Section 20 Of The Securities Exchange Act Of 1934

100 181 323 3 struck out the term securities laws as used herein and in subsection h of this section includes the securities act of 1933 15 u s c.

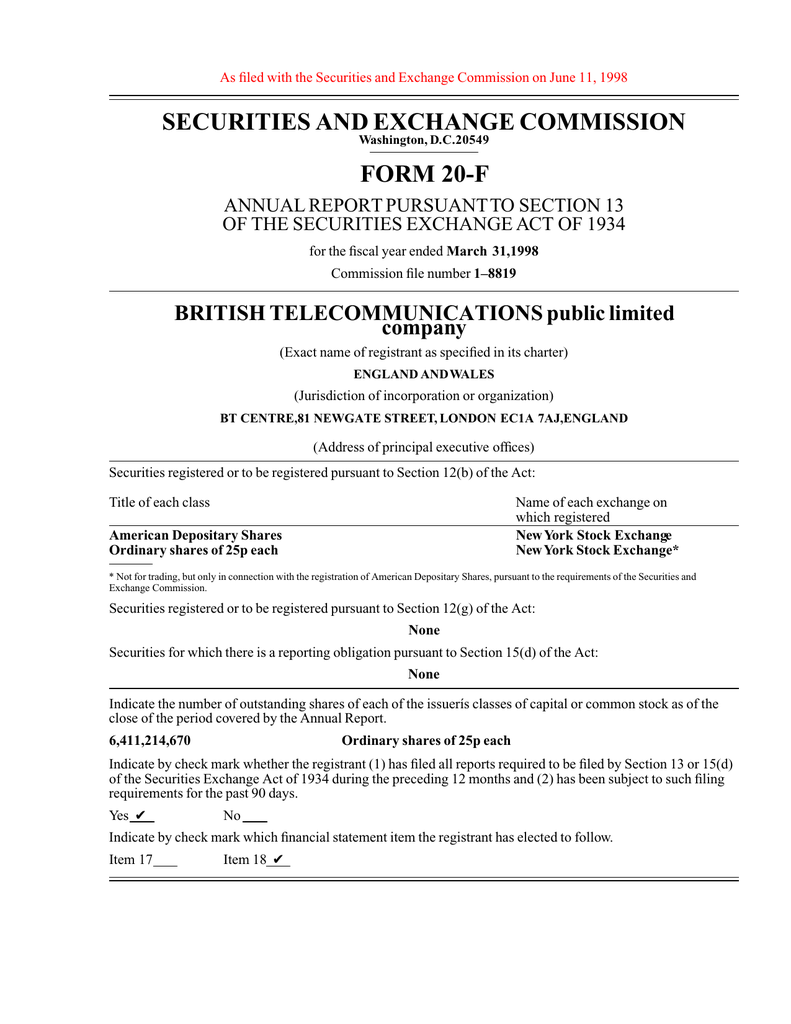

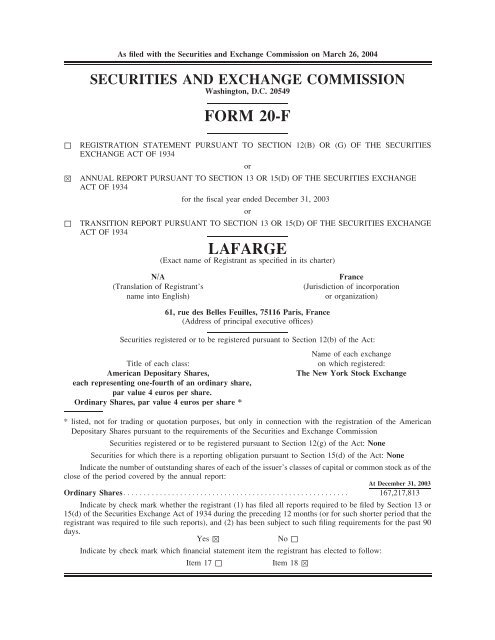

Section 20 of the securities exchange act of 1934. See the full text of the securities exchange act of 1934. Companies with more than 10 million in assets whose securities are held by more than 500 owners must file annual and other periodic reports. June 6 1934 ch.

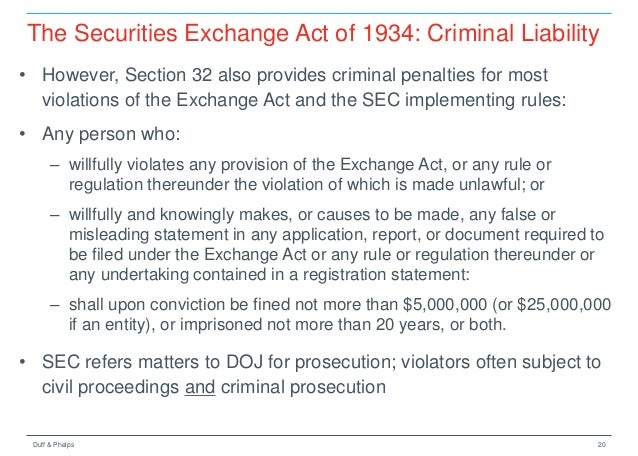

Janov criminal charges in corporate. 78t provides for joint and several liability for people who control or abet violators of the exchange act thus increasing the chance that an investor will be able to collect any damages that are awarded. See mark jickling paul h.

104 67 set out as a note under section 77l of this title. 881 necessity for regulation as provided in this title sec. Carson ii the liability of controlling persons under the federal securities acts 72 notre dame l.

Thus if an employee violates a provision of the exchange act the employer could be held liable. Section 20 codified in 15 u s c. 79 et seq the trust indenture act of.

Section 1 short title section 2 necessity for regulation section 3 definitions and application section 3a swap agreements section 3b securities related deriviatives section 3c clearing for security based swaps section 3d security based swap execution facilities section 3e segregation of assets held as collateral in security based swap transations section 4 securities. 78a et seq is a law governing the secondary trading of securities stocks bonds and debentures in the united states of america. 78a et seq the public utility holding company act of 1935 15 u s c.

77a et seq commenced before and pending on dec. The securities exchange act of 1934 also called the exchange act 34 act or 1934 act pub l. 881 enacted june 6 1934 codified at 15 u s c.

:max_bytes(150000):strip_icc()/13DMGM1-aee26459dcdd44df809decca5ddb72bb.jpg)