Section 56 Of Income Tax Act 2013

1961 income tax department all acts income tax act 1961.

Section 56 of income tax act 2013. Section 56 2 x of the income tax act it act provides that where any person receives any property including shares of a company for a consideration less than its fair market value computed as per the prescribed method the fair value as exceeding the consideration would be taxable in the hands of the person receiving such property. Scope of total income. The income tax department never asks for your pin numbers.

By yonazi mngumi the income tax act contains a provision which aims at taxing gains arising from direct or indirect transfer of shares in a resident entity. Section 56 of the income tax act 1961 income from other sources chargeable as gift assessment year 2012 13 bonus shares can never be considered as received without consideration or for inadequate consideration calling for application of sub clause c of clause vii of section 56 2 in favor of assessee. Clause v was inserted vide finance no.

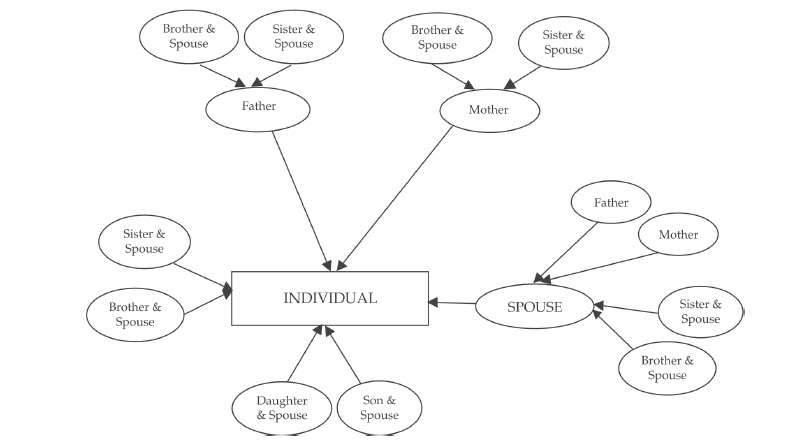

The persons who are considered as relatives are. Brother or sister of the spouse of the individual. Apportionment of income between spouses governed by portuguese civil code.

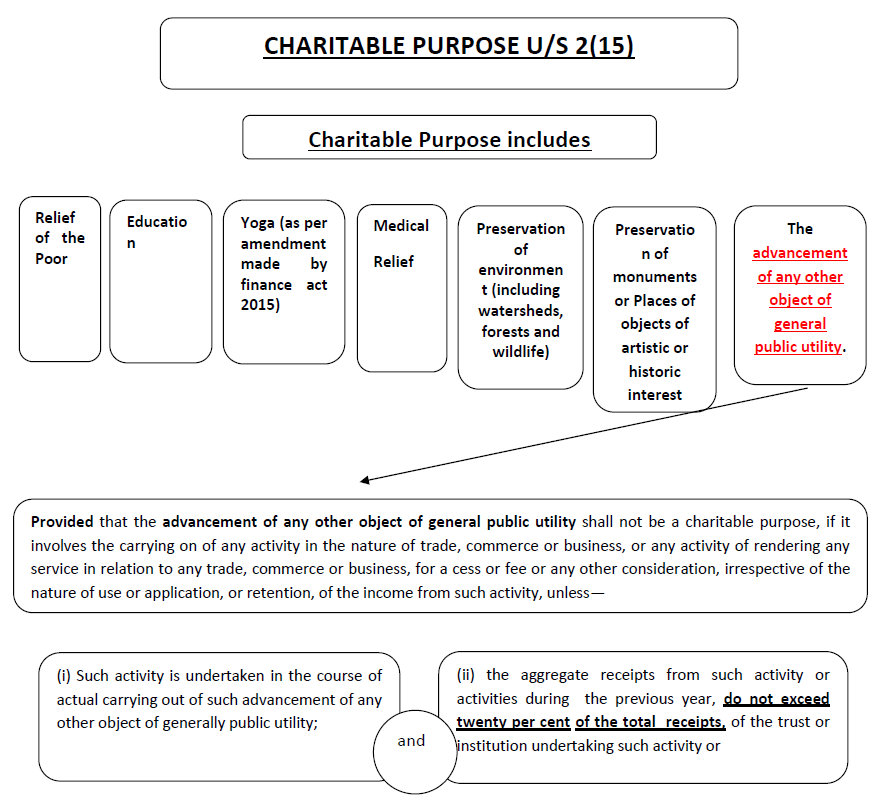

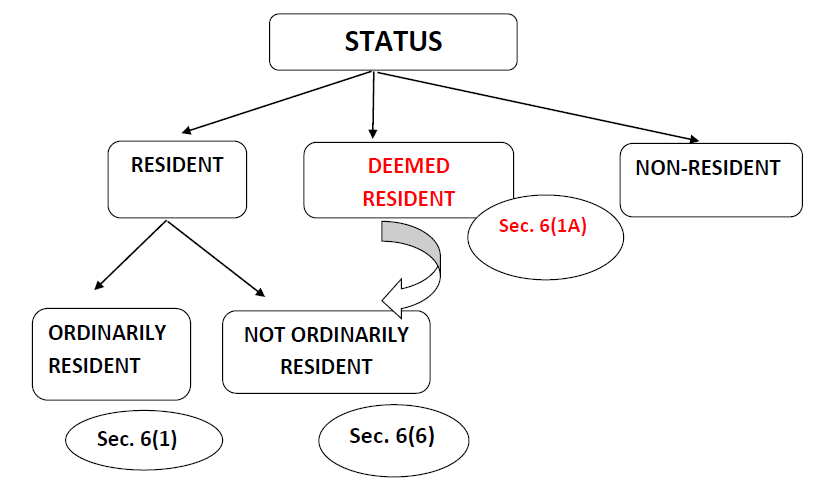

1 4 2005 in section 56 2 of the act to provide that any sum of money received by an assessee being individual or huf exceeding 25 000 will be deemed to be income and will be chargeable to tax as income under the head income from other sources. The respective provision is section 56 of the act which was amended last year by the finance act 2012 and became effective 1 july 2012 in its current form. Income from other sources section 56 to 59 income which is not chargeable to tax under any of the heads of income specified in the income tax act viz.

F income from other sources. 1 income of every kind which is not to be excluded from the total income under this act shall be chargeable to income tax under the head income from other sources if it is not chargeable to income tax under any of the heads specified in section 14 items a to e. Brother or sister of the individual.

2 act 2004 w e f. Salary house property business or profession and capital gain and which is also not exempt from tax under any section of the income tax act is chargeable to tax under this head. As per section 56 2 vii if any some received from specified person as relative under income tax act then it will not be taxable hence 40000 received from relative will not be taxable and 30000 from non relative is less than 50000 hence there is also no liability arise of tax on such 30000 therefore there is no tax liability.