Section 43 5 Of Income Tax Act

In sections 28 to 41 and in this section unless the context otherwise requires.

Section 43 5 of income tax act. Under section 43 5 d of the income tax act 1961 act which was inserted by finance act w e f. The following deductions are specified in this section. Section 43 5 in the income tax act 1995.

01 04 2006 applicable from ay 2005 06. Stocks and shares is periodically or ultimately settled otherwise than by the actual. The income tax department never asks for your pin numbers.

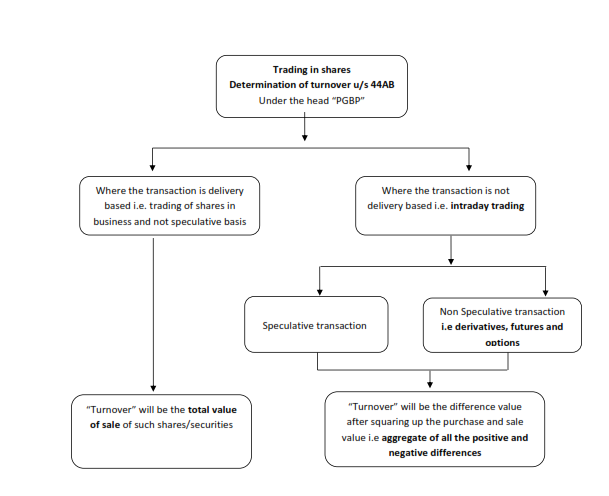

A a contract in respect of raw materials or merchandise entered into by a person in the course of his manufacturing or merchanting business to guard against loss through future price fluctuations in respect of his contracts for actual delivery of goods manufactured by him or merchandise sold by him. 43 5 d ii of the income tax act. Transactions in respect of trading in derivatives carried out in the recognized stock exchange will not be regarded as speculative transaction.

Apportionment of income between spouses governed by portuguese civil code. Interest paid on these taxes are also eligible for deduction. 15 2014 income tax entral government hereby notifies the ace derivatives and commodity exchange limited ahmedabad as a recognised association for the purposes of clause e of the proviso to clause 5 of the section 43 5 with effect from the date of publication of this.

Transaction in which a contract for the purchase or sale of any commodity including. 1961 income tax department all acts income tax act 1961. 43 5 defines the speculative transaction.

15 2014 income tax 20 03 2014 notification no. Scope of total income. Section 43 5 stated that transactions where contract for the purchase or sale of any commodity including stocks and shares is periodically or ultimately settled otherwise than by the actual delivery or transfer of the commodity or scrips it would not be deemed to be speculative transaction.