Section 404 Of The Sarbanes Oxley Act States That

A full 9 out of every 10 companies with ineffective section 404 controls self reported effective section 302 controls in the same period end that an adverse section 404 was reported 90 in accurate without a section 404 audit.

Section 404 of the sarbanes oxley act states that. The essence of section 302 of the sarbanes oxley act states that companies are required to disclose on an almost real time basis information concerning material changes in its financial condition or operations. 16 state the term state means any state of the united states the district of columbia puerto rico the virgin islands or any other territory or possession of the united states. A clear understanding of the requirements of the sarbanes oxley act and the fundamentals of internal controls.

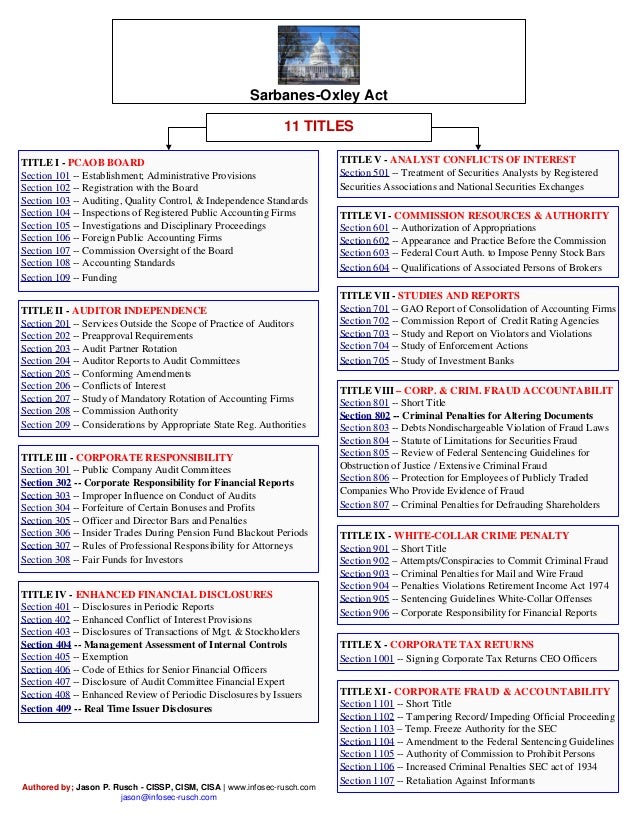

Here is a direct excerpt from the sarbanes oxley act of 2002 report for section 409. All annual financial reports must include an internal control report stating that management is responsible for an adequate internal control structure and an assessment by management of the effectiveness of the control structure. Sarbanes oxley act section 404 this section is listed under title iv of the act enhanced financial disclosures and pertains to management assessment of internal controls.

Summary of section 404. Real time issuer disclosures. Section 404 of the sarbanes oxley act requires public companies annual reports to include the company s own assessment of internal control over financial reporting and an auditor s attestation.

Improper influence on conduct of audits. Section 404 and certification section 404 requires corporate executives to certify the accuracy of financial statements personally. 78c a 47 is amended by inserting the sarbanes oxley act of.

Section 404 b requires a publicly held company s auditor to attest to and report on management s assessment of its internal controls. Since the law was enacted however both requirements have been postponed for smaller public companies. The sarbanes oxley act requires that the management of public companies assess the effectiveness of the internal control of issuers for financial reporting.

B conforming amendment section 3 a 47 of the securities exchange act of 1934 15 u s c. If the sec finds violations ceos could face 20 years in jail. A discussion of how the annual requirements of section 404 relate to the quarterly require ments of section 302 i e the quarterly certification by the ceo and cfo.