Section 382 Analysis

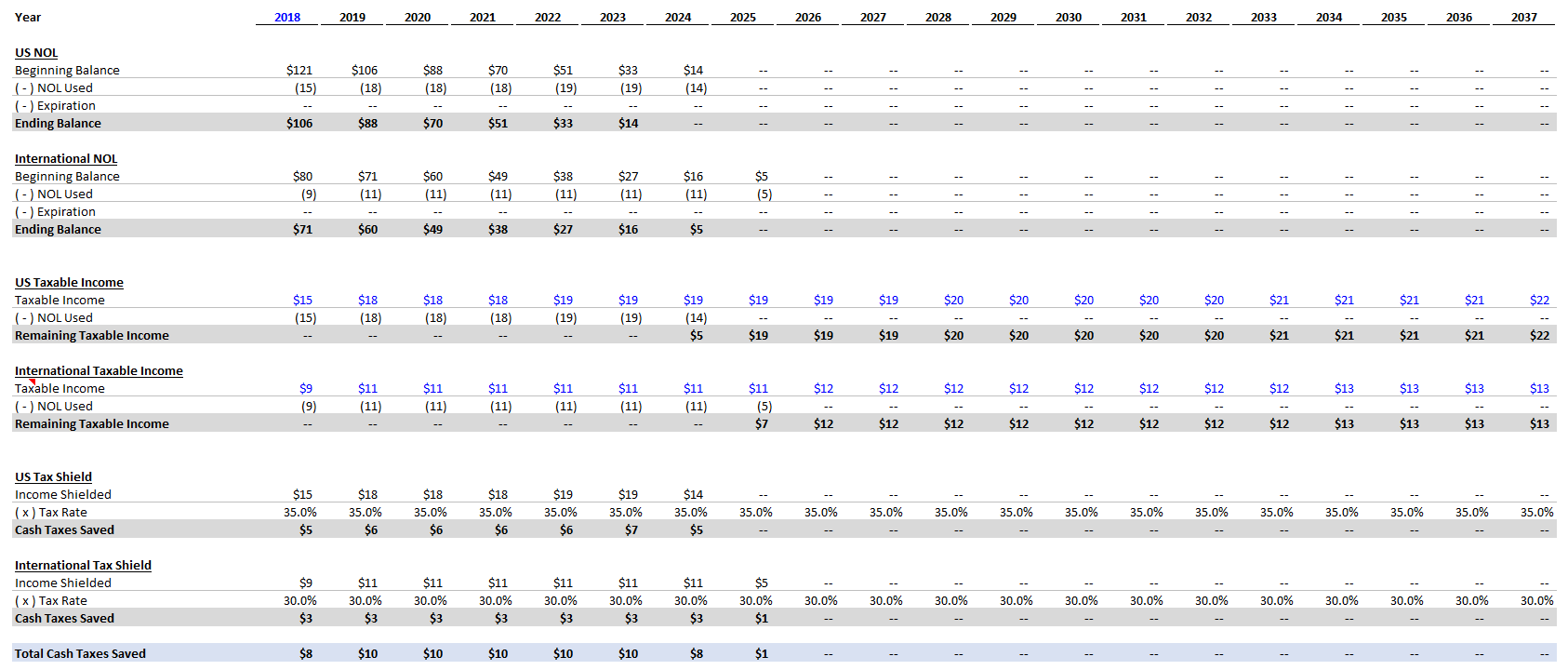

Section 382 generally limits the use of nols and credits following an ownership change which occurs when one or more 5 percent shareholders increase their ownership in aggregate by more than 50 percentage points over the lowest percentage of stock owned by such shareholders at any time during the testing period generally three years.

Section 382 analysis. Business interest expense carryforwards and built in losses by corporations. Complex rules require careful analysis. In an effort to limit loss trafficking congress enacted sec.

Sections 382 of the tax code limits the use of net operating losses nols and certain other tax attributes e g. Tax director real estate company i don t know where we would be without this product. 382 to limit the use of corporate nols following an ownership change.

Loss corporations entities that have a nol or built in gain or loss are eligible to use a nol subject to section 382. Section 382 of the internal revenue code generally requires a corporation to limit the amount of its income in future years that can be offset by historic losses i e net operating loss nol carryforwards and certain built in losses after a corporation has undergone an ownership change. The section 382 anolyzer has proven to be an excellent and reliable solution for all of our needs from updating our analysis each quarter to doing modeling scenarios for capital raise transactions.

A loss corporation is a firm that can use tax attributes such as net operating loss nol to deduct their taxable income. An ownership change is defined generally as a greater than 50 change in the ownership of stock among certain 5 shareholders over a three year period sec. As a summary c corporations are those under us law that are taxed separately from their owners.

Under section 382 of the irc a c corporation is required to have a limit to offset historic losses. Since its revision as part of the tax reform act of 1986 section 382 has largely been a form driven provision filled with objective rules and confusing interpretations. Section 382 can best be described as an intricate construct that usually numbs the mind with its complexity and often baffles the senses with its result.

Congress enacted internal revenue code section 382 to prevent trafficking in losses.