Section 6055 And 6056

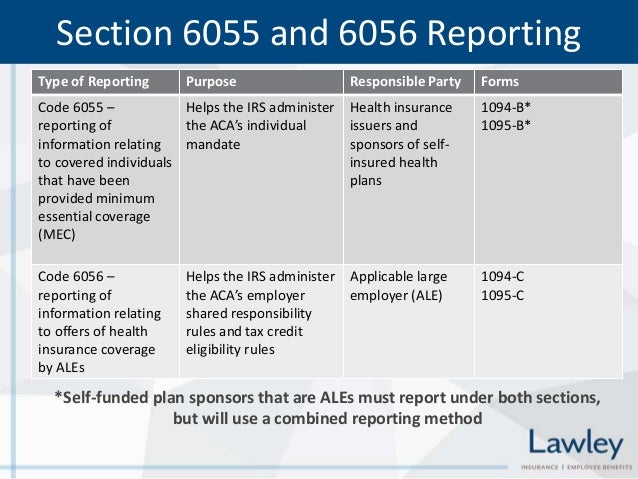

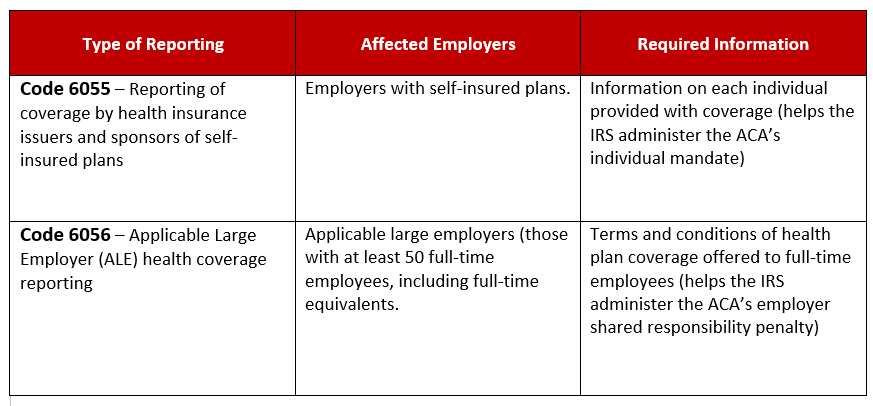

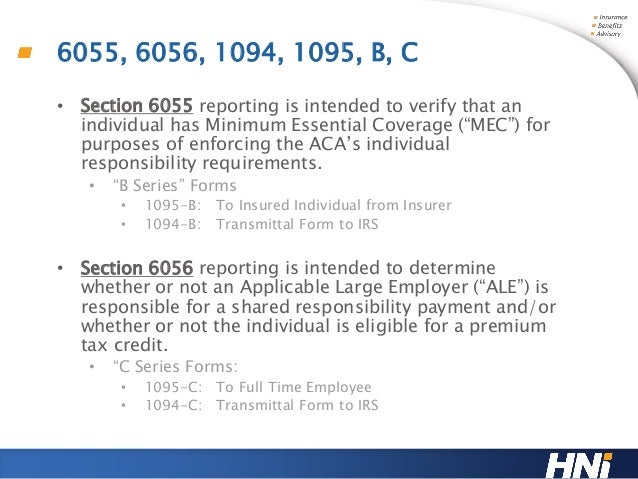

These are new reporting rules set out in internal revenue code sections 6055 and 6056.

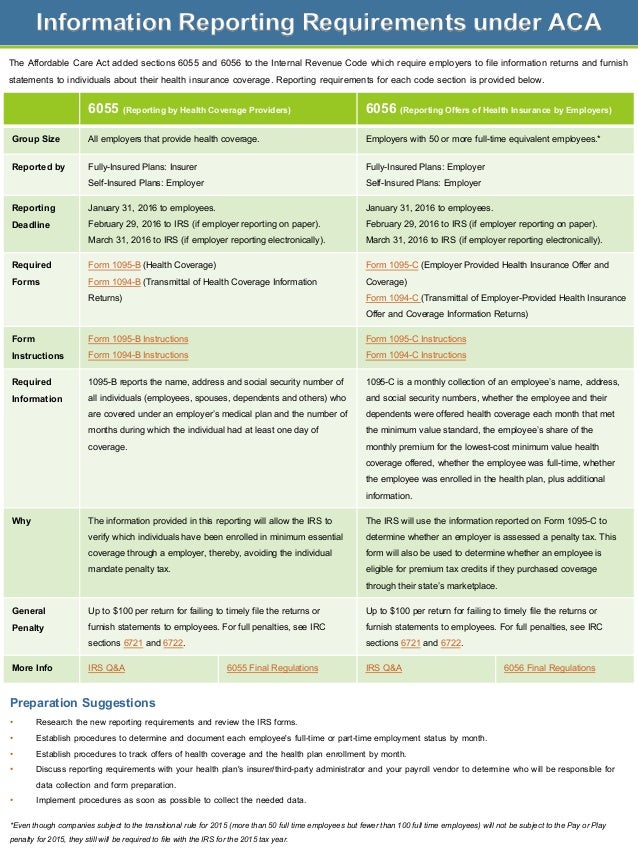

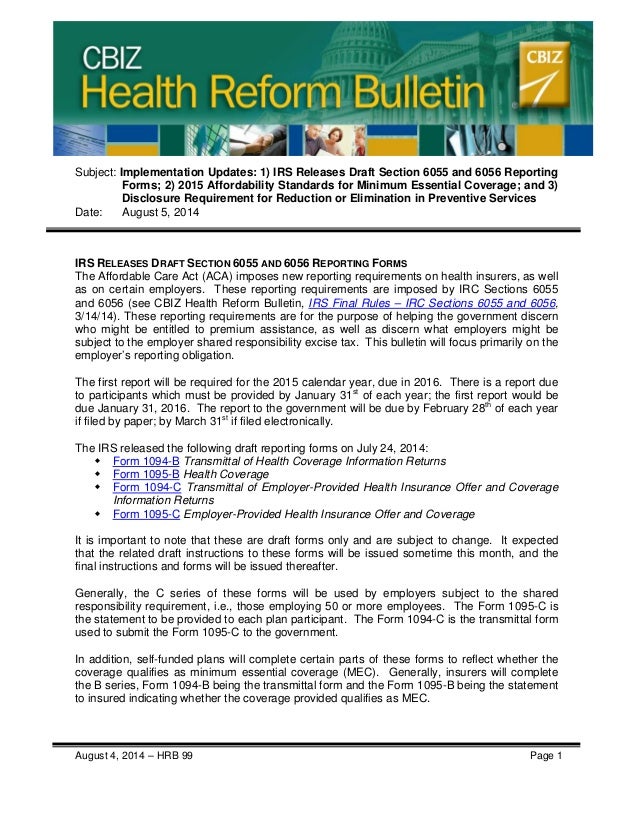

Section 6055 and 6056. The first filings will be due in early 2016 for coverage provided in 2015. Responding to widespread requests the final rules provide for a single consolidated form that employers will use to report to the irs and employees under both sections 6055 and 6056 thereby simplifying the process and avoiding duplicative reporting. Large employers are defined by the irs as having over 50 full time employees including ftes full time equivalents.

It is recommended that employers and others seek legal and or accounting expertise to assess your organization s reporting requirements. E coverage provided by governmental units. Sections 1311 1402 and 1412 of the patient protection and affordable care act referred to in subsec.

Employers that have fewer than 50 full time employees including ftes are considered small employers and are exempt from the employer shared responsibility. In a nutshell these sections call for some employers to report to the irs information about employer sponsored health coverage. On march 10 2014 the irs released final regulations detailing the reporting requirements for information returns and individual statements under code 6055 and 6056 to administer tax provisions of the affordable care act.

Certain employers required to report on health insurance coverage. Overview of the 6055 and 6056 reporting requirements. Information required under this section with the return and statement required to be provided by the issuer under section 6055.

For returns filed electronically with the irs under sections 6055 and 6056 any failures that reporting entities corrected by july 30 or november 1 2016 respectively under sections 6721 b 1 and b 2 were subject to reduced penalties. B 1 b iii are classified to sections 18031 18071 and 18082 respectively of title 42 the public health and welfare. Sections 6055 and 6056 of the irs code describe the related reporting requirements.

Section 6055 and 6056 reporting is required of large employers. For returns filed electronically with the irs under sections 6055 and 6056 any failures that issuers correct by july 30 or november 1 2016 respectively will be subject to reduced penalties.