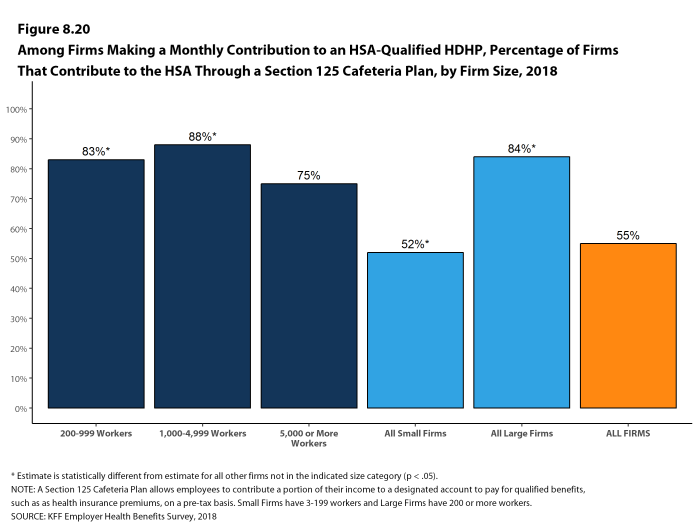

Section 125 Plan Definition

A section 125 cafeteria plan is an employer sponsored benefits plan that lets employees pay for certain qualified medical expenses such as health insurance premiums on a pre tax basis.

Section 125 plan definition. This is a flexible benefit plan. A plan wherein an employer offers a choice of salary or specified nontaxable fringe benefits from which participating employees may select. A section 125 plan is something that the employer must maintain separately from the health insurance policy or any other benefit program that their employees participate in and the section 125 plan includes a summary plan description which should be updated annually.

Employees receive benefits as pre tax deductions. The plan may be funded with employer contributions employee contributions usually through salary reduction agreements or a combination of both. A plan named after the section of the irs tax code that permits employee contributions the ability to be matched by pre tax dollars.

These benefits may be. However there are four exceptions to this general rule. A section 125 plan typically prohibits the deferral of compensation.

A 125 cafeteria plan is a written plan that allows employees to elect between permitted taxable benefits such as cash and certain qualified benefits. Also called a section 125 plan. If taken as a.

Section 125 is a written plan that lets employees choose between qualifying benefits and cash. A section 125 plan is part of the irs code that enables and allows employees to take taxable benefits such as a cash salary and convert them into nontaxable benefits. A section 125 plan is the only means by which you can offer employees a choice between taxable and nontaxable benefits without the choice causing the benefits to become taxable.

It s called a cafeteria plan because like walking through a cafeteria and selecting various dishes to eat employees can choose the types of healthcare options they want such as medical dental vision and other benefits and decline the ones they don t. A cafeteria plan also known as a section 125 plan is a written plan that offers employees a choice between receiving their compensation in cash or as part of an employee benefit.

:max_bytes(150000):strip_icc()/thinkstockphotos-462417173-5bfc2b4446e0fb005144d05d.jpg)