Direct Tax Sections List

I want this short cut sections so please sent to my mail id.

Direct tax sections list. Total income to include income of any other person. Such a tax may be levied in proportion to population in the district of columbia 1981 a penalty imposed for nonpayment of a direct tax is not a part of the tax itself and hence is not subject to the rule of apportionment. Computation of total income.

Direct taxes law and practice dr vinod k singhania dr kapil singhania. Get all the details here in this article. Remuneration remuneration is any type of compensation or payment that.

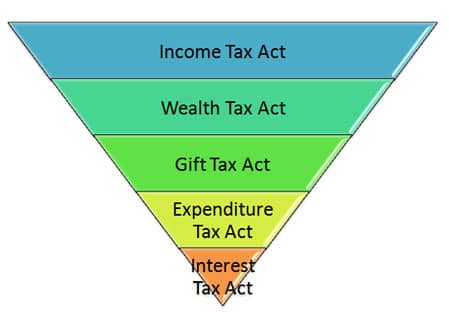

Miscellaneous the power of congress to levy direct taxes is not confined to the states represented in that body. Types of direct taxes 1. Such a tax is levied on the taxable portion.

Krunal nemlawala on january 17 2014 at 5 15 am said. Summary of income tax sections. In the united states article i section 2 clause 3 of the constitution requires that direct taxes imposed by the national government be apportioned among the states on the basis of population.

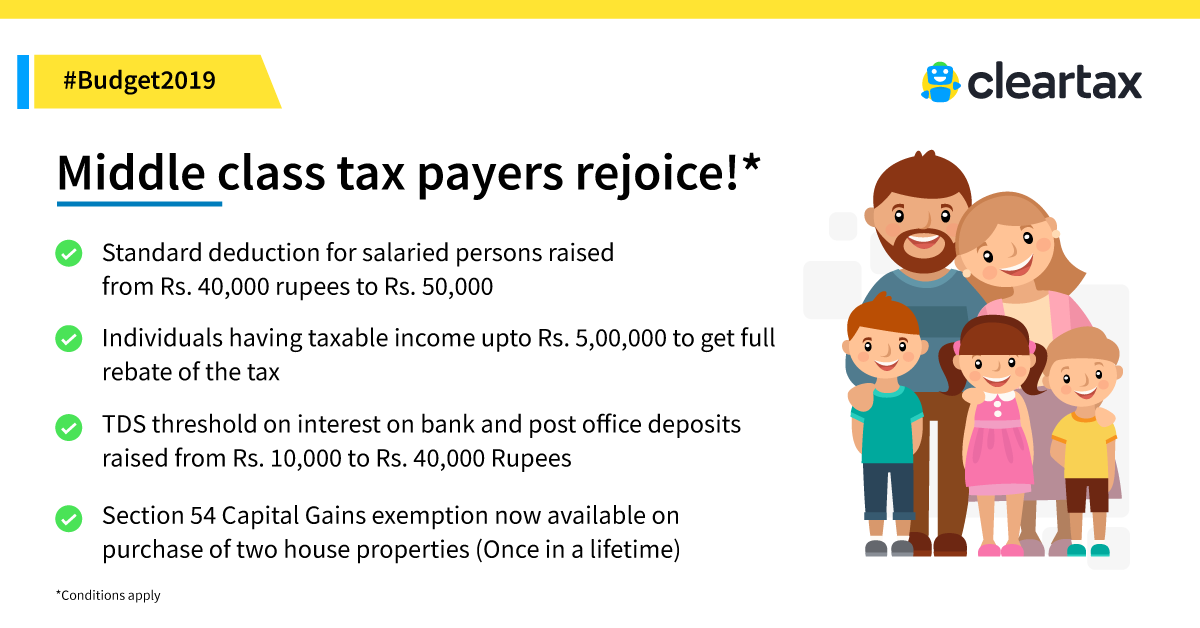

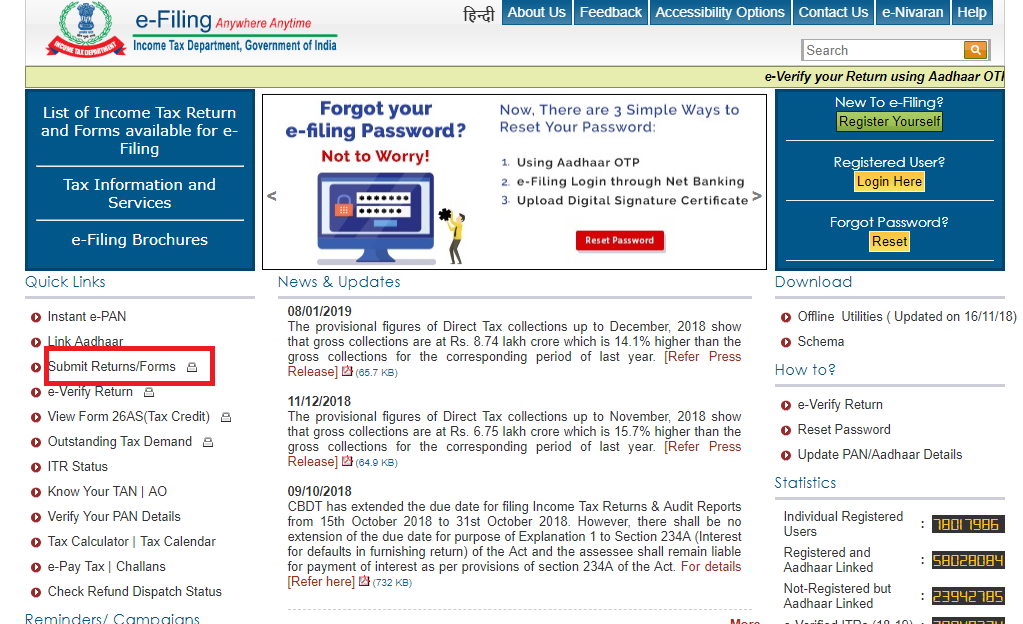

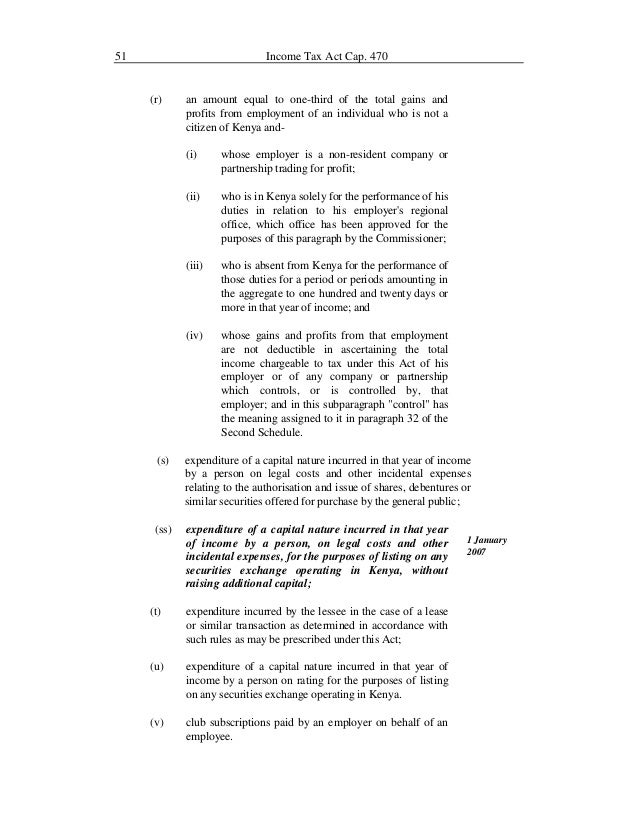

The title or contents topics covered under sections 1 to 298 of income tax act 1961 as amended by the latest finance act. 8 thoughts on list of important direct tax sections reply. It is based on one s income.

Kalpana on july 27 2014 at 5 58 am said. Deductions include deduction against salaries against income from house properties against profits and gains of business or profession against capital gains and against income from other sources. Please send all details income tax.

(viia).jpg)