Section 25d Tax Credit

25d is the residential energy efficient property credit.

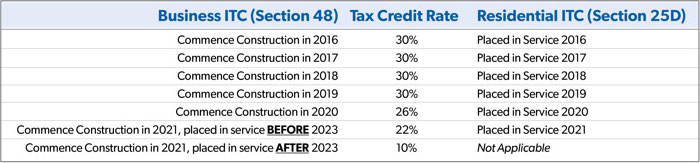

Section 25d tax credit. 110 343 106 c 3 b inserted at end such term shall not include any facility with respect to which any qualified small wind energy property expenditure as defined in subsection d 4 of section 25d is taken into account in determining the credit under such section. Section 25d d 1 of the code defines the term qualified solarwater heating property. For residential systems the solar panel system must be placed in service by the end of 2019 to receive the full 30 tax credit according to section 25d of the irs code governing the renewable energy credit.

Both the 25c credit and the 25d credit are nonrefundable personal tax credits. A rule for years in which all personal credits allowed against regular and alternative minimum tax in the case of a taxable year to which section 26 a 2 applies if the credit allowable under subsection a exceeds the limitation imposed by section 26 a 2 for such taxable year reduced by the sum of the credits allowable under this subpart other than this section such excess. The credit is computed as the energy percentage 30 percent or 10 percent depending on the energy source multiplied by the.

25d residential energy credit. Section 25d a 2 of the code allows an individual a credit against the income tax imposed for the taxable year in an amount equal to the applicable percentage of the qualified solar water heating property expenditures made by the taxpayer during such year. Amendment by section 402 i 3 e of pub.

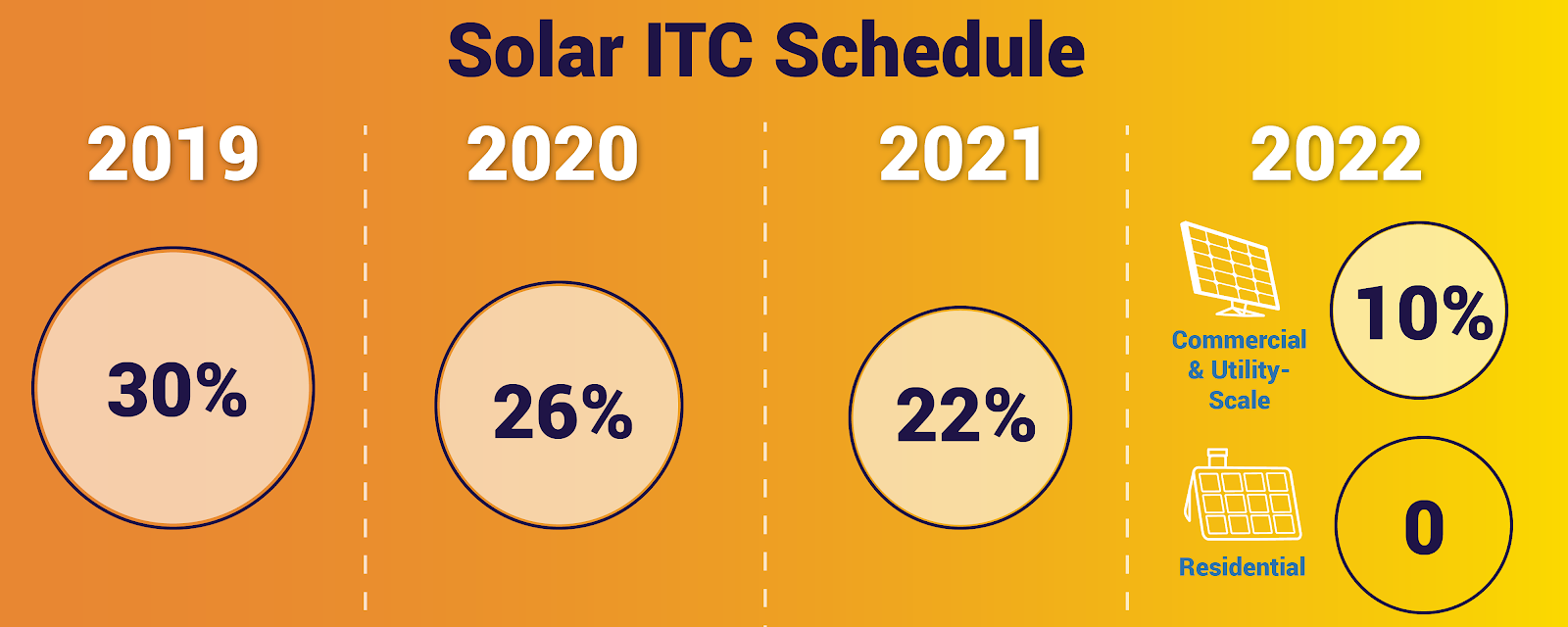

An individual is allowed as a credit against the tax imposed for the taxable year an amount equal to the sum of the qualified solar electric property expenditures. A taxpayer will not receive a tax refund for any amount that exceeds the taxpayer s tax liability for the year. The 25d tax credit will step down to 26 in 2020 22 in 2021 and 0 starting in 2022.

109 135 set out as a note under section 23 of this title. The residential credit is claimed on the tax return for the year in which the qualifying expenditures are incurred and the tax rules say the costs are incurred when the system installation has been completed. 107 16 901 in the same manner as the provisions of such act to which such amendment relates see section 402 i 3 h of pub.

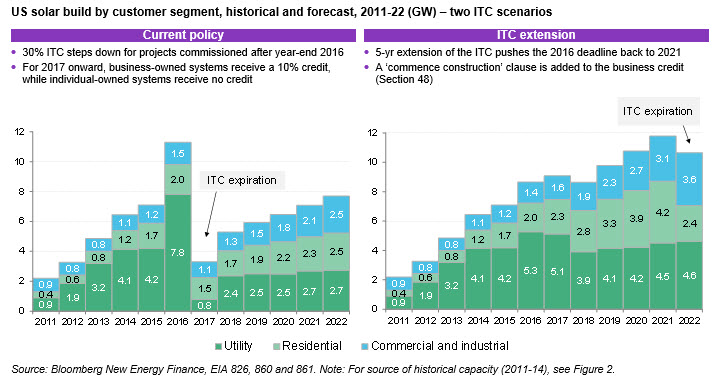

109 135 subject to title ix of the economic growth and tax relief reconciliation act of 2001 pub. The section 48 commercial credit can be applied to both customer sited commercial solar systems and large scale utility solar farms.