Section 125 Cafeteria Plan Definition

Employees their spouses and dependents can all benefit from section 125 plans.

Section 125 cafeteria plan definition. Highly compensated participants as to contributions and benefits. Section 125 is a written plan that lets employees choose between qualifying benefits and cash. No federal or social security taxes.

Section 125 cafeteria plans must be created by an employer. A cafeteria plan is a type of employee benefit plan offered in the united states pursuant to section 125 of the internal revenue code. If taken as a.

A cafeteria plan is a separate written plan maintained by an employer for employees that meets the specific requirements of and regulations of section 125 of the internal revenue code. A cafeteria plan allows employees to pay certain qualified expenses such as health insurance premiums on a pre tax basis thereby reducing their total taxable income and increasing their spendable take home income. Its name comes from the earliest such plans that allowed employees to choose between different types of benefits similar to the ability of a customer to choose among available items in a cafeteria.

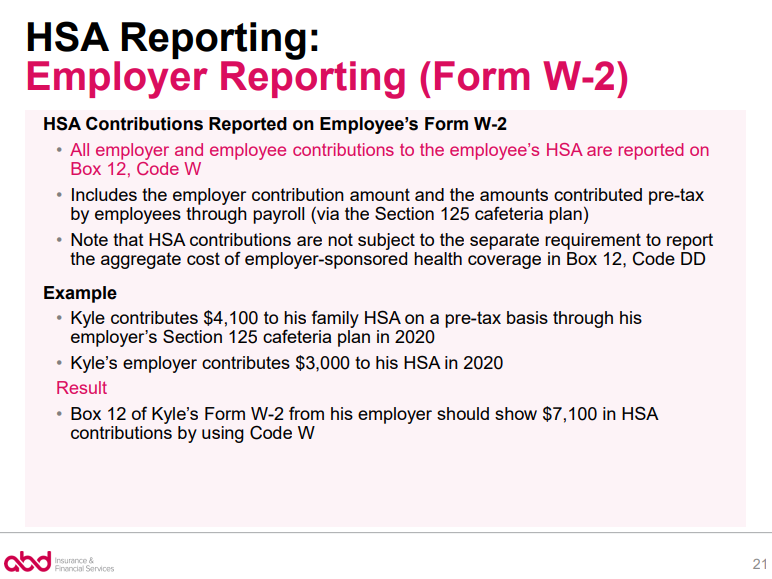

With pre tax benefits you deduct the employee s contribution before you withhold taxes reducing their taxable income. Except as provided in subsection b no amount shall be included in the gross income of a participant in a cafeteria plan solely because under the plan the participant may choose among the benefits of the plan. Section 125 of the internal revenue code irc specifies that cafeteria plans are exempt from the calculation of gross income for federal income tax purposes.

It provides participants an opportunity to receive certain benefits on a pretax basis. Qualified cafeteria plans are excluded from gross income. It s called a cafeteria plan because like walking through a cafeteria and selecting various dishes to eat employees can choose the types of healthcare options they want such as medical dental vision and other benefits and decline the ones they don t.

Employees receive benefits as pre tax deductions. To qualify a cafeteria plan must allow employees to choose from two or more benefits consisting of cash or. Once a plan is created the benefits are available to employees their spouses and dependents.