Section 754 Basis Adjustment

The section 754 election must be made in a statement that is filed with the partnership s timely filed return including any extension for the tax year during which the distribution or transfer occurs.

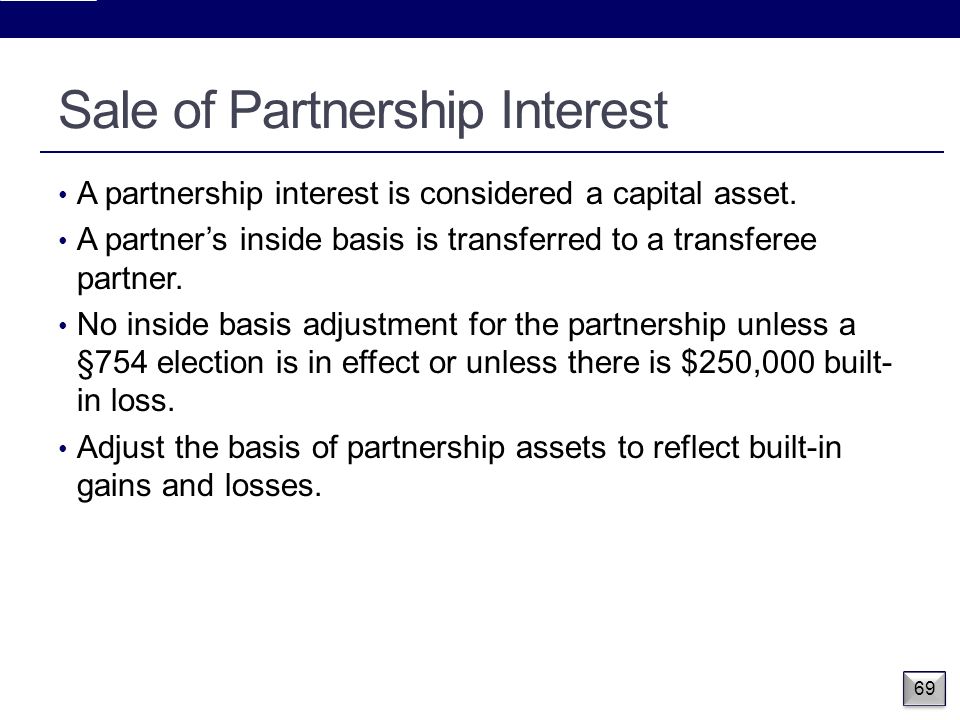

Section 754 basis adjustment. The sale of a partnership interest which is governed by section 743 or a distribution of property. You can verify that the adjustment does not need to be entered by reviewing the supplemental information to see if the depreciation adjustment is reducing the net income. Under section 754 a partnership may elect to adjust the basis of partnership property when property is distributed or when a partnership interest is transferred.

Entering section 754 basis adjustment. A section 754 depreciation adjustment reported on the supplemental information page of a k 1 does not usually need to be reported anywhere on the individual tax return. The statement must include.

Section 754 and 743 b depreciation is usually used to reduce the income reported on the k 1 from the partnership side. Section 754 allows a partnership to make an election to step up the basis of the assets within a partnership when one of two events occurs. The above scenario can be remedied by the fund making a section 754 election and adjusting the basis pursuant to section 743 b.

734 b and 743 b shall be made in a written statement filed with the partnership return for the tax year during. This election allows the new partner to receive the benefits of depreciation or amortization that he or she may not have received if the election was not made. If a partnership files an election in accordance with regulations prescribed by the secretary the basis of partnership property shall be adjusted in the case of a distribution of property in the manner provided in section 734 and in the case of a transfer of a partnership interest in the manner provided in section 743.

Distribution of partnership property or transfer of an interest by a partner. The adjustment in the basis of the assets of the partnership is equal to the transferee partner s initial basis in the partnership less his proportionate share of the adjusted basis of the partnership assets. In other words the partnership will step up or step down its basis in partnership property when a specific event a property distribution or the transfer of a partnership interest occurs.

The name and address of the partnership. 754 election is made then adjustments can be made to the basis of partnership property the inside basis under sections 734 b and 743 b. How the amount of the adjustment is allocated among hi i d i d d s 755 cummings lockwood llc 2011 11 11.