Section 12 A Of The Income Tax Act

Section 11 and 12 of the income tax act provides exemptions to ngo s.

Section 12 a of the income tax act. Lexis nexis butterworths 24 may 2010 12i. 1 any voluntary contributions received by a trust created wholly for charitable or religious purposes or by an institution established wholly for such purposes not being contributions made with a specific direction that they shall form part of the corpus. Under the income tax act 1961 non profit entities such as charitable trusts religious organizations ngos which are registered under section 12a are eligible to claim full exemption from income tax.

Section 2 15 defines charitable purpose and sections 11 12 12a 12aa and 13 of the income tax act are the main sections that deal with scheme of taxation exemption in respect of income of charitable or religious trusts institution. Any voluntary contribution received by a trust wholly for charitable or religious purposes or by an institution established wholly for such purposes not being contributions made with a specific direction that they shall form part of the corpus of the trust or institution shall be deemed to be the income. B where the total income of the trust or institution as computed under this act without giving effect to the provisions of section 11 and section 12 exceeds the maximum amount which is not chargeable to income tax in any previous year the accounts of the trust or institution for that year have been audited by an accountant as defined in the.

Apportionment of income between spouses governed by portuguese civil code. Comptroller means the comptroller of income tax appointed under section 3 1 and includes for all purposes of this act except the exercise of the powers conferred upon the comptroller by sections 34f 9 37ie 7 37j 5 67 1 a 95 96 96a and 101 a deputy comptroller or an assistant comptroller so appointed. Section 12 of income tax act income of trusts or institutions from contributions 12.

Income of religious trusts or institutions from voluntary contributions. Hence it is important for all such ngos trusts or organization to get registered under section 12a soon after incorporation. Additional investment and training allowances in respect of industrial policy projects 1 for the purposes of this section adjudication committee means the committee contemplated in subsection 16.

58 of 1962 source. Income tax act 34 of 1953. The income tax act 58 of 1962 aims.

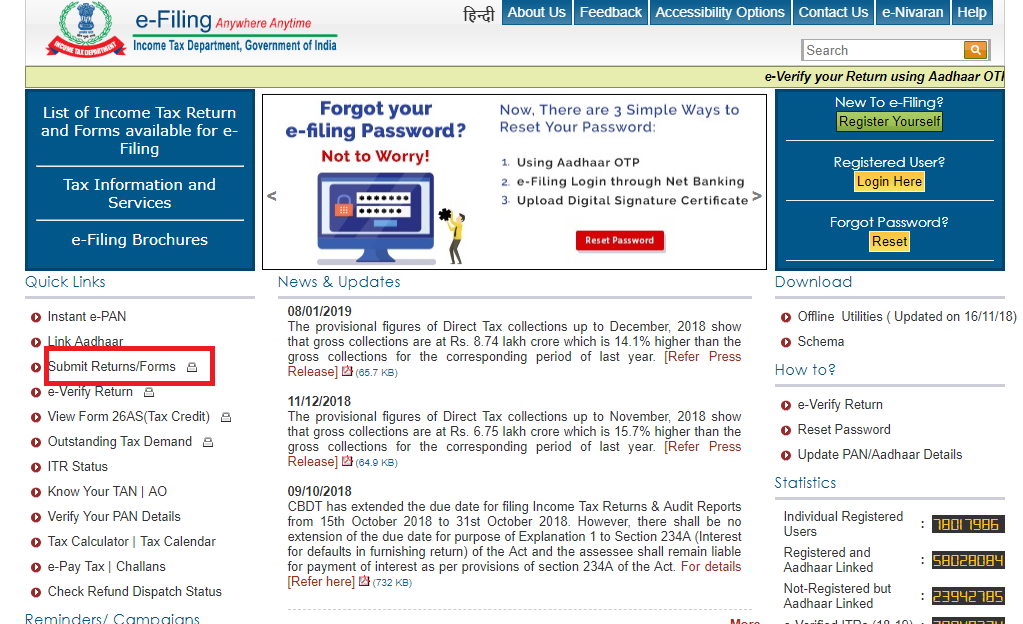

To consolidate the law relating to the taxation of incomes and donations. 1961 income tax department all acts income tax act 1961. The income tax department never asks for your pin numbers.