Irc Section 401 A 9

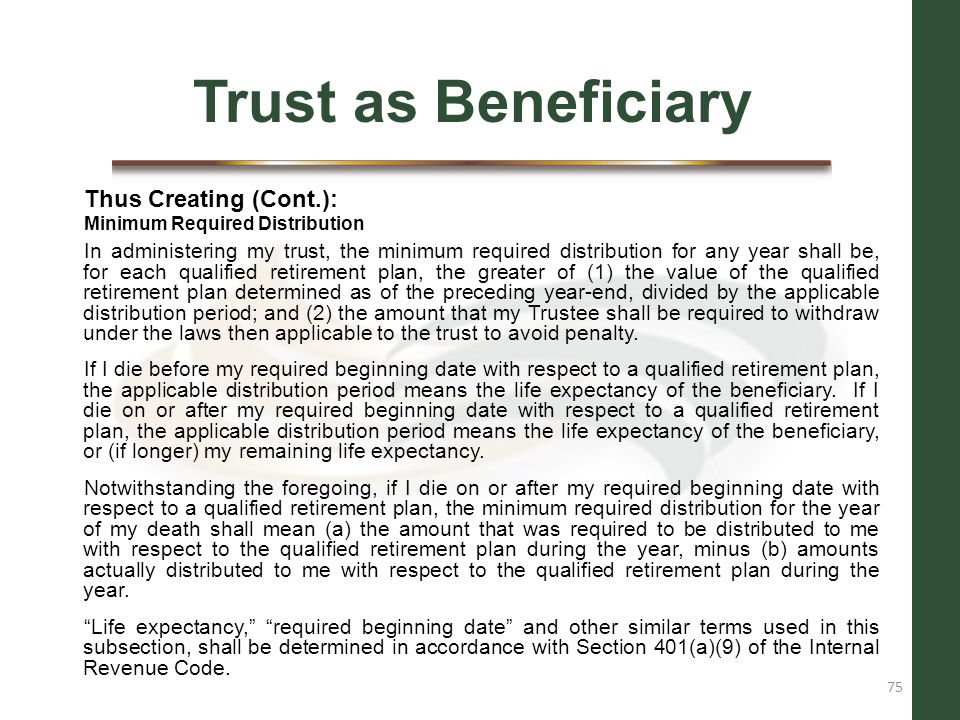

In order to satisfy section 401 a 9 except as otherwise provided in this section distributions of the employee s entire interest under a defined benefit plan must be paid in the form of periodic annuity payments for the employee s life or the joint lives of the employee and beneficiary or over a period certain that does not exceed the maximum length of the period certain determined in accordance with a 3 of this section.

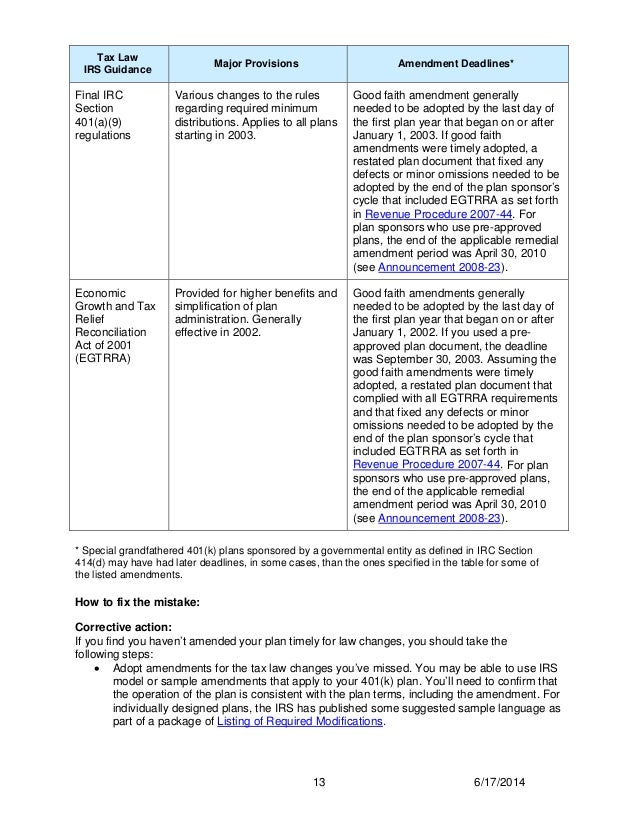

Irc section 401 a 9. B distribution calendar year. 1 401 a 9 9 life expectancyand distributionperiod tables. The distribution rules of section 401 a 9 apply to all account balances and benefits in existence on or after january 1 1985.

Section 401 a 9 irc section 401 a 9. What is the life expectancyfor an individual for purposesof determining required minimum distributionsunder section 401 a 9. Internal revenue code section 401 a 9 required distributions 9 required distributions a in general a trust shall not constitute a qualified trust under this subsection unless the plan provides that the entire interest of each employee i will be distributed to such employee not later than the required beginning date or.

401 a 9 was added to the code by the self employed individuals retirement act of 1962 and was expanded to all qualified plans by section 242 of the tax equity and fiscal responsibility act. For individuals dying on or after january 1 2020 this section creates a ten year distribution period for most designated beneficiaries similar to the five year period that has long been applied to non designated beneficiaries. This section and 1 401 a 9 2 through 1 401 a 9 9 apply for purposes of determining required minimum distributions for calendar years beginning on or after january 1 2003.

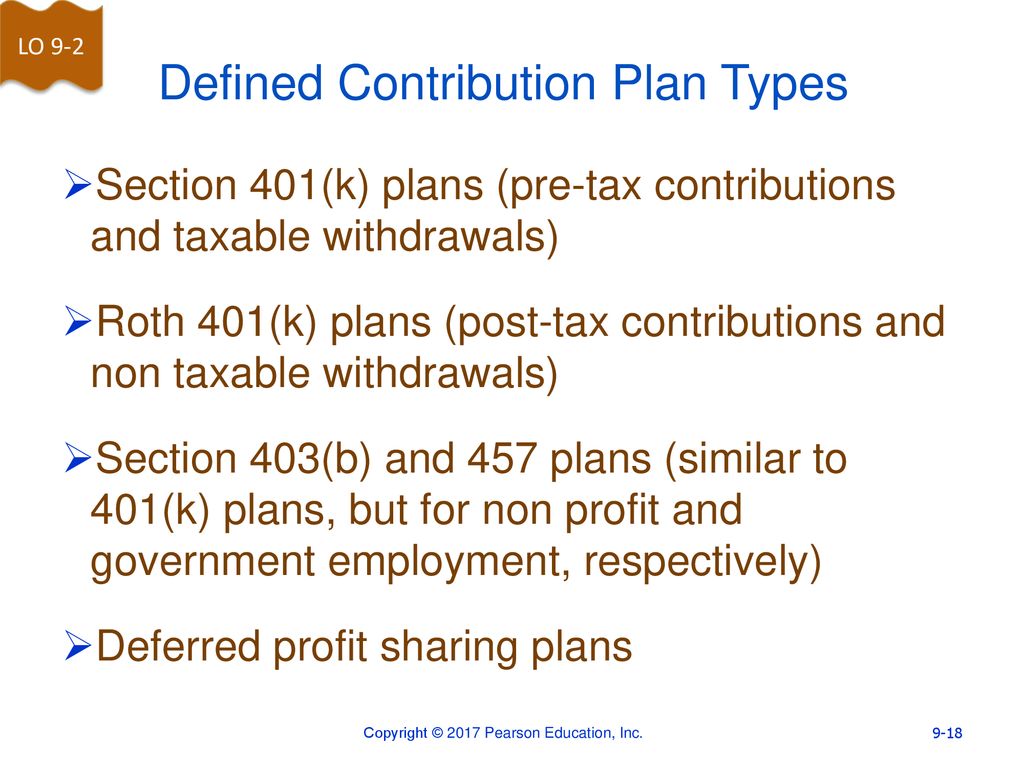

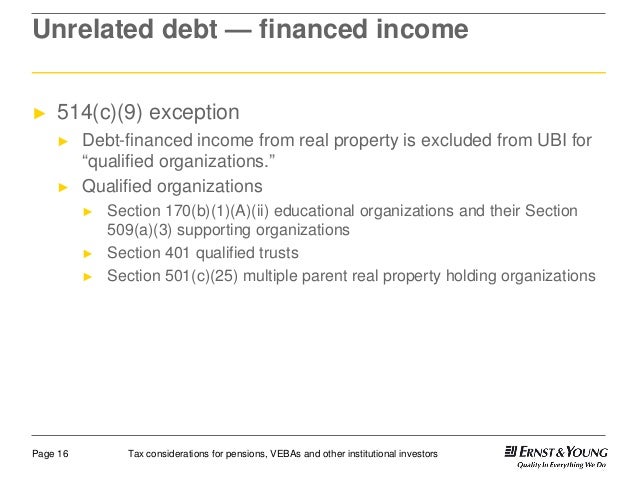

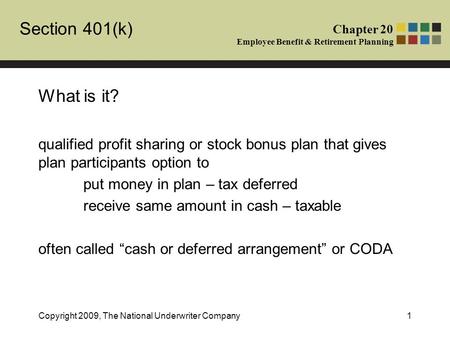

For purposes of this section and sections 402 403 and 404 the term annuity includes a face amount certificate as defined in section 2 a 15 of the investment company act of 1940 15 u s c sec. Internal revenue code section 401 a 9 qualified pension profit sharing and stock bonus plans a requirements for qualification. A trust created or organized in the united states and forming part of a stock bonus pension or profit sharing plan of an employer for the exclusive benefit of his employees or their.

Section 401 a 1 of the act adds a new subsection h to 26 u s c. A 1 the following table referred to as the single life table is used for determining the life expectancyof an individual.