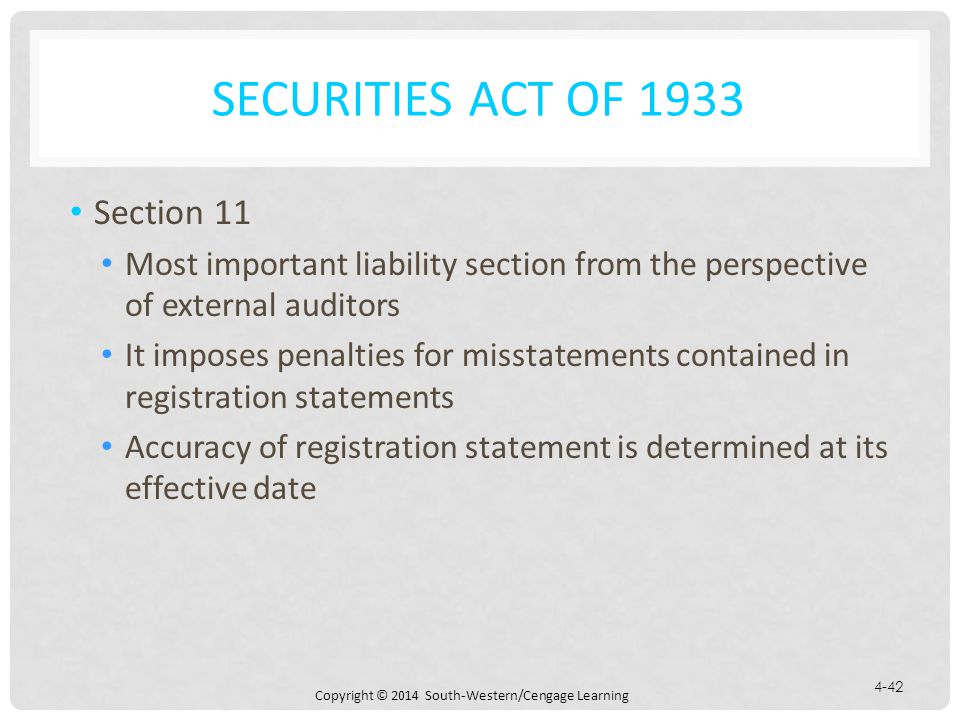

Section 11 Securities Act Of 1933

The 1933 act was the first major federal legislation to regulate the offer and sale of securities.

Section 11 securities act of 1933. Section 15 liability of controlling persons. The primary purpose of the 33 act is to ensure that buyers of securities receive complete and accurate. Section 11 of securities act of 1933.

This provision primarily applies to omissions and errors in disclosure pursuant to a public offerings. Section 13 limitation of actions. The focus of this research guide is on liability under section 11 of the securities act of 1933.

Sections 11 a and b of the 33 act provide for strict liability tort liability for issuers who make material misstatements or omissions in the issuance of securities. Securities act of 1933. Often referred to as the truth in securities law the securities act of 1933 has two basic objectives.

Prohibit deceit misrepresentations and other fraud in the sale of securities. Securities act of 1933 history. Section 14 contrary stipulations void.

The 1933 act covers initial distributions of securities while the 1934 act covers regulating the secondary markets. Section 16 additional remedies. Section 12 civil liabilities arising in connection with prospectuses and communications.

Chriswell corporation decided to raise additional long term capital by issuing 20 million of 12 percent subordinated debentures to the public. In that spirit congress passed the securities act of 1933. The securities acts of 1933 and 1934 provide comprehensive legislation for united states securities.