Irs Section 368

Section 368 outlines a format for tax treatment to reorganizations as described in the internal revenue code irc of 1986.

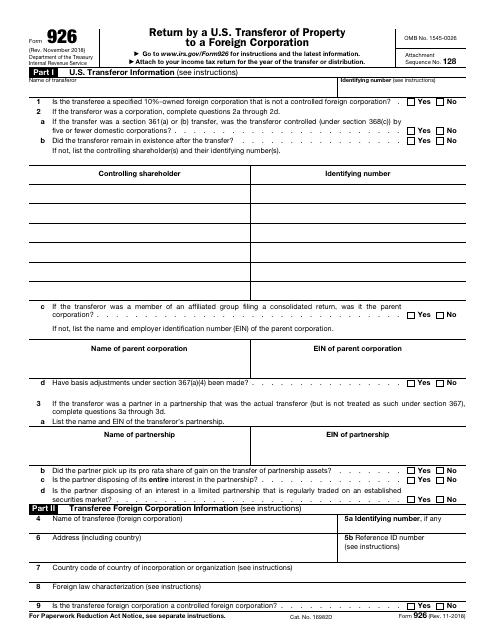

Irs section 368. Section 1 c of pub. Read the code on findlaw. These reorganization transactions however have to meet certain legal requirements to classify for favorable treatment.

22 1986 100 stat. 1954 as added by section 2131 a of the tax reform act of 1976 pub. Section 368 definitions relating to corporate reorganizations.

1954 as added by section 2131 a of the tax reform act of 1976 pub. Except that sections 367 d and 1492 of the internal revenue code of 1986. These reorganization transactions however have to meet certain legal requirements to classify for favorable treatment.

94 455 title xx 2131 a oct. 91 681 as amended by pub. Under 1 368 2 f of the income tax regulations if a transaction otherwise qualifies as a reorganization a corporation remains a party to a reorganization even though the stock or assets acquired in the reorganization are transferred in a transaction described in 1 368 2 k.

This document contains final regulations that provide guidance regarding the qualification of a transaction as a corporate reorganization under section 368 a 1 f by virtue of being a mere change of identity form or place of organization of one. Internal revenue code 26 usca section 368. 4 1976 90 stat.

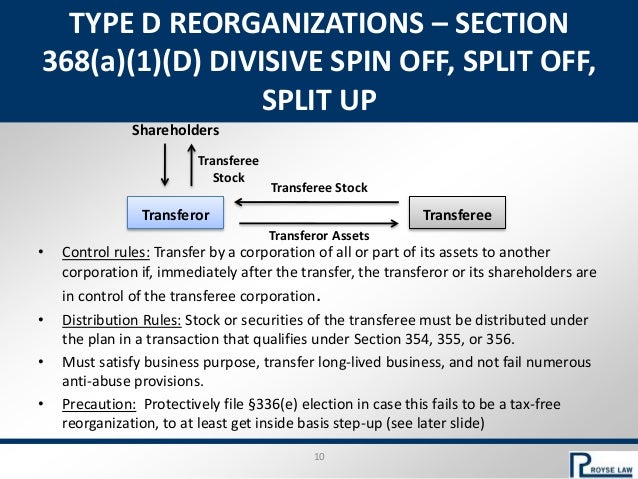

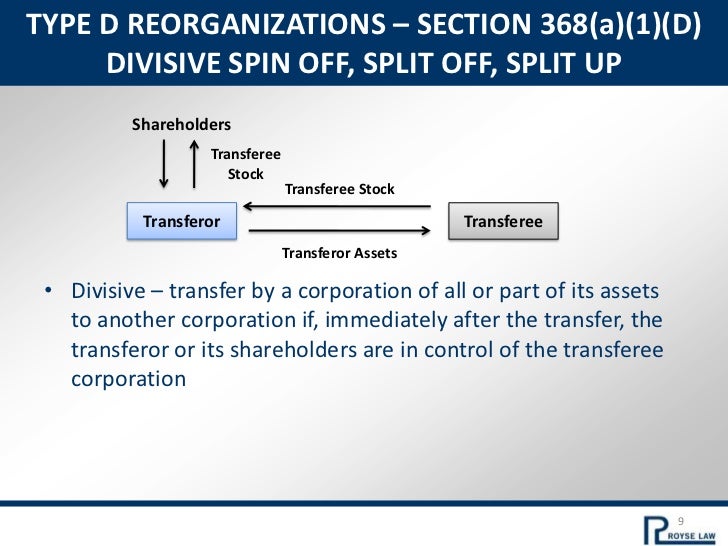

4 1976 90 stat. Is a transaction in which 1 a parent corporation transfers all of the interests in its limited liability company that is taxable as a corporation to its subsidiary first. Managing a tax free reorganization is entirely dependent on the tax jurisdiction section 368 section 368 outlines a format for tax treatment to reorganizations as described in the internal revenue code irc of 1986.