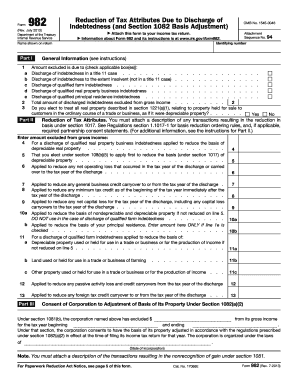

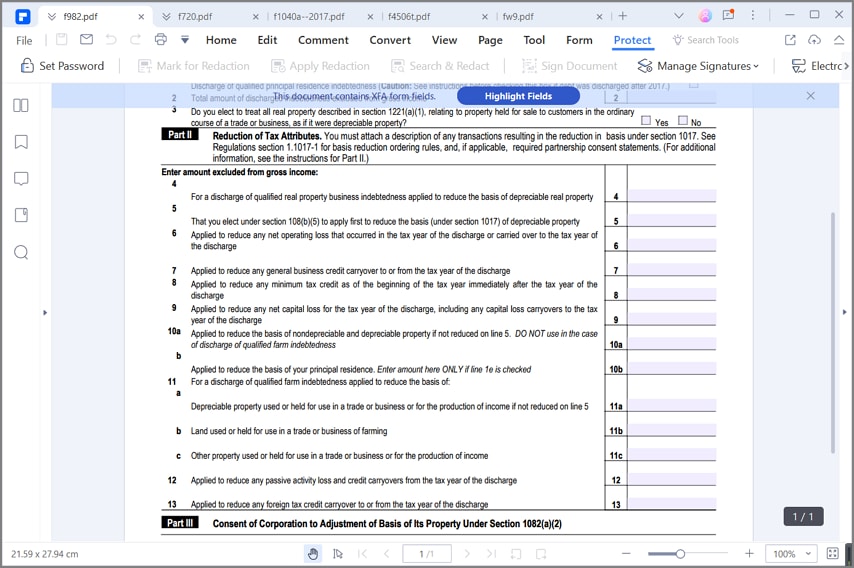

Section 1082 Basis Adjustment

Instructions for form 982 reduction of tax attributes due to discharge of indebtedness and section 1082 basis adjustment publications.

Section 1082 basis adjustment. The corporation is organized under the laws of. Under that section the corporation consents to have the basis of its property adjusted in accordance with the regulations prescribed under section 1082 a 2 in effect at the time of filing its income tax return for that year. March 2018 department of the treasury internal revenue service section references are to the internal revenue code unless otherwise noted.

Use form 982 to show the amounts of canceled debt excluded from income and the reduction of tax. 1 section 1082 a 2 sets forth seven categories of property the basis of which for determining gain or loss shall be reduced in the order stated. Form 982 is used to determine under certain circumstances described in section 108 the amount of discharged indebtedness that can be excluded from gross income.

You must attach a description of the transactions resulting in the nonrecognition of gain under section 1081. Instructions for form 982 reduction of tax attributes due to discharge of indebtedness and section 1082 basis adjustment. To make an election under section 1017 b 3 e or 4 c a taxpayer must enter the appropriate information on form 982 reduction of tax attributes due to discharge of indebtedness and section 1082 basis adjustment and attach the form to a timely filed including extensions federal income tax return for the taxable year in which the taxpayer has cod income that is excluded from gross income under section 108 a.

General instructions future developments for the latest information about. Publication 225 farmer s tax guide cancellation of debt. Current revision form 982 pdf information about form 982 reduction of tax attributes due to discharge of indebtedness and section 1082 basis adjustment including recent updates related forms and instructions on how to file.

Reduction of tax attributes due to discharge of indebtedness and section 1082 basis adjustment for use with form 982 rev. Under that section the corporation consents to have the basis of its property adjusted in accordance with the regulations prescribed under section 1082 a 2 of the internal revenue code in effect at the time of filing its income tax return for that year. Of state of incorporation note.