W2 Section 12

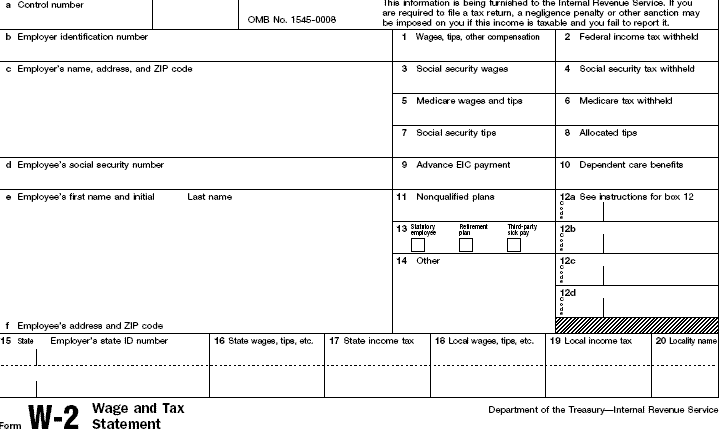

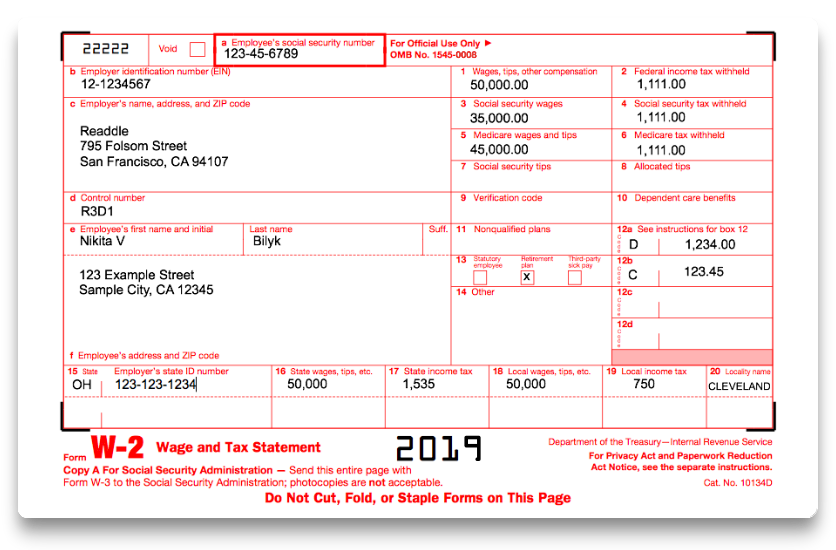

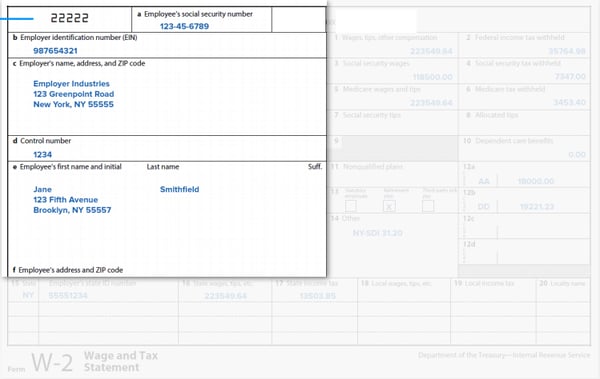

Your w 2 has four sections in box 12 labeled 12a 12b 12c and 12d.

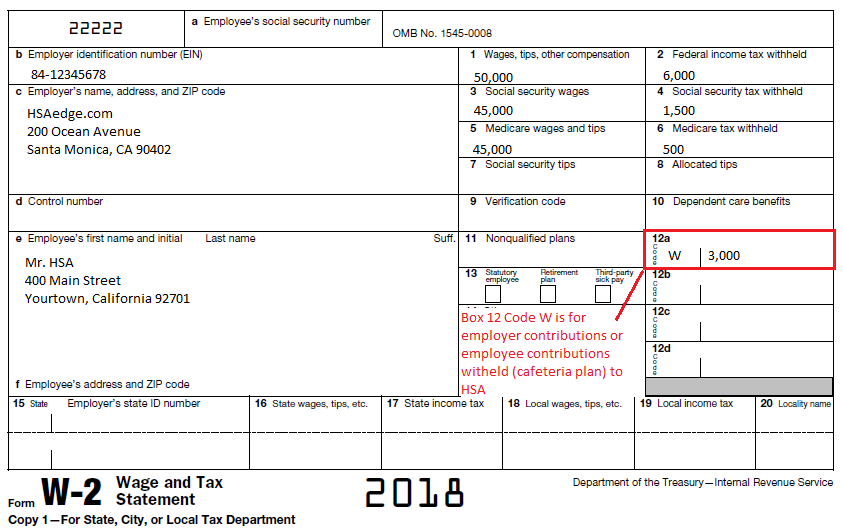

W2 section 12. They are not taxed and are not included in your w 2 box 1 wages so you can not deduct them as medical expenses. The w 2 you got from your employer will have four lines for box 12 labeled 12a 12b 12c and 12d. Sec 125 is your employer s benefit plan.

Include this tax on form 1040. It is critical that business owners correctly determine whether the individuals providing services are employees or independent contractors. They just give your employer space to provide more information you need to prepare your tax return.

Include this tax on form 1040 schedule 4 line 58. These lowercase letters don t mean anything. Include this tax on form 1040.

Use box 14 if railroad retirement taxes apply. Include this tax on form 1040 schedule 4 line 58. B uncollected medicare tax on tips.

If box 12 on your w 2 is empty don t enter anything for box 12. Uncollected medicare tax on tips but not additional medicare tax c. Box 12 various form w 2 codes on box 12 that reflect different types of compensation or benefits.

Section 457 b plan or b included in box 3 and or 5 if it is a prior year deferral under a nonqualified or section 457 b plan that became taxable for social security and medicare taxes this year because there is no. You must report all employer contributions including an employee s contributions through a cafeteria plan to an hsa in box 12 of form w 2 with code w. A uncollected social security or rrta tax on tips.