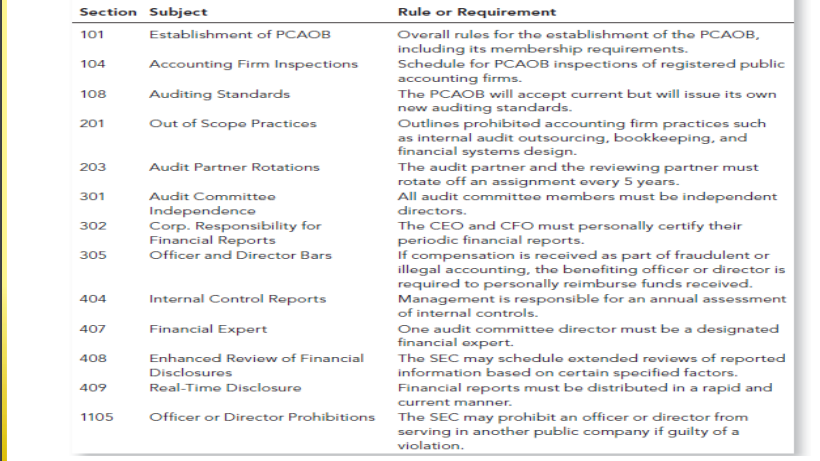

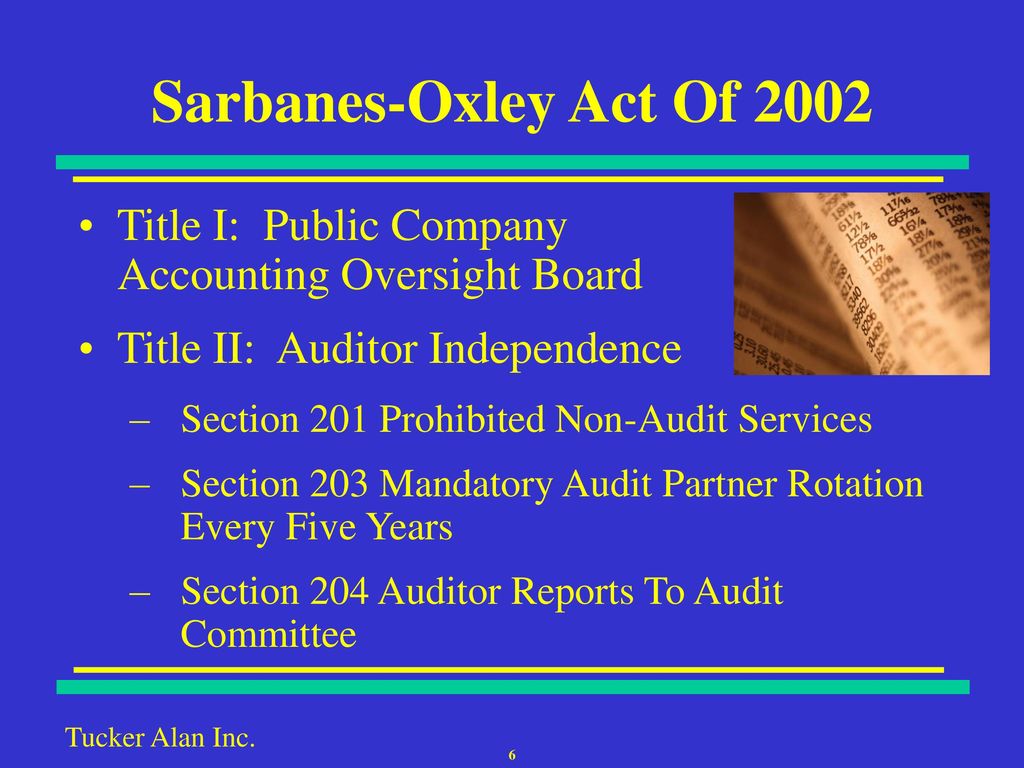

As mandated by section 203 of the sarbanes oxley act the new rules provide that an accounting firm will not be independent if either the lead audit partner or the concurring partner perform audit services for more than five consecutive fiscal years of an audit client.

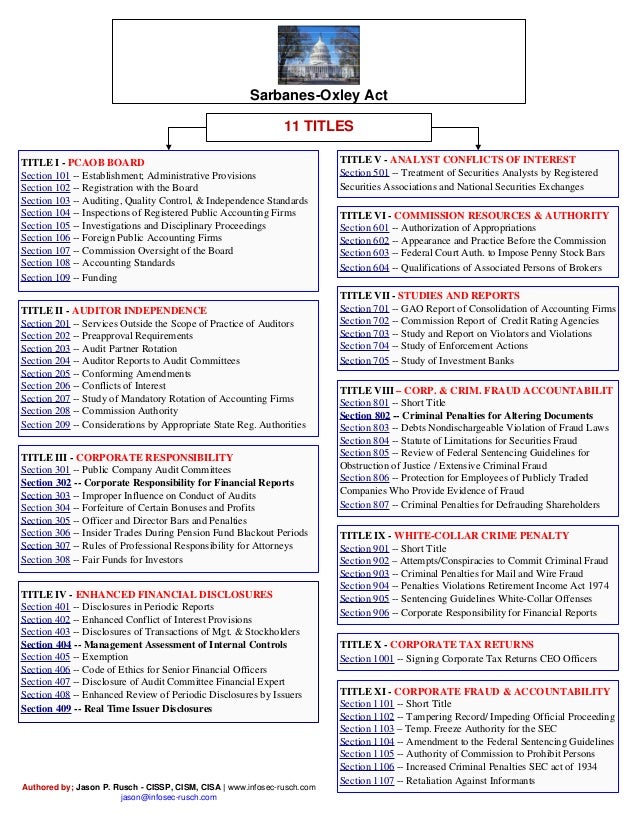

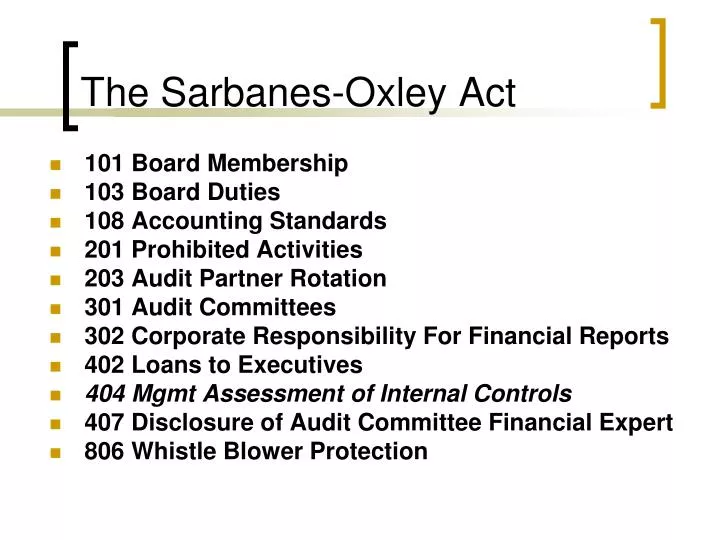

Sarbanes oxley section 203. The actual table of contents from the sarbanes oxley act of 2002 report issued on july 24 2002 in the u s. The rules will specify that the lead and concurring partner must rotate after five years and be subject to a five year time out period after rotation. A violation of rules of the public company accounting oversight board board is treated as a violation of the 34 act giving rise to the same penalties that may be imposed for violations of that act.

Study of mandatory rotation of registered public accounting firms. Commission rules and enforcement. It shall be unlawful for a registered public accounting firm to provide audit services to an issuer if the lead or coordinating audit partner having primary responsibility for the audit or the audit partner responsible for reviewing the audit has performed audit services for.

745 enacted july 30 2002 also known as the public company accounting reform and investor protection act in the senate and corporate and auditing accountability responsibility and transparency act in the house and more commonly called sarbanes oxley sarbox or sox is a united states federal law that set new or. This document sets out the text of the sarbanes oxley act of 2002 as originally enacted. Sarbanes oxley act of 2002 toc.

The sarbanes oxley act of 2002 pub l. Extending beyond the mandate of section 203 the final rules also require a. The securities exchange commission sec administers sarbanes oxley.

As defined in section 2 of the sarbanes oxley act of 2002 directly or indirectly including through any subsidiary to extend or maintain credit to arrange for the extension of credit or to renew an extension of credit in the form of a personal loan to or for any director or executive officer or. Auditor reports to audit committees. Study of mandatory.

Section 203 of the sarbanes oxley act specifies that the lead and concurring partner must be subject to rotation requirements after five years. Order regarding section 103 a 3 b of the sarbanes oxley act of 2002 the sarbanes oxley act of 2002 act established the public company accounting oversight board pcaob and charged it with the responsibility of overseeing the audits of public companies that are subject to the u s. Section 203 of the sarbanes oxley act of 2002 specifies that.