Section 197 Intangible

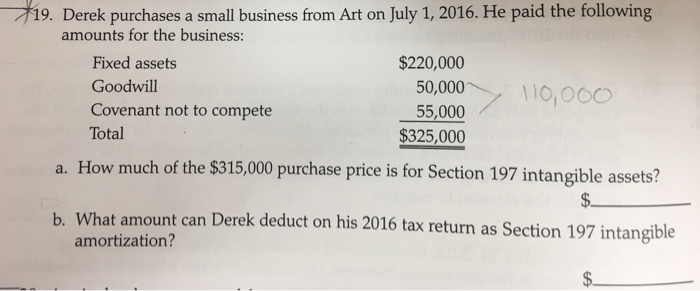

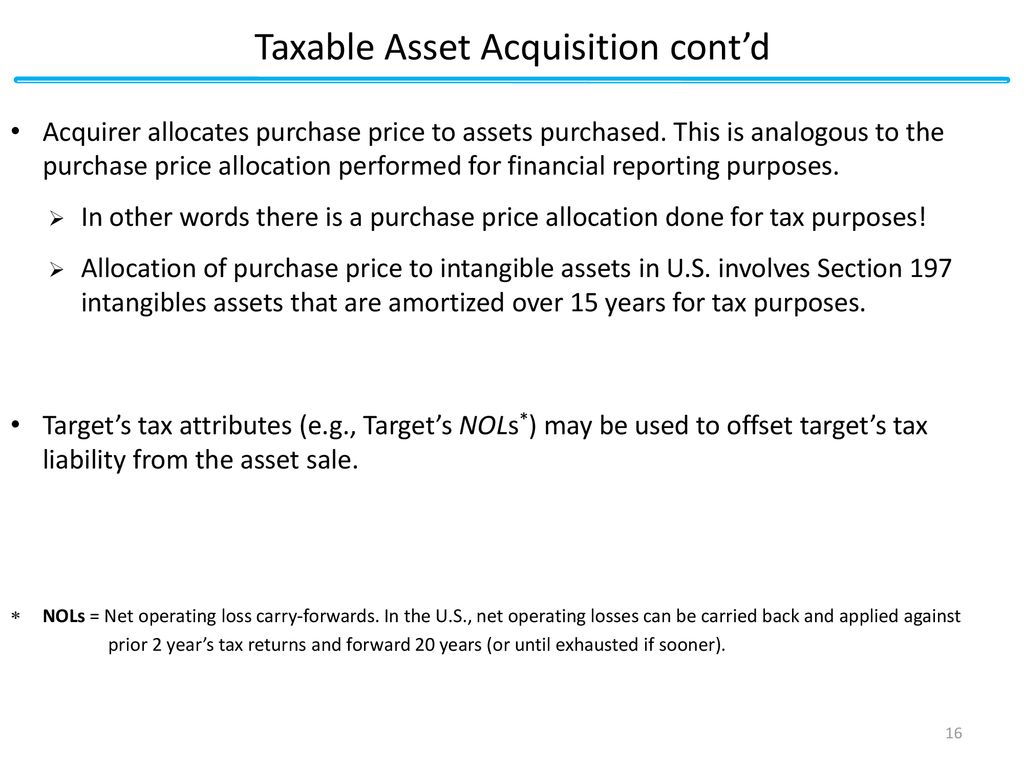

Section 197 amortization rules apply to some business assets but not to others.

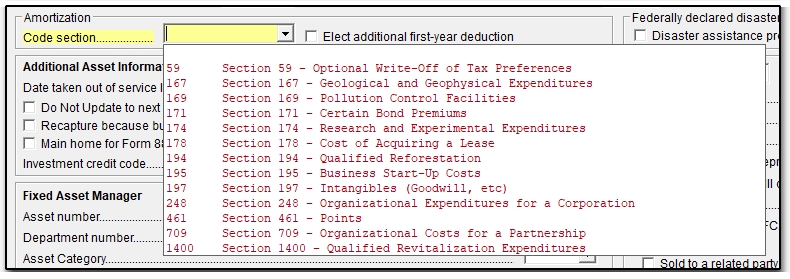

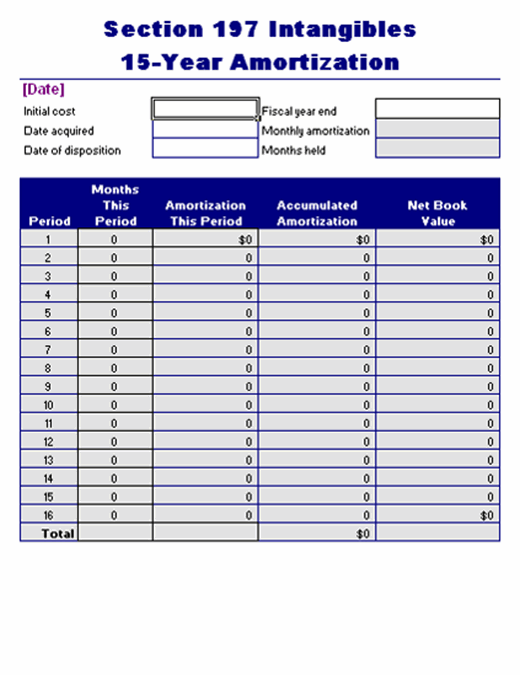

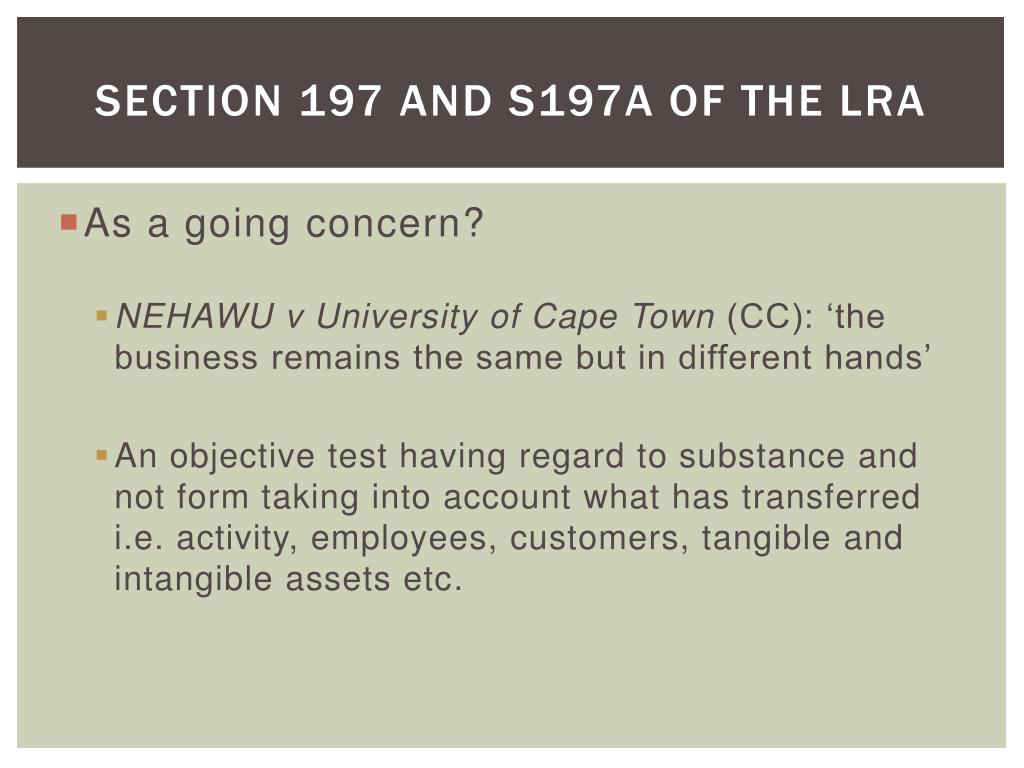

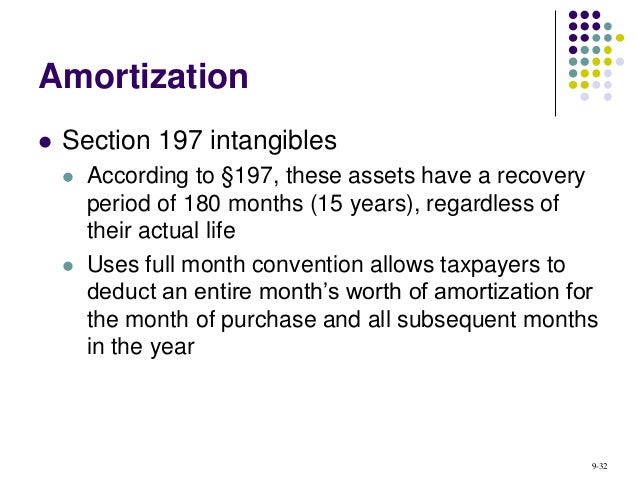

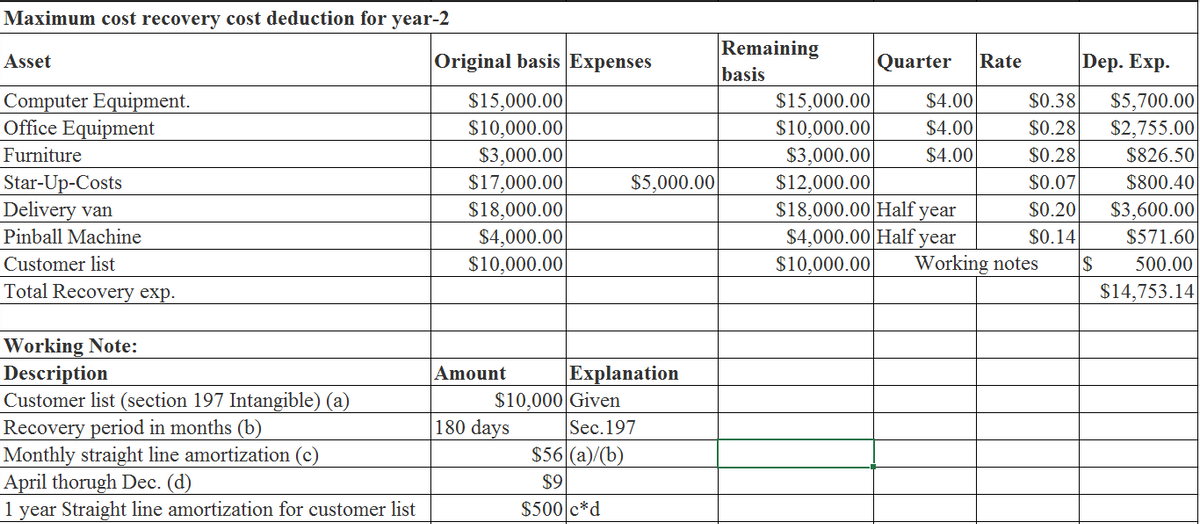

Section 197 intangible. You must generally amortize over 15 years the capitalized costs of section 197 intangibles you acquired after august 10 1993. Section 197 intangibles acquired after august 10 1993 or after july 25 1991 if elected must be amortized over a 15 year period regardless of the assets useful life. You must amortize these costs if you hold the section 197 intangibles in connection with your trade or business or in an activity engaged in for the production of income.

Any remaining gain or any loss is a section 1231 gain or loss. Start amortization the month the intangible is acquired. The term amortizable section 197 intangible does not include any section 197 intangible acquired in a transaction one of the principal purposes of which is to avoid the requirement of subsection c 1 that the intangible be acquired after the date of the enactment of this section or to avoid the provisions of subparagraph a.

:max_bytes(150000):strip_icc()/GettyImages-923167626-1425a7c433954d43a6bd05221eb373e6.jpg)