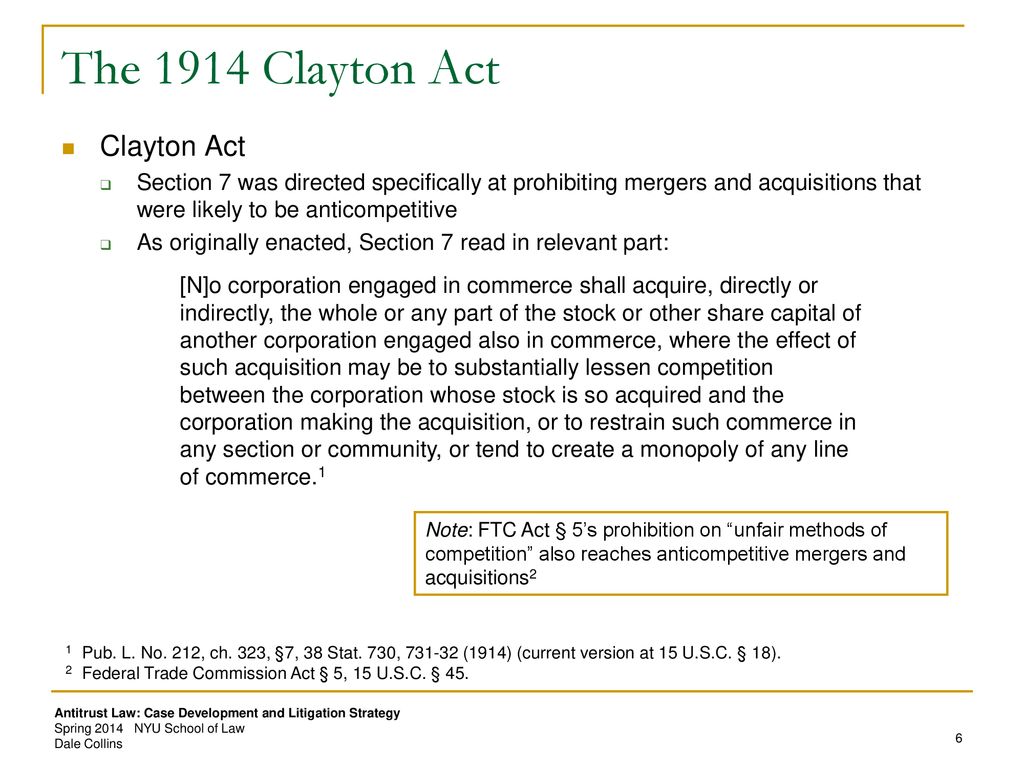

Section 7 Of The Clayton Act 15 Usc 18

Section 7 of the clayton act 15 u s c.

Section 7 of the clayton act 15 usc 18. Section 7 of the clayton act allows greater regulation of mergers than just sherman act section 2 since it does not require a merger to monopoly before there is a violation. 209 1890 15 u s c. Clayton act 15 u s c.

Acquisition by one corporation of stock of another. Clayton act 7the other violations for which private relief is authorized are combinations or. Section 7a of the clayton act 15 u s c.

It allows the federal trade commission and department of justice to regulate all mergers and gives the government discretion whether to give approval to a merger or not which it still commonly does today. Conspiracies in restraint of trade 26 stat. No person engaged in commerce or in any activity affecting commerce shall acquire directly or indirectly the whole or any part of the stock or other share capital and no person subject to the jurisdiction of the federal trade commission shall acquire the whole or any part of the assets of another person engaged also in commerce or in any activity affecting commerce.

D of this section as added by section 201 of this act shall take effect on the date of enactment of this act. 1390 the act requires all persons contemplating certain mergers or acquisitions which meet or exceed the jurisdictional thresholds in the act to file notification with the commission and the assistant attorney general and to wait a designated period of time before consummating such transactions. Us code section 12.

This description of the clayton act tracks the language of the u s. The amendment made by section 201 of this act enacting this section shall take effect 150 days after the date of enactment of this act sept. Code except that sometimes we use plain english and that we may refer to the act meaning clayton act rather than to the subchapter or the title of the united states code.

Source creditreferences in textamendmentseffective date. Section 7 of the clayton act prohibits mergers and acquisitions where the effect may be substantially to lessen competition or to tend to create a monopoly as amended by the robinson patman act of 1936 the clayton act also bans certain discriminatory prices services and allowances in dealings between merchants. 18 generally prohibits the acquisition of one company s stock by another company when the effect of such acquisition may be substantially to lessen competition or to tend to create a monopoly as cited by seaquist 2012 section.