Section 1255 Property Definition

1255 a 1 a the applicable percentage of the aggregate payments with respect to such property excluded from gross income under section 126 or.

Section 1255 property definition. 1255 a 3 applicable percentage. If section 126 property is disposed of more than 10 years after such date the applicable percentage is 100 percent reduced but not below zero by 10 percent for each year or part. 1255 a 2 section 126 property for purposes of this section section 126 property means any property acquired improved or otherwise modified by the application of payments excluded from gross income under section 126.

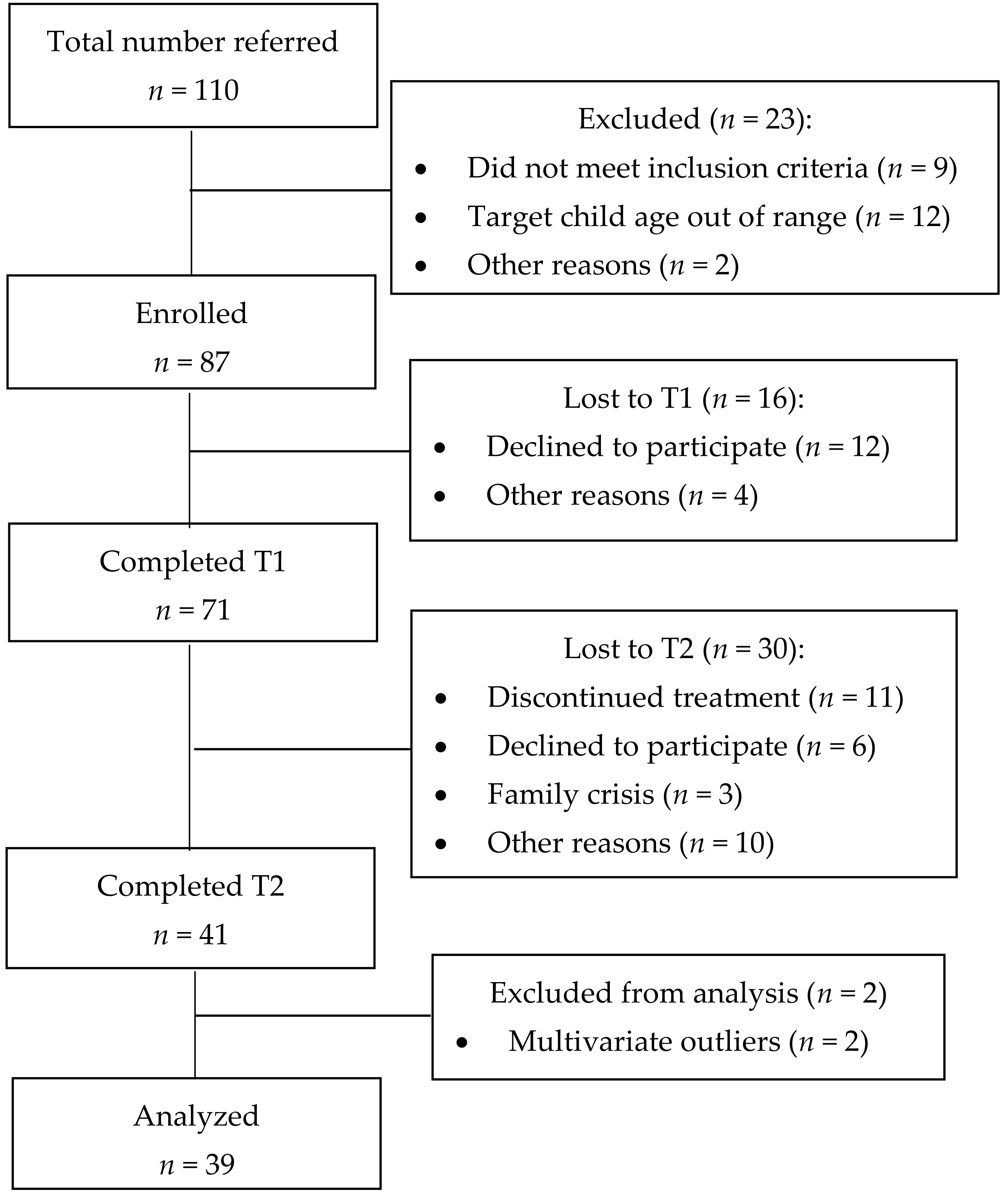

Part iii section 1255 if you receive certain cost sharing payments on property and you exclude those payments from income the excess of a sale exchange or involuntary conversion or the fair market value in the case of any other disposition you must treat part of the gain as ordinary income. 1255 a 1 b the excess of. Learn about 1231 1245 1250 property and its treatment for gains and losses.

You can see from the examples that only certain section will apply. Upon any disposition of section 1254 property or any disposition after december 31 1975 of oil gas or geothermal property gain is treated as ordinary income in an amount equal to the lesser of the amount of the section 1254 costs as defined in paragraph b 1 of this section with respect to the property or the amount if any by which the amount realized on the sale. The internal revenue code includes multiple classifications for property.