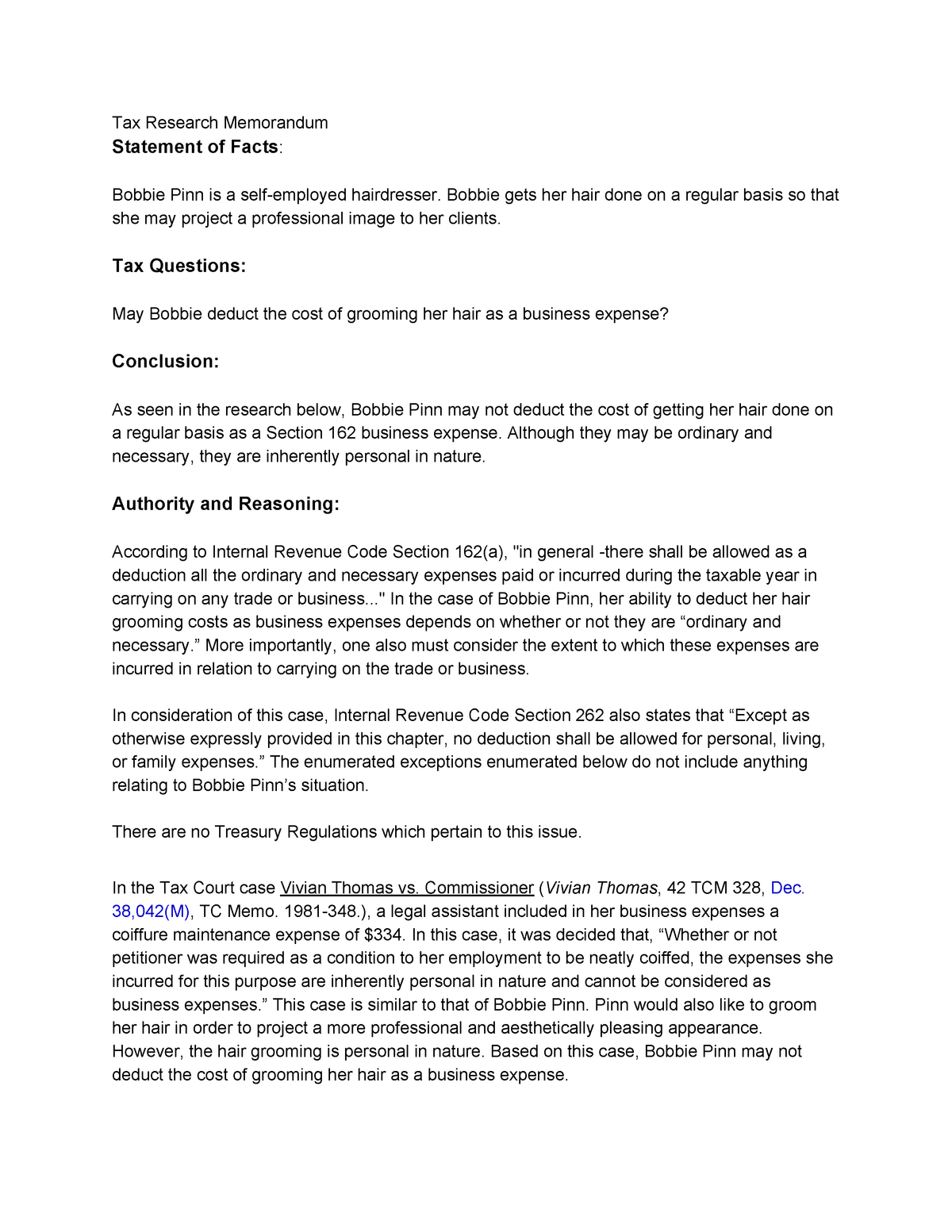

Internal Revenue Code Section 162

It is one of the most important provisions in the code because it is the most widely used authority for deductions.

Internal revenue code section 162. Internal revenue code 162 26 u s c. Rules regarding the practical application of irc 162 have evolved largely from case law and administrative guidance. Internal revenue code section 162 a 2 trade or business expenses a in general.

162 trade or business expenses. Code unannotated title 26. Title 26 internal revenue code subtitle a income taxes chapter 1 normal taxes and surtaxes subchapter b computation of taxable income part vi itemized deductions for individuals and corporations sec.

Law and analysis section 162 a allows a deduction for all the ordinary and necessary expenses paid or incurred during the taxable year in carrying on any trade or business. D expenses paid or incurred by a taxpayer in attending a convention or other meeting may constitute an ordinary and necessary business expense under section 162 depending upon the facts and circumstances of each case. 162 a is part of united states taxation law.

Internal revenue code irc or the code 162 allows deductions for ordinary and necessary trade or business expenses paid or incurred during the course of a taxable year. Internal revenue code section 162 a trade or business expenses a in general. It concerns deductions for business expenses.

162 u s. Section 162 g of such code as added by subsection a shall apply with respect to amounts paid or incurred after december 31 1969. Any amount paid by a taxpayer for insurance to which paragraph 1 applies shall not be taken into account in computing the amount allowable to the taxpayer as a deduction under section 213 a.

Section 162 a of the internal revenue code 26 u s c. Internal revenue code 162. No distinction will be made between self employed persons and employees.