Section 127 Tuition Reimbursement

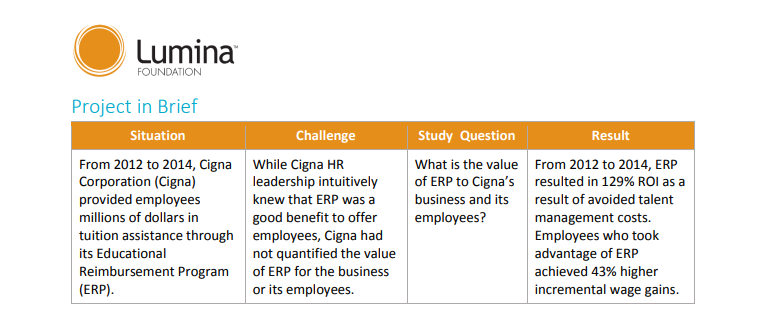

In the case of cigna every 1 spent on education assistance equaled 1 29 saved on talent management costs.

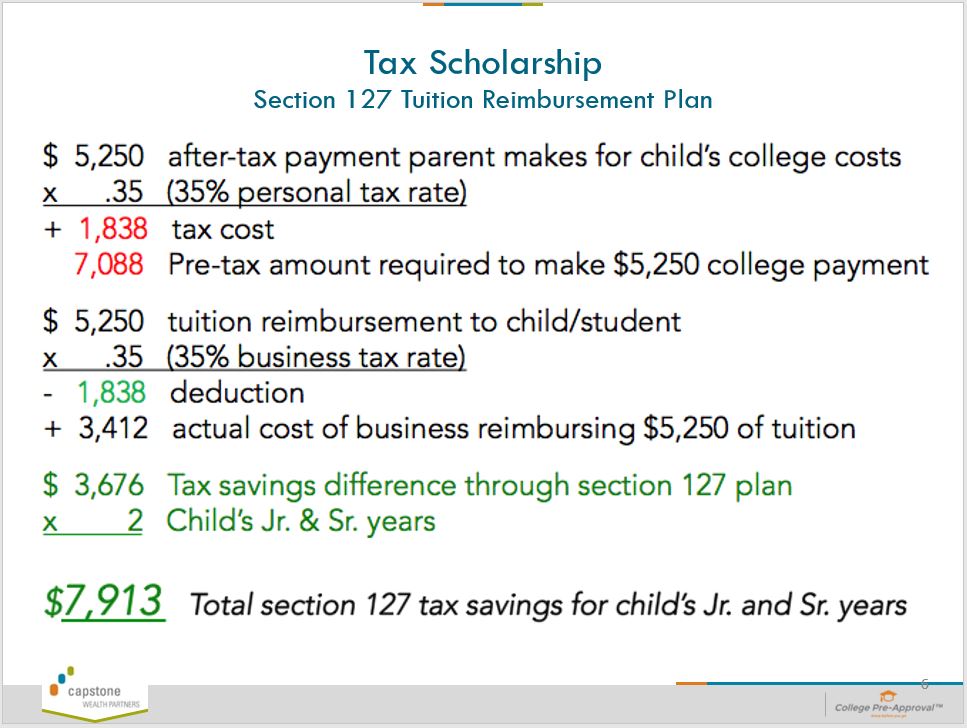

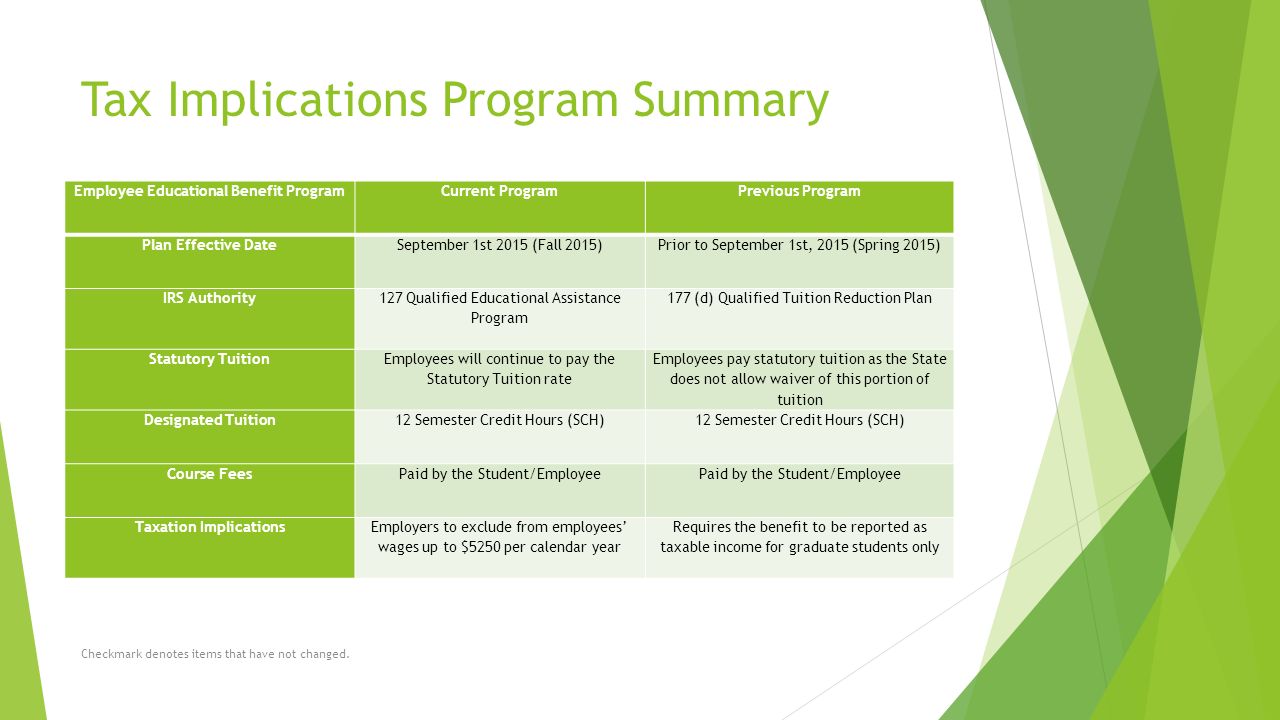

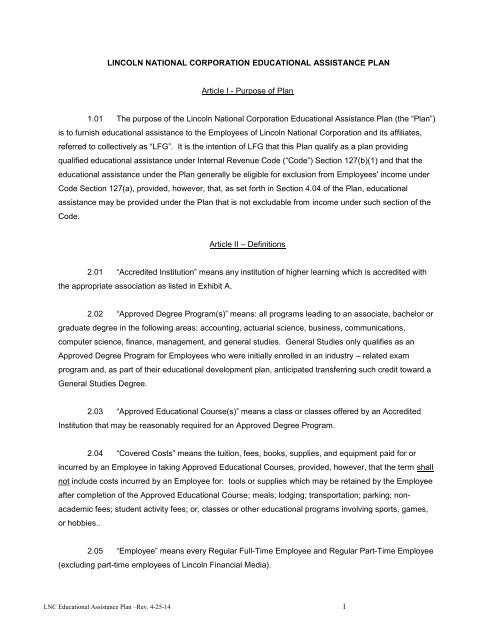

Section 127 tuition reimbursement. Section 127 according to section 127 of the internal revenue code you can give an employee up to 5 250 per calendar year and that amount is not included in the employee s income. Companies setting up a tuition program under irc section 127 for example can deduct up to 5 250 per calendar year for each enrolled employee. The employer deducts the.

However qualified expenses do not include meals lodging and transportation. In addition to attracting top workers tuition reimbursement benefits help employers reduce turnover. Set forth in internal revenue code section 127 b 3.

Amounts for additional education expenses exceeding 5 250 may be excluded from tax under irc section 132 d. Not more than 5 percent of the amounts paid or incurred by the employer for educational assistance during the year may be provided for the class of individuals who are shareholders or owners or their spouses or dependents each of whom on any day of the year owns more than 5 percent of the stock or of the capital or profits interest in the employer. Under section 127 b 3 a program is a qualified program for a program year only if no more than 5 of the amounts paid or incurred by the employer for educational assistance benefits during the year are provided to the limitation class described in subparagraph 2.

Section 127 of the federal tax code given a permanent extension in the january 2013 tax cut allows employers to give employees up to 5 250 a year in tuition assistance. This plan prohibits the company from offering eligible employees a choice between educational assistance and other compensation. That means you will not include the educational assistance on the employee s form w 2 and the money is considered non taxable income.

Under section 127 reimbursable education includes any form of instruction or training that improves or develops the capabilities of an individual and is not limited to job related or degree programs. To 5 250 may be excluded from tax under irc section 127.