Section 404 Of The Sarbanes Oxley Act Of 2002

The public company accounting reform and investor protection act otherwise known as the sarbanes oxley act the act was enacted in july 2002 after a series of high profile corporate scandals involving companies such as enron and worldcom.

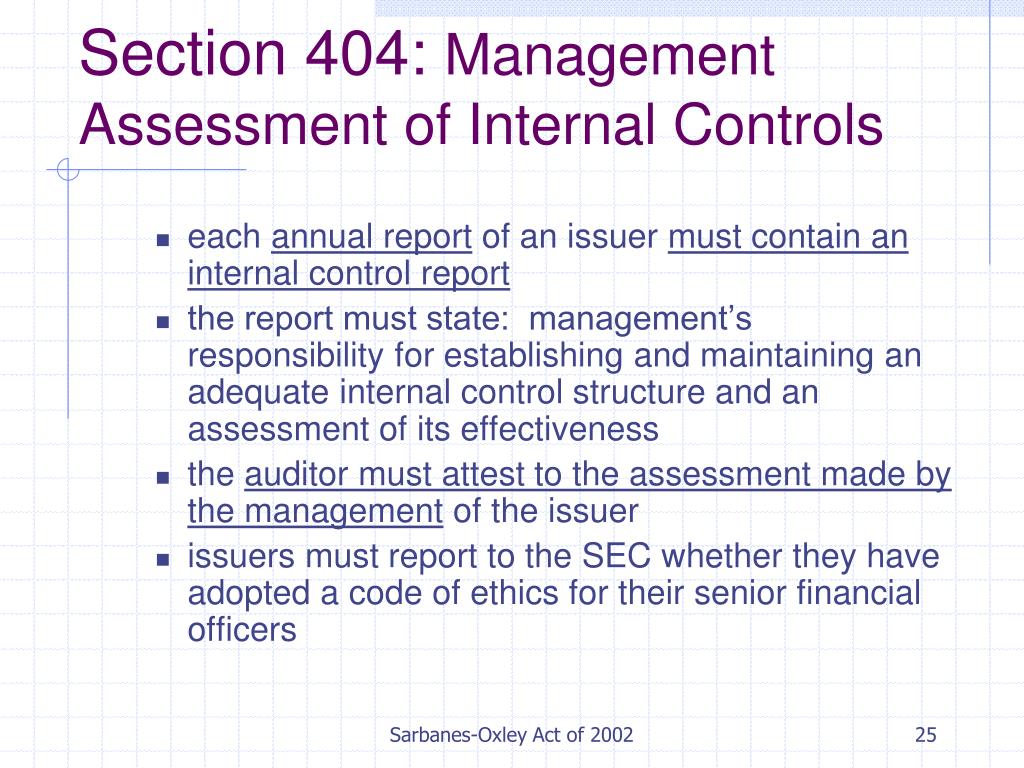

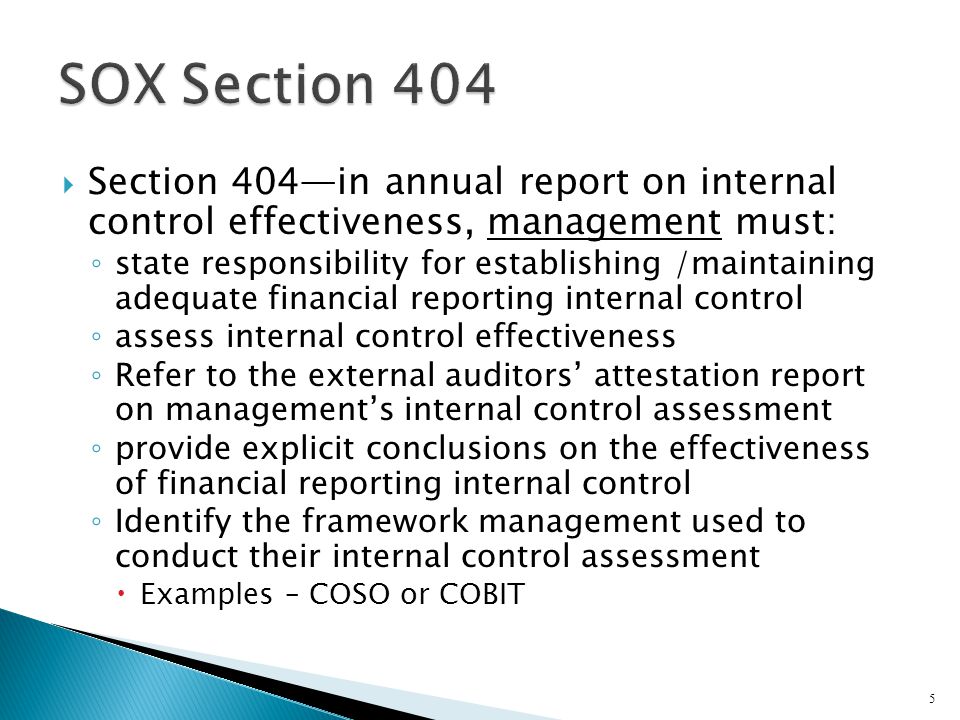

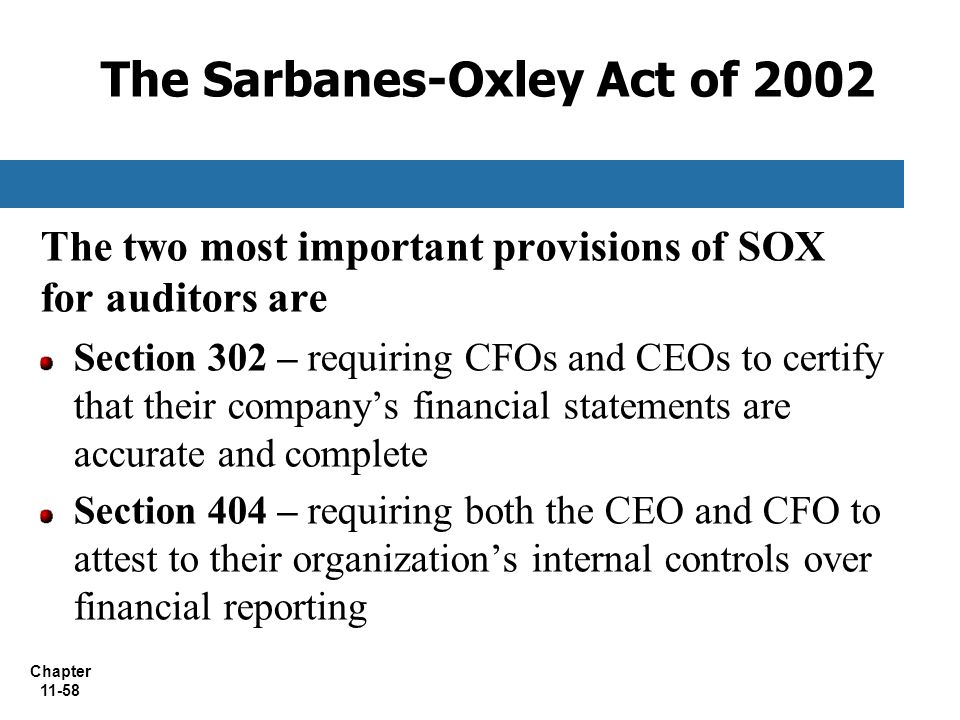

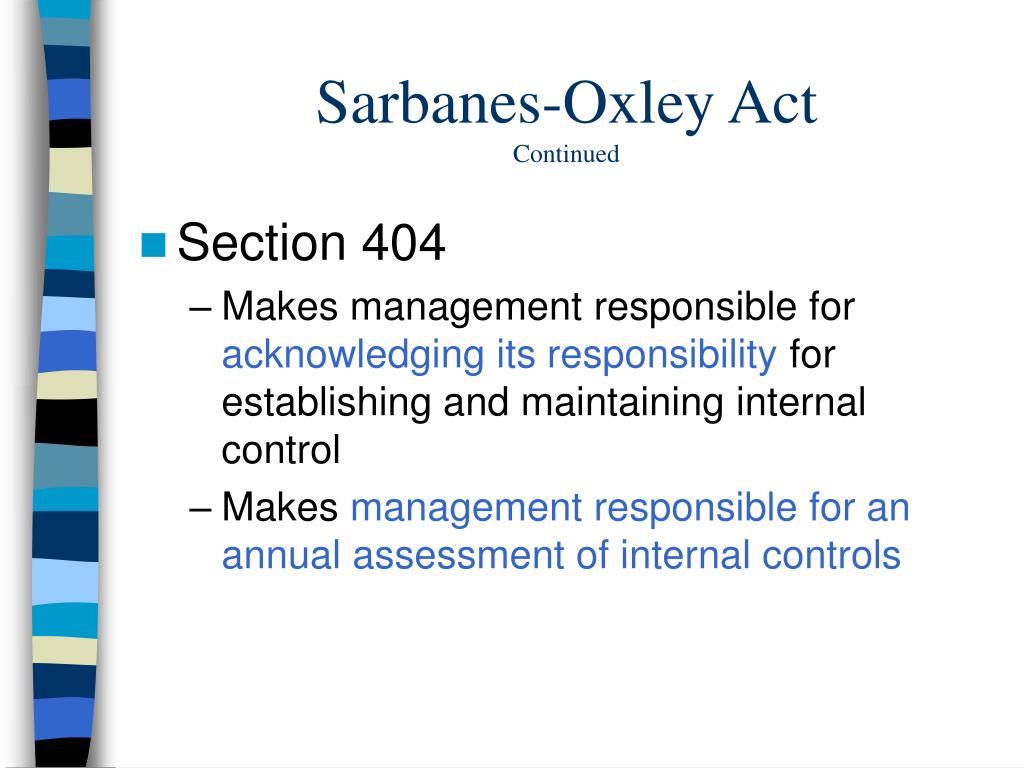

Section 404 of the sarbanes oxley act of 2002. Summary of section 404. Section 404 b requires a publicly held company s auditor to attest to and report on management s assessment of its internal controls. Section 404 is the most complicated most contested and most expensive to implement of all the sarbanes oxley act sections for compliance.

By july of 2002 stock market indices had fallen 40 percent in 30 months. Section 404 a of the act. The registered accounting firm shall in the same report attest to and report on the assessment on the effectiveness of the internal control structure and procedures for financial reporting.

Section 404 of the sarbanes oxley act seeks to build on this correlation by requiring that every public company annually issue and file with the securities and exchange commission a management report concerning the effectiveness of the company s internal control over financial reporting. Section 404 b of sarbanes oxley act of 2002 the sarbanes oxley act requires that the management of public companies assess the effectiveness of the internal control of issuers for financial reporting. Pdf 1 8 mb section 404 of the sarbanes oxley act requires public companies annual reports to include the company s own assessment of internal control over financial reporting and an auditor s attestation.

Section 404 of the sarbanes oxley act of 2002 in the early 2000s bankruptcies and financial scandals of well respected companies such as enron and worldcom flooded the news. Section 404 and certification section 404 requires corporate executives to certify the accuracy of financial statements personally. Since the law was enacted however both requirements have been postponed for smaller public companies.

This statement shall also assess the effectiveness of such internal controls and procedures. If the sec finds violations ceos could face 20 years in jail. Issuers are required to publish information in their annual reports concerning the scope and adequacy of the internal control structure and procedures for financial reporting.

But only a few ceos have faced criminal charges.