Section 37a Of Income Tax Act

Appeals under income tax act.

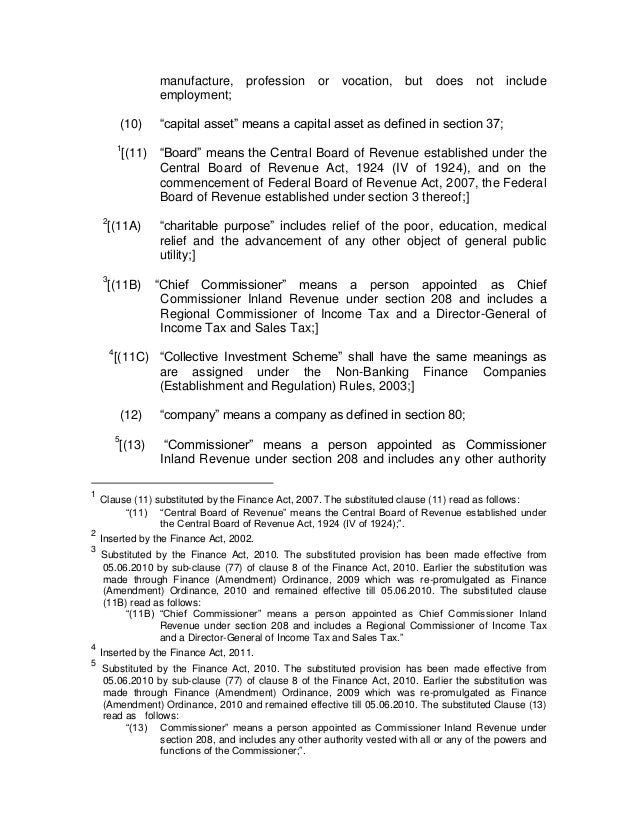

Section 37a of income tax act. 37a and 38 capital gain income tax section 37. Repealed by act no. As alluded to earlier section 37a of the income tax act no.

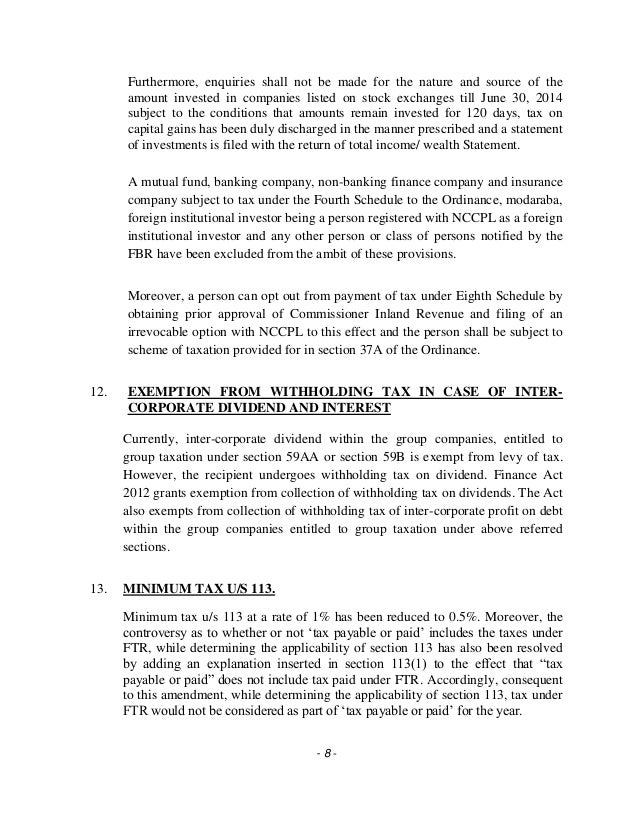

1961 pan section 139a and aadhaar number section 139aa. A rehabilitation trust contemplated in section 37a of the act. It regulates mining rehabilitation funds rehabilitation fund created with the sole object of applying their property for the environmental rehabilitation of mining areas and grants a tax deduction for payments made to such dedicated.

Certain interest on housing bonds exempt. 33 of 1997. Section 4 1 c of the premier vesting act no.

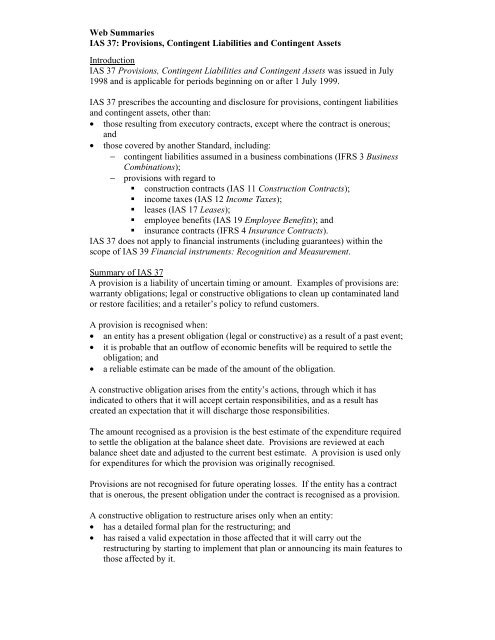

Return of income and procedure of assessment section 139 to 154 penalties under income tax act. Understanding allowability of business expenditure under section 37 of the income tax act 1961 with latest case laws. This deduction would not necessarily benefit mining companies which are not in a tax paying position.

58 of 1962 the act aligns tax policy with environmental regulation. Section 37 of the income tax act 1961 is a residuary section for allowability of business expenditure and the same is given below. Income tax act shall continue to be treated as an approved plan fund or scheme for the purposes of the income tax act.

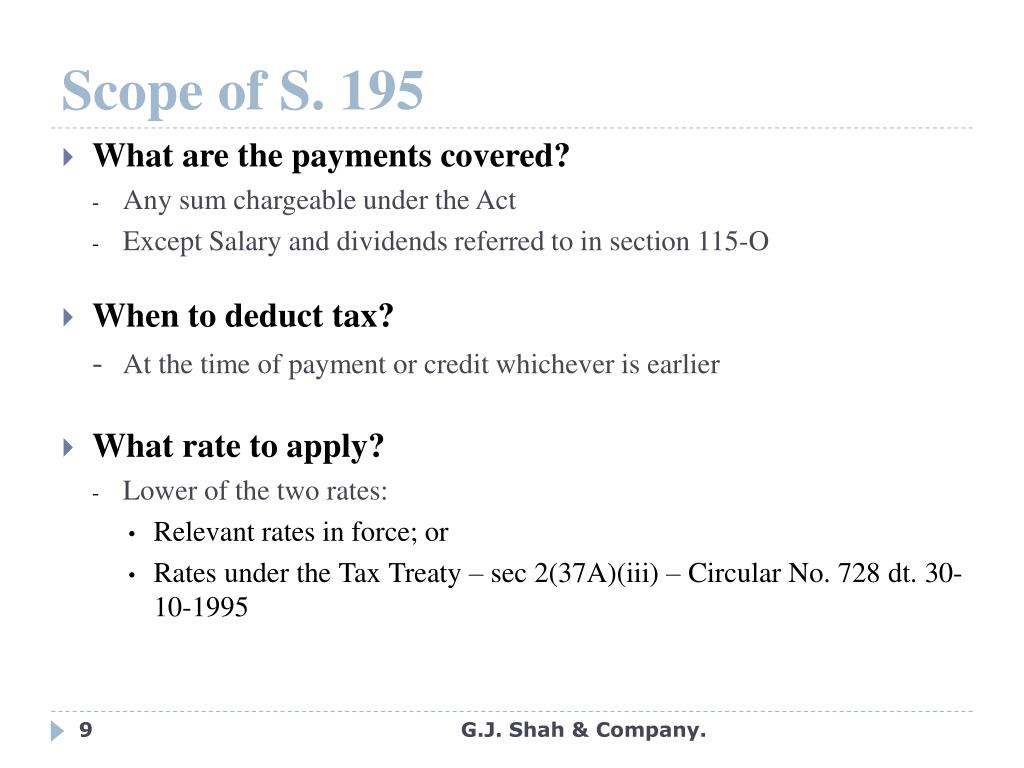

Payment of advance tax and refund of tax. The capital gain arising on or after the first day of july 2010 from disposal of securities held for a period of less than a year shall be chargeable to tax at the rates specified in division vii of part i of the first schedule. The figure 113 omitted by the finance act 1965 w.

(viia).jpg)