Section 162 Irs Code

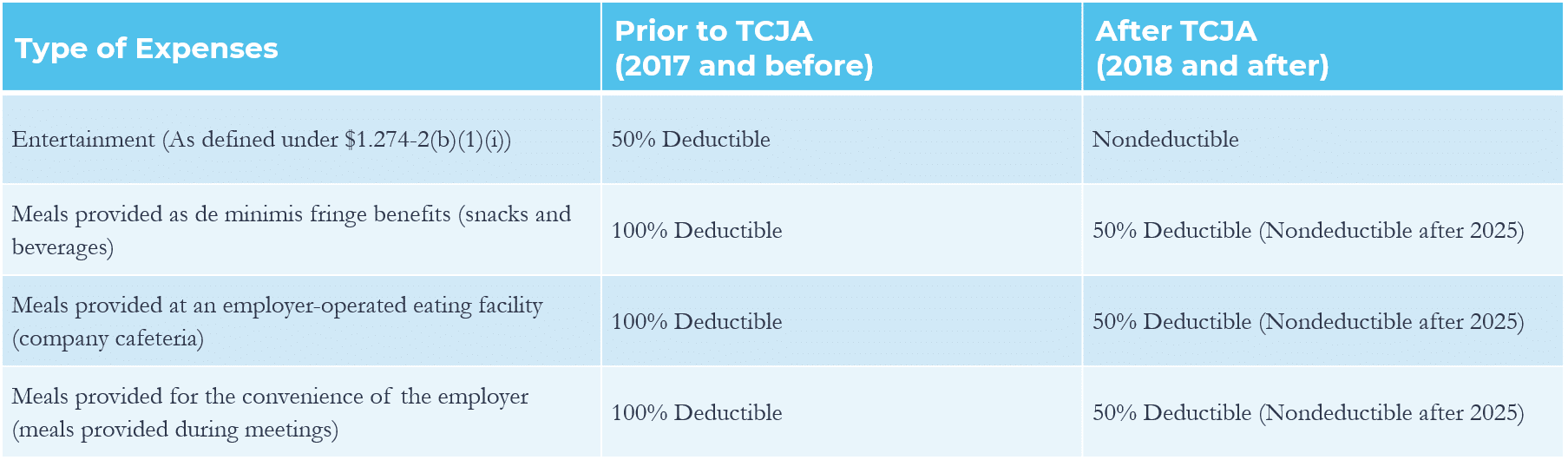

If an expense is not deductible then congress considers the cost to be a consumption expense.

Section 162 irs code. It is one of the most important provisions in the code because it is the most widely used authority for deductions. Internal revenue code 162. Law and analysis section 162 a allows a deduction for all the ordinary and necessary expenses paid or incurred during the taxable year in carrying on any trade or business.

Section 162 a of the internal revenue code 26 u s c. 162 u s. A qualifying event described in section 162 k 3 a of the internal revenue code of 1986 or section 603 1 of the employee retirement income security act of 1974 29 u s c.

Internal revenue code section 162 a trade or business expenses a in general. 1954 in the case of any individual who was a state legislator at any time during any taxable year beginning before january 1 1981 and who for the taxable year elects the application of this section for any period during such a taxable year in which he was a state legislator. Code unannotated title 26.

There shall be allowed as a deduction all the ordinary and necessary expenses paid or incurred during the taxable year in carrying on any trade or business including 1 a reasonable allowance for salaries or other compensation for personal services actually rendered. Section 262 however provides that no deduction is allowed for personal living or family expenses. 1163 1 relating to the death of a retired employee occurring after the date of the qualifying event described in subparagraph a.

Trade or business expenses. It concerns deductions for business expenses.