Section 179 Irc

This section shall not apply to any section 179 property purchased by any person described in section 46 e 3 unless the credit under section 38 is allowable with respect to such person for such property determined without regard to this section 1988 subsec.

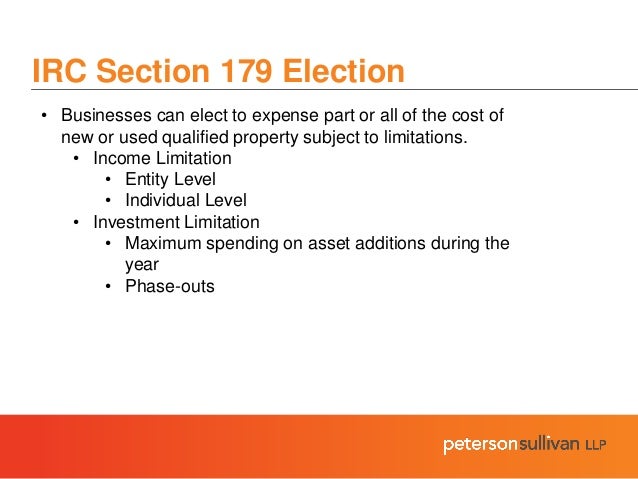

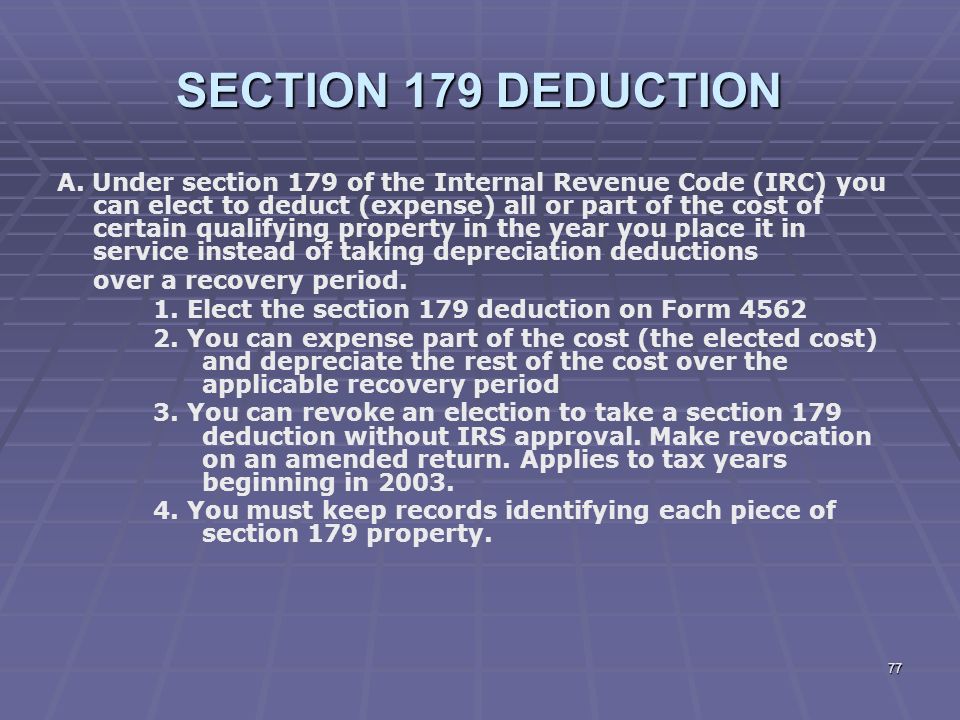

Section 179 irc. 179 allows a taxpayer to elect to deduct the cost of certain types of property on their income taxes as an expense rather than requiring the cost of the property to be capitalized and depreciated this property is generally limited to tangible depreciable personal property which is acquired by purchase for use in the. An increased section 179 deduction is available to enterprise zone businesses for qualified zone property placed in service during the tax year in an empowerment zone. The amendments made by this section enacting this section and amending sections 263 312 1016 1245 and 1250 of this title shall apply to property placed in service after december 31 2005 u s.

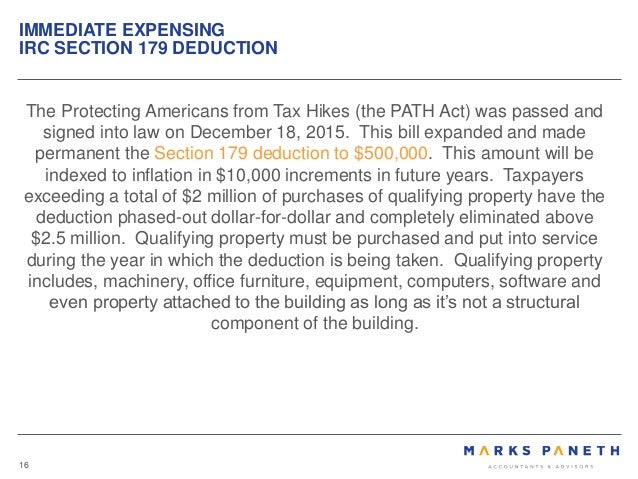

Ir 2018 257 december 21 2018. Companies can deduct the full price of qualified equipment purchases up to 1 040 000 with a total equipment. Section 179 does come with limits there are caps to the total amount written off 1 040 000 for 2020 and limits to the total amount of the equipment purchased 2 590 000 in 2020.

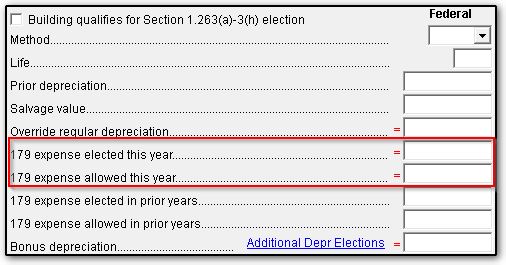

Section 179 deductions speed up the deduction taking all of the cost as a deduction in the first year. 5 read as follows. The 2020 section 179 deduction limit for businesses is 1 040 000 jan 16 2020 the section 179 deduction for 2020 is 1 040 000 dollars.

Bonus depreciation remains at 100 until january 1 2023. For more information including the definitions of enterprise zone business and qualified zone property see sections 1397a 1397c and 1397d of the internal revenue code. These rules as amended by the tax cuts and jobs act tcja in december 2017 generally apply to tax years beginning after 2017.

The deduction begins to phase out on a dollar for dollar basis after 2 590 000 is spent by a given business thus the entire deduction goes away once. Section 179 of the irc allows businesses to take an immediate deduction for business expenses related to depreciable assets such as equipment vehicles and software. Prior to amendment par.

Washington the internal revenue service issued revenue procedure 2019 08 pdf today to provide guidance on deducting expenses under section 179 a and on deducting depreciation under section 168 g.