Irs Regulations Section 1 6081 5

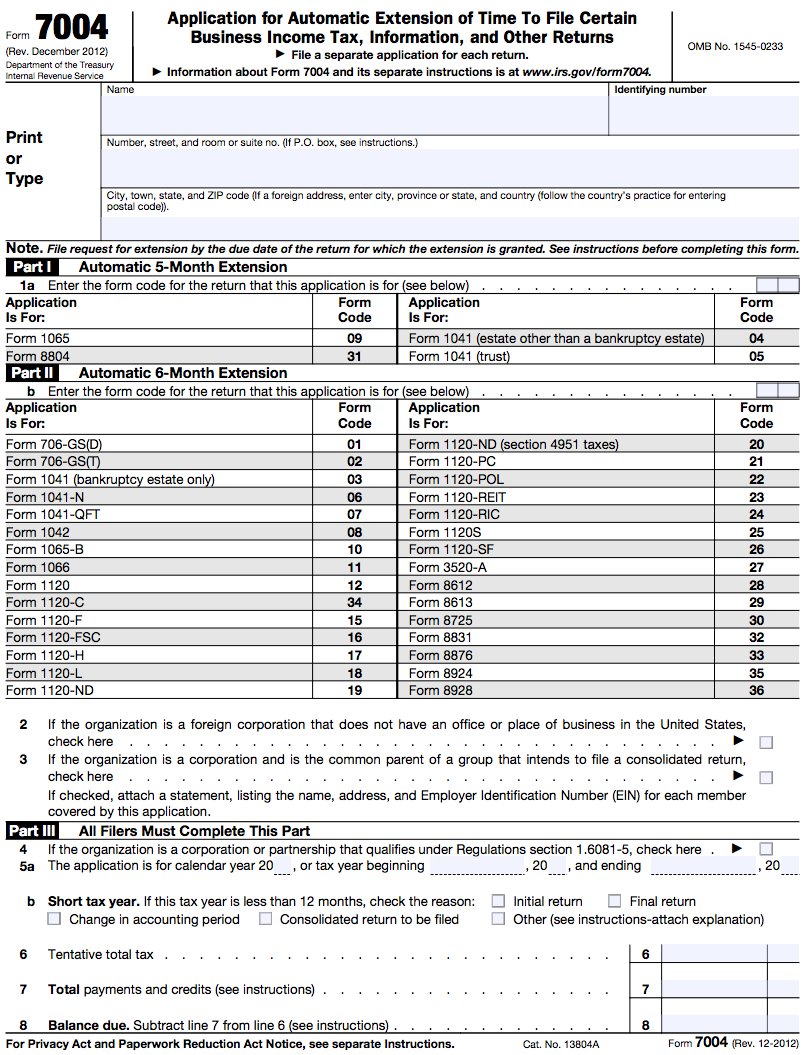

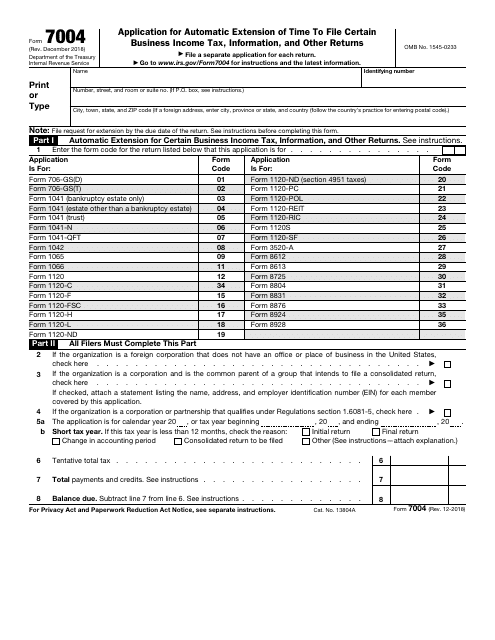

The form then asks if your business qualifies under regulations section 1 6081 5 of the internal revenue code.

Irs regulations section 1 6081 5. Treasury regulations section 1 6081 1 is where you look in the holy tax scriptures for the answer. 1 6081 4 automatic extension of time for filing individual income tax return. B application for extension of time.

F this section applies to returns filed on or after january 30 2020. 1 6081 5 extensions of time in the case of certain partnerships corporations and u s. For rules relating to extensions of time for paying tax see 1 6161 1.

Section 1 6081 1 a gives the irs the authority in its discretion to grant you an additional extension of time. Part ii section 1561 and following of subchapter b of chapter 6 of the internal revenue code code part ii provides rules to limit the amounts of certain specified tax benefit items of component members of a controlled group of corporations for their tax years which include a particular december 31st date or in the case of a short taxable year member. A in general 1 limitation.

You do not need to submit form 7004 for this 3 month extension which moves the deadline to the 15th day of the 6th month following the end of the tax year. Section 1 6081 1 b tells you how to do it and what to put in the letter. Under regulations section 1 6081 5 these types of corporations are automatically given an extra three months to file and pay their taxes.

Section 1 6081 5 is amended by revising paragraph b to read as. Certain foreign and domestic corporations and certain partnerships are entitled to an automatic extension of time to file and pay under regulations section 1 6081 5. Except in the case of an extension of time pursuant to 1 6081 5 an extension of time for filing an income tax return shall not operate to extend the time for the payment of the tax unless specified to the contrary in the extension.

The text of proposed 1 6081 4 is the same as the text of 1 6081 4t published elsewhere in this issue of the federal register. A an extension of time for filing returns of income and for paying any tax shown on the return is hereby granted to and including the fifteenth day of the sixth month following the close of the taxable year in the case of 1 partnerships which are required under section 6072 b to file return. Section 1 6081 5t as contained in 26 cfr part 1 revised april 2019 applies to applications for an automatic extension of time to file returns before january 30 2020.