Section 192 2b Income Tax

Yes you are right provisions of section 192 2b clearly states that loss from house property can be considered by the employer while deducted tds from salary.

Section 192 2b income tax. Permanent account number. Income tax department currently selected. Particulars of income under any head of income other than salaries not being a.

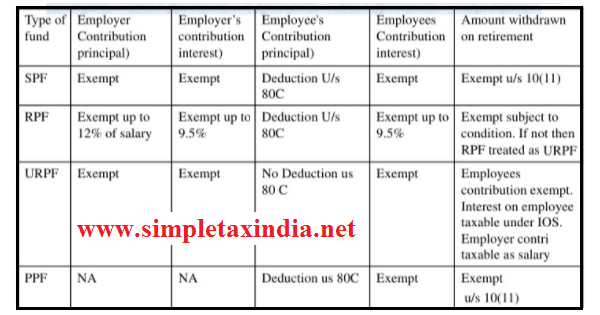

Section 192 in the income tax covers the provisions relating to deduction of tax at source on salary income. Usually following incomes declared for inclusion and. What is section 192 in income tax.

Faqs on section 192 tds on salary. Name and address of the employee. Section 192 2a furnishing of particulars of other income of employee section 192 2b.

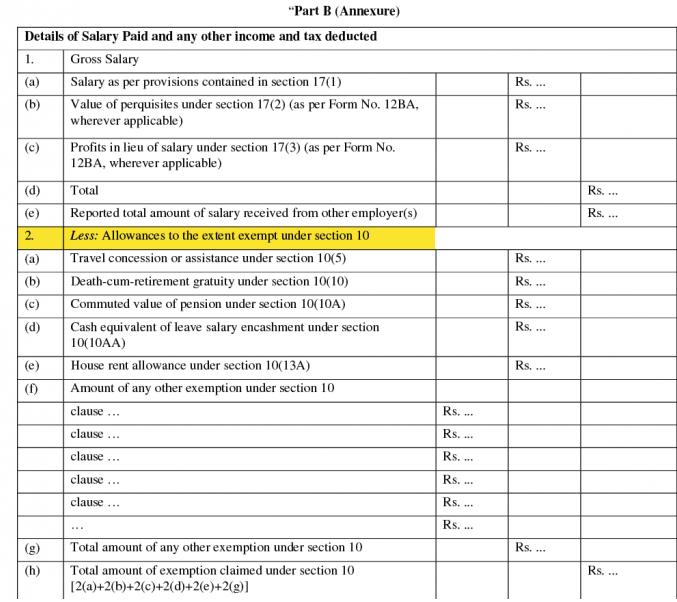

Banks has been advised that as per section 17 1 ii of the income tax act 1961 the term salary includes pension once tax has been deducted under section 192 of the income tax act 1961 the tax deductor is bound by section 203 to issue the certificate of tax deducted in form 16. Form for sending particulars of income u s 192 2b for the year ending 31 03 20 1. The following may send to the employer.

Employees submission of information regarding income under any other head. Section 192 2b enables a taxpayer employee to furnish particulars of income under any head other than salaries to his employee for inclusion in taxable income and deduction of tax at source. Form 12ba alongwith form 16 issued by employer to employee with tds on salary certificate section 192 2c and rule 26a 2 a person responsible for paying any income chargeable under the head salaries shall furnish to the person to whom such payment is made a statement giving correct and complete particulars of perquisites or profits in lieu of salary provided to him and the value.

10e to the employer to avail the above benefit. Employee shall submit the prescribed information in form no. Employee may submit to the employer the details of his other incomes chargeable to tax for that fy.