Section 213 Of The Internal Revenue Code

There shall be allowed as a deduction the expenses paid during the taxable year not compensated for by insurance or otherwise for medical care of the taxpayer his spouse or a dependent as defined in section 152 determined without regard to subsections b 1 b 2 and d 1 b thereof to the extent that such expenses exceed 10 percent of adjusted gross income.

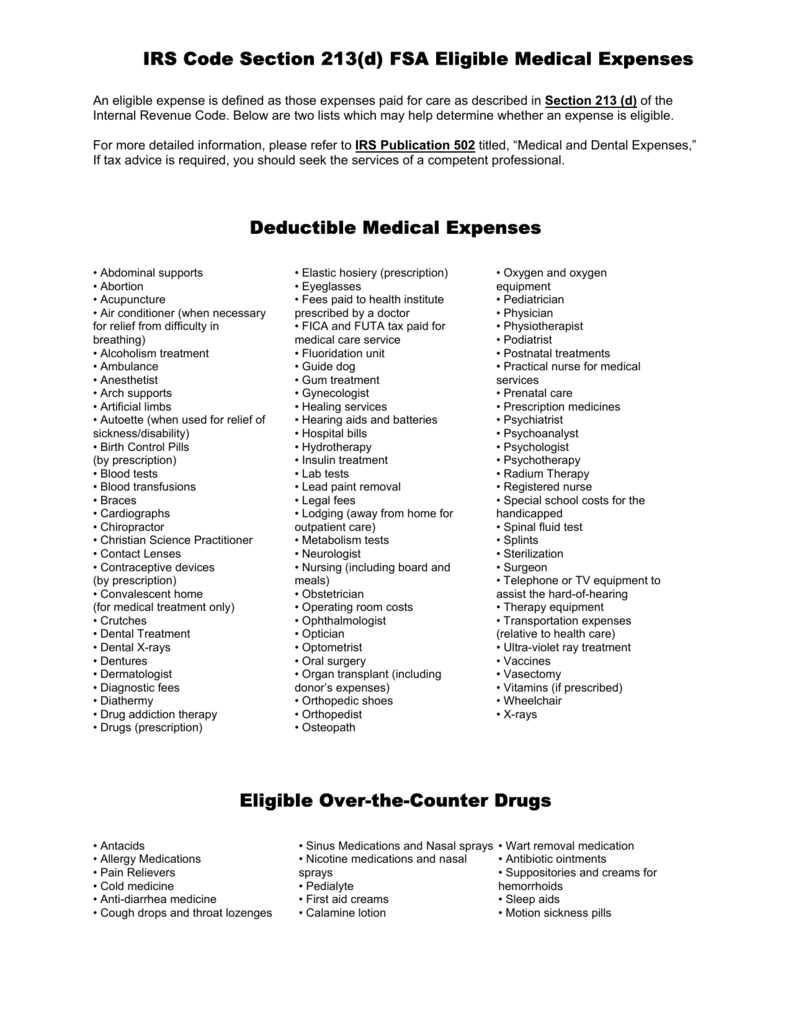

Section 213 of the internal revenue code. 213 d eligible medical expenses. Below are two lists which may help determine whether an expense is eligible. An eligible expense is defined as those expenses paid for care as described in section 213 d of the internal revenue code.

An eligible expense is defined as those expenses paid for care as described in section 213 d of the internal revenue code. Below are two lists which may help determine whether an expense is eligible. Section 213 of the internal revenue code irc allows a deduction for expenses paid during the taxable year not compensated for by insurance or otherwise for medical care of the taxpayer spouse or dependent to the extent the expenses exceed 7 5 of adjusted gross income.

Irs code section 213 d eligible medical expenses. For more detailed information please refer to irs publication 502. Below are two lists which may help determine whether an expense is eligible.

Under section 213 d medical care includes amounts paid for the diagnosis cure mitigation treatment or prevention of disease or for the purpose of affecting any structure or function of the body. Irs code section 213 d eligible medical expenses. 213 d 11 b by a corporation or partnership which is related within the meaning of section 267 b or 707 b to the individual.