Irc Section 121 California

Section 121 of the internal revenue code of 1986 as amended by this section shall be applied without regard to subsection c 2 b thereof in the case of any sale or exchange of property during the 2 year period beginning on the date of the enactment of this act if the taxpayer held such property on the date of the enactment of this act and fails to meet the ownership and use requirements of subsection a thereof with respect to such property.

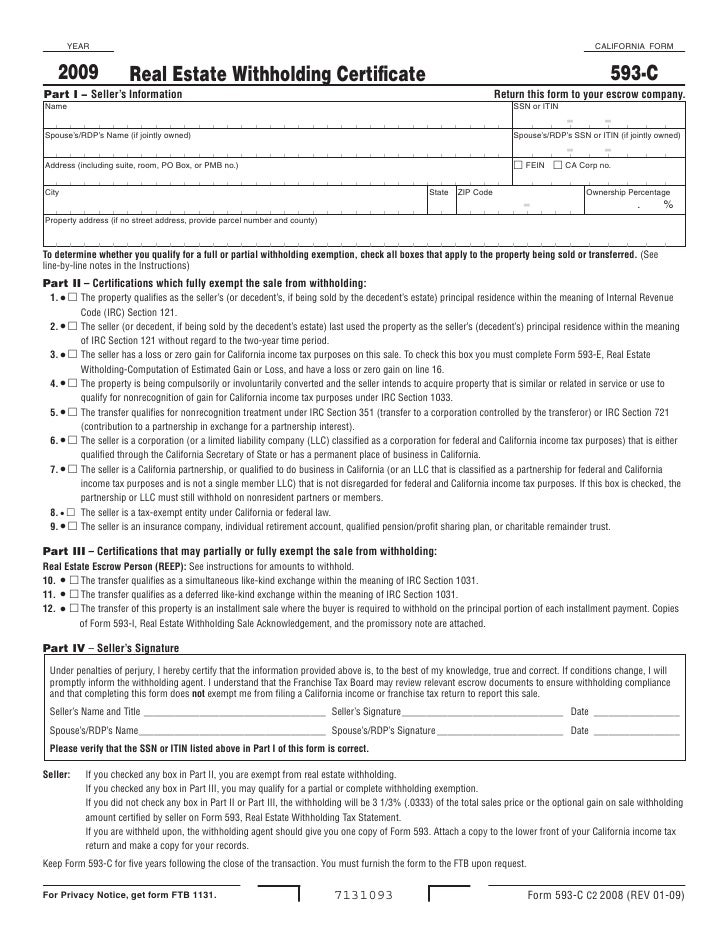

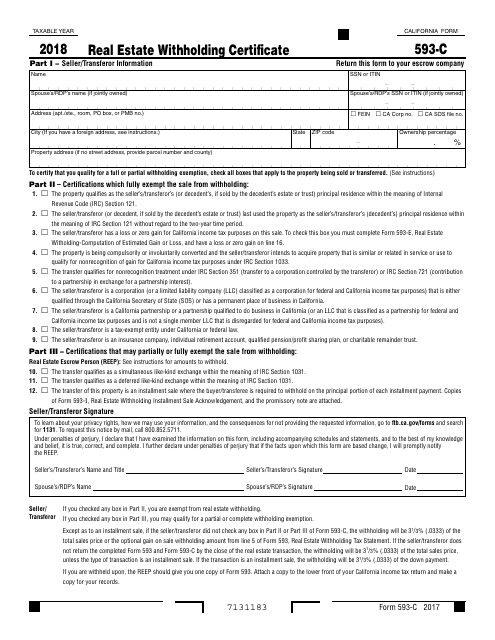

Irc section 121 california. Homeowners who have resided in their residence for at least two of the last five years may be eligible for the principal residence exclusion allowed under section 121 of the internal revenue code. Section 121 of the internal revenue code of 1986 as amended by this section shall be applied without regard to subsection c 2 b thereof in the case of any sale or exchange of property during the 2 year period beginning on the date of the enactment of this act if the taxpayer held such property on the date of the enactment of this act and fails to meet the ownership and use requirements of subsection a thereof with respect to such property. 121 provides that taxpayers may exclude up to 250 000 500 000 for joint returns from the gain on the sale or exchange of a principal residence provided they meet certain ownership and use requirements.

Internal revenue code 121. Code unannotated title 26. Section 121 a generally provides with certain limitations and exceptions that gross income does not include gain from the sale or exchange of property if during the 5 year period ending on the date of the sale or exchange the taxpayer has owned and 8.

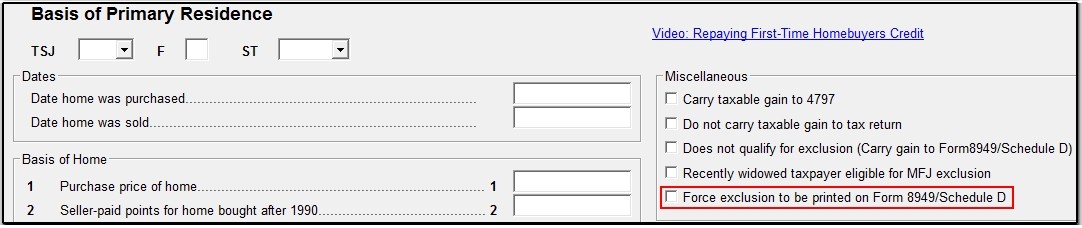

Section 121 exclusion of gain from sale of principal residence. Among the tax benefits available to homeowners one of the most useful is the principal residence exclusion provided by internal revenue code irc section 121 which allows homeowners to exclude a certain portion of their capital gains when they sell their primary residence. Under current law sec.

Gross income shall not include gain from the sale or exchange of property if during the 5 year period ending on the date of the sale or exchange such property has been owned and used by the taxpayer as the taxpayer s principal residence for periods aggregating 2 years or more. Exclusion of gain from sale of principal residence.