Section 179 Depreciation Calculator

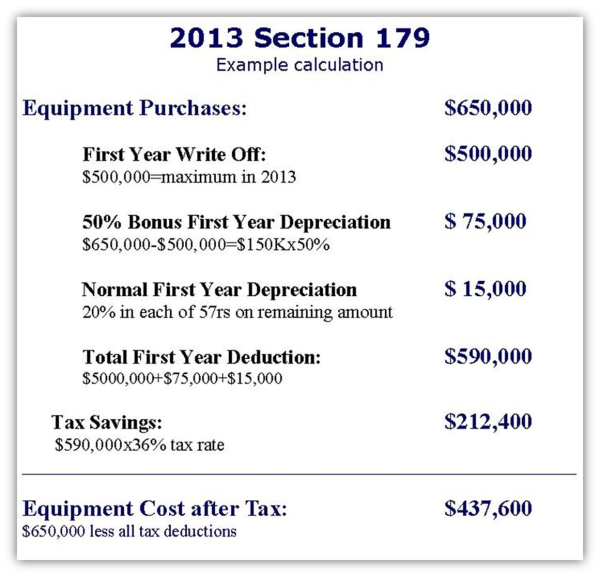

After the section 179 benefits are exhausted.

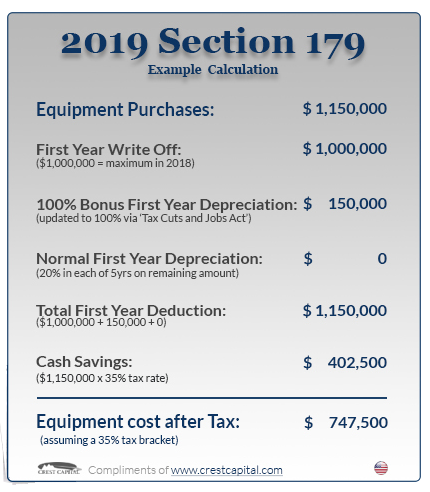

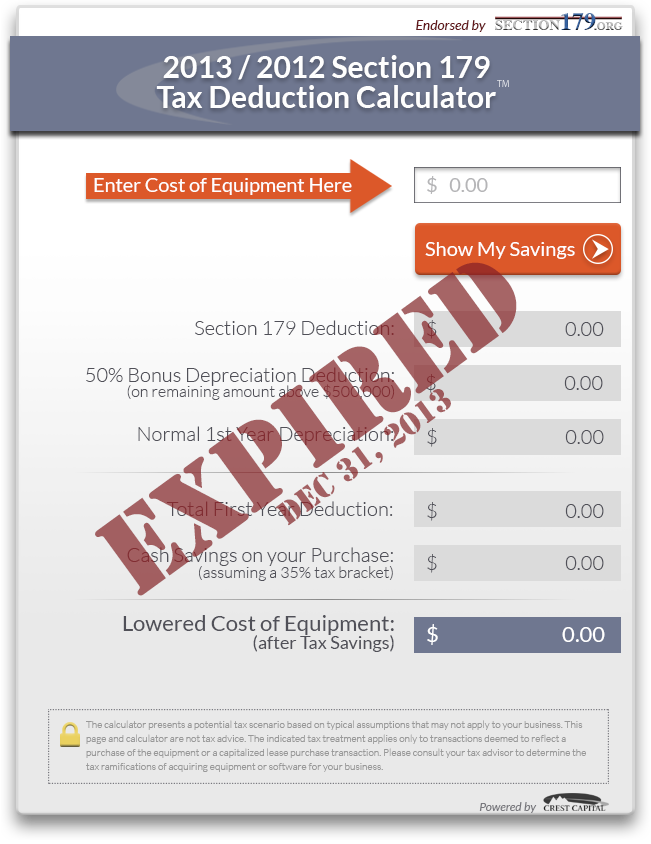

Section 179 depreciation calculator. Above is the best source of help for the tax code. Bonus depreciation of 100 can be now taken until 2022 on the remaining amount of equipment placed into service. To give you an estimate of how much money you can save here s a section 179 deduction calculator to make computing section 179 deductions simple.

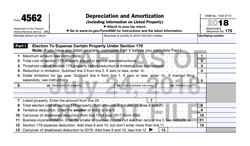

The macrs depreciation calculator adheres to us income tax code as found in irs publication 946 opens in new tab. Section 179 calculator are you considering whether or not to purchase or lease equipment in the current tax year. See maximum depreciation deduction in chapter 5.

If you have a question about the calculator and what it does or does not support feel free to ask it in the comment section on this page. Section 179 is simple. Use this calculator to help determine your section 179 write off amount and the tax savings it might generate for you.

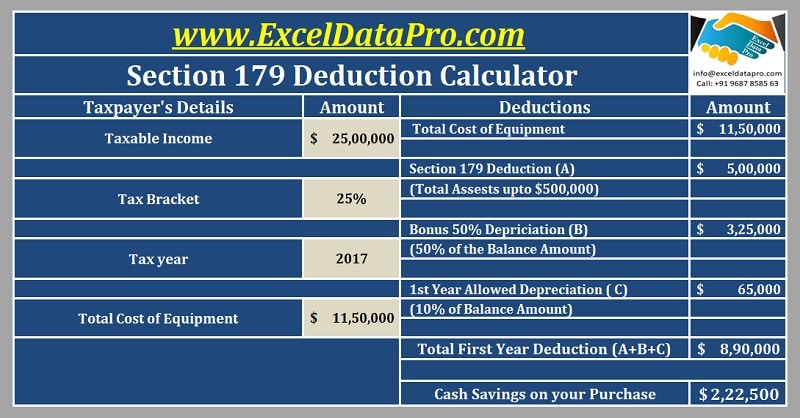

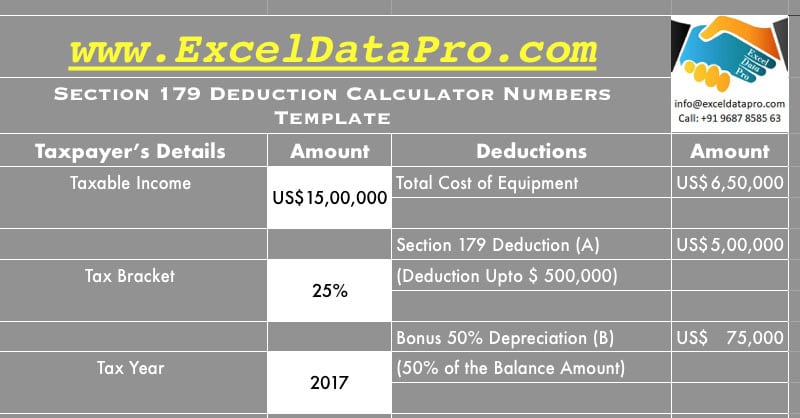

You buy finance or lease qualifying equipment vehicles and or software and then take a full tax deduction on for this year. This free section 179 calculator is updated for 2020 go ahead and punch up some numbers to see how much you can save. This provides significant tax savings compared to depreciating the assets over several years.

Section 179 calculator leveraging section 179 of the irs tax code could be the best financial decision you make this year. The section 179 tax deduction encourages small and medium businesses to invest in themselves by allowing a full write off of the cost of new and used qualifying equipment. Section 179 is a type of tax deduction that lets you deduct up to 1 million in equipment and other fixed assets as a business expense on your tax return.

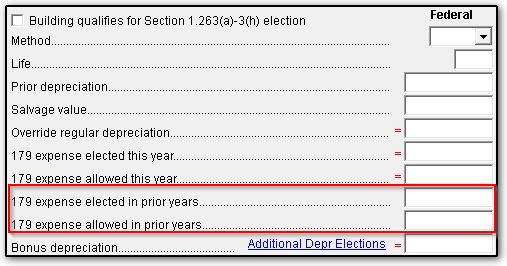

This section 179 deduction calculator for 2020 may very well help in your decision as section 179 will save your company a lot of money the deduction is at a robust 1 040 000 and will stay there for the entirety of 2020. The total section 179 deduction and depreciation you can deduct for a passenger automobile including a truck or van you use in your business and first placed in service in 2019 is 10 100 if the special depreciation allowance does not apply. Section 179 deduction calculator is an excel template to help you calculate the amount you could save on your tax bill by taking the section 179 deduction.