Section 302 Of The Sarbanes Oxley Act

Sarbanes oxley act section 302 this section is of course listed under title iii of the act and pertains to corporate responsibility for financial reports.

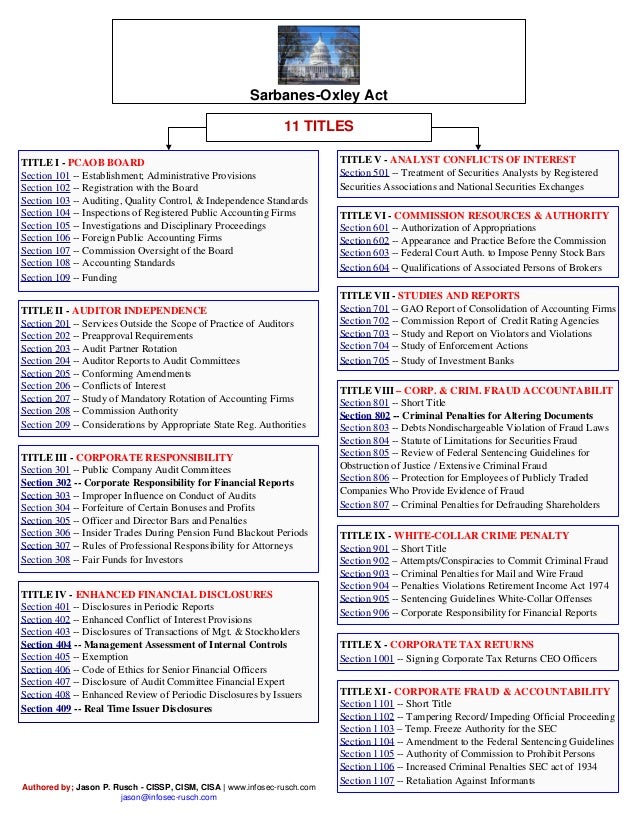

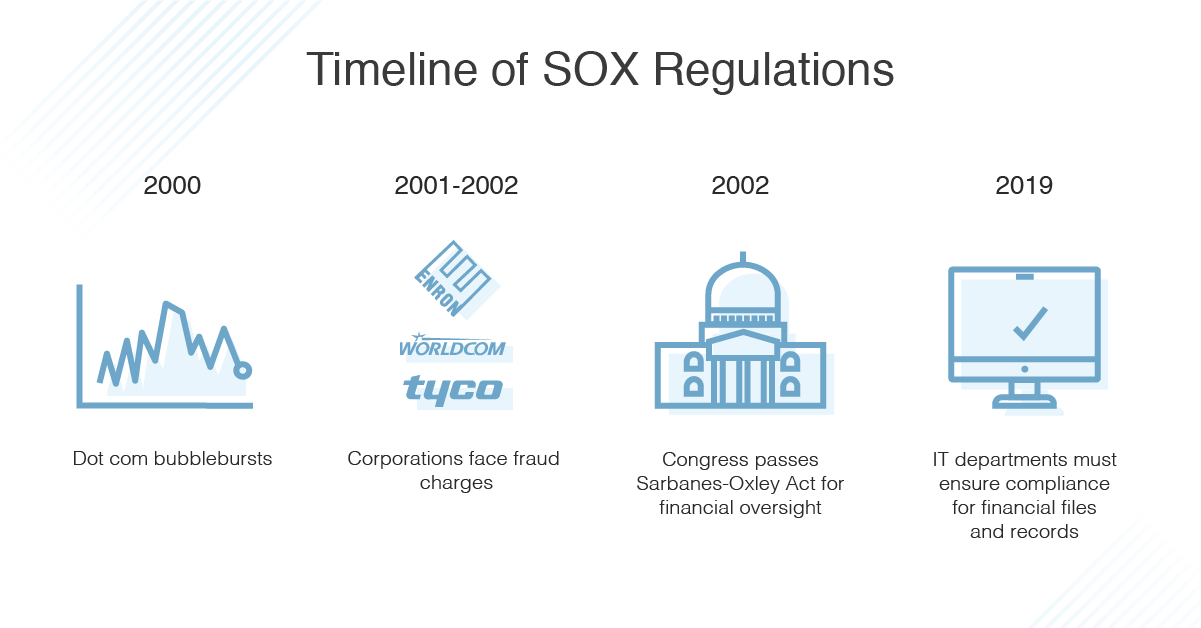

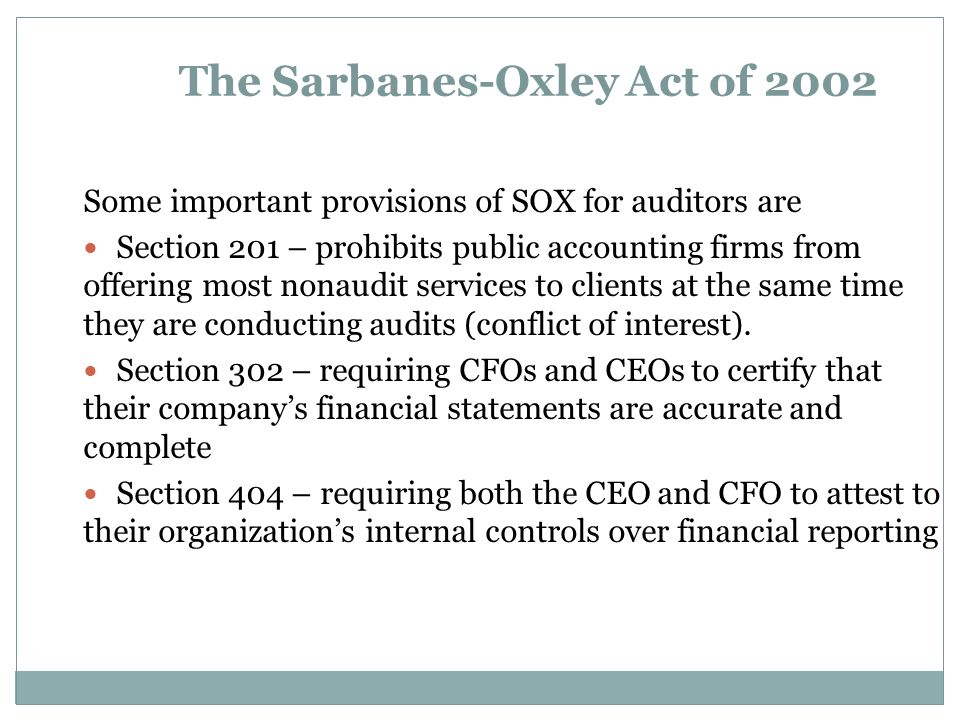

Section 302 of the sarbanes oxley act. Here is the direct excerpt from the sarbanes oxley act of 2002 report. 745 enacted july 30 2002 also known as the public company accounting reform and investor protection act in the senate and corporate and auditing accountability responsibility and transparency act in the house and more commonly called sarbanes oxley sarbox or sox is a united states federal law that set new or. Commission rules and enforcement.

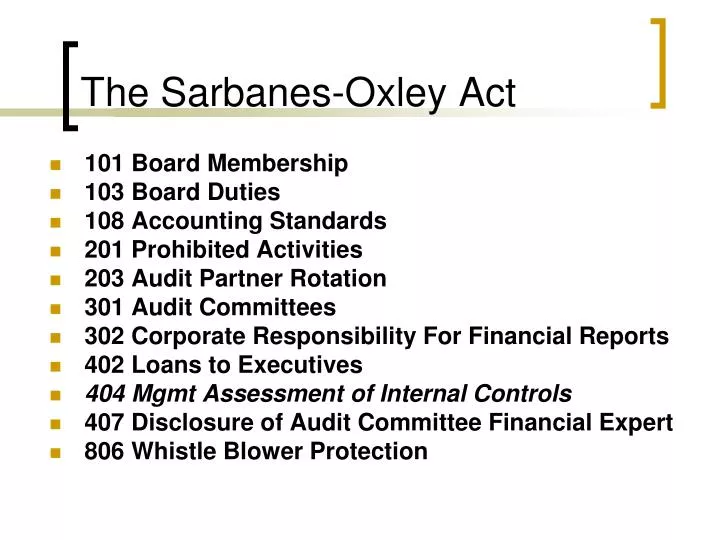

Section 302 of the sarbanes oxley act focuses on disclosure controls and procedures plus the personal accountability of signing officers. Other countries may follow the u s lead and impose requirements similar to those in sections 302 and 404. A violation of rules of the public company accounting oversight board board is treated as a violation of the 34 act giving rise to the same penalties that may be imposed for violations of that act.

The sarbanes oxley act of 2002 sponsored by paul sarbanes and michael oxley represents a huge change to federal securities law. 25 section 302 of the act entitled corporate responsibility for financial reports requires the commission to adopt final rules that must be effective by august 29 2002 30 days after the date of enactment under which the principal executive officer or officers and the principal financial officer or officers or persons providing similar functions of an issuer each must certify the information contained in the. Sox 302 requires that the principal executive and financial officers of a company typically the ceo and cfo personally attest that financial information is accurate and reliable.

Summary of sarbanes oxley act of 2002 section 3. The essence of section 302 of the sarbanes oxley act states that the ceo and cfo are directly reponsible for the accuracy documentation and submission of all financial reports as well as the internal control structure to the sec. The signing officers have reviewed the report.

Although there are a number of contentious sox sections that have created debate comments and objections sections 302 and 404 create the most radical ongoing and potentially onerous compliance obligations. Welcome to sarbanes oxley 101. As previously noted the section 302 certifications are in addition to and not in lieu of the certifications required by section 906 of the sarbanes oxley act which carry criminal sanctions for an officer who knowingly certifies a report that does not meet statutory standards.

The sarbanes oxley act of 2002 pub l. B foreign reincorporations have no effect nothing in this section 302 shall be interpreted or applied in any way to allow any issuer to lessen the legal force of the statement required under this section 302 by an issuer having reincorporated or having engaged in any other transaction that resulted in the transfer of the corporate domicile or offices of the issuer from inside the united states to outside of the united states.

/us-president-george-w--bush-signs-hr-3763-as-membe-51681899-eedd5241d1ca43d5ad2d854242e9a1a7.jpg)