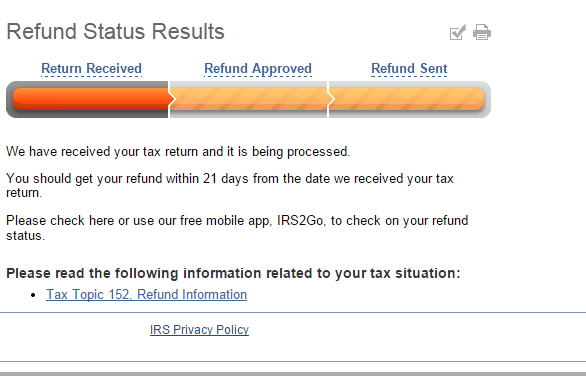

Section 152 Of The Internal Revenue Code

/GettyImages-57173091-66f9b5d085fc4aa780d30dc7d2261489.jpg)

Section 152 d 1 d provides that an individual is not a qualifying relative of the taxpayer if the individual is a qualifying child of any other taxpayer.

Section 152 of the internal revenue code. Internal revenue code 26 usca section 152. Read the code on findlaw. B exceptions for purposes of this section 1 dependents ineligible if an individual is a dependent of a taxpayer for any taxable year of such taxpayer beginning in a calendar year such individual shall be treated as having no dependents for any taxable year of such individual beginning in such calendar year.

A in general for purposes of this subtitle the term dependent means 1 a qualifying child or 2 a qualifying relative.

Source : pinterest.com