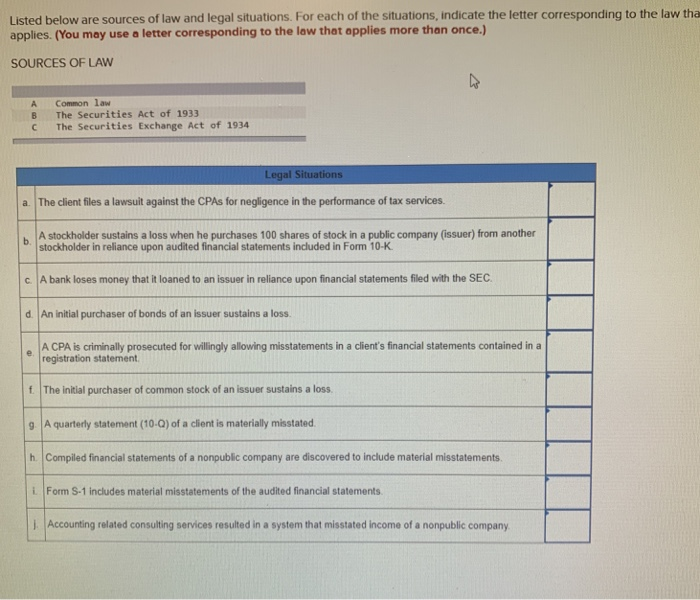

Section 17 A Of The Securities Act Of 1933

General rules and regulations promulgated under the securities exchange act of 1934 17 cfr part 240.

Section 17 a of the securities act of 1933. A the information required in a prospectusneed not follow the order of the items or other requirements in the form. Congress passed the 1933 securities act in the wake of the market crash of 1929 to provide investors with full disclosure of material information concerning public offerings of securities in commerce to protect investors against fraud and through the imposition of specified civil liabilities to promote ethical standards of honesty and fair dealing 1 as the key enforcement provision of the 1933 act section 17 a prohibits fraud and misrepresentations in the offer or sale of. Such information shall not however be set forth in such fashion as to obscure any of the required information or any information necessary to keep the required information from being incomplete or misleading.

An act to provide full and fair disclosure of the character of securities sold in interstate and foreign commerce and through the mails and to prevent frauds in the sale thereof and for other purposes. It provides for liability for fraudulent sales of securities. Payment is made through the issuance of securities to platform on a one time basis accruing monthly.

Section 17 of the 33 act is an anti fraud provision applicable to the initial sale or issuance of securities. As of last day of previous month other fixed date no more than 30 days earlier the. Some courts have found an implied right of private action under this provision though this is becoming a less favored position.

It provides for liability for fraudulent sales of securities. Securities act of 1933 long title an act to provide full and fair disclosure of the character of securities sold in interstate and foreign commerce and through the mails and to prevent frauds in the sale thereof and for other purposes. It shall be unlawful for any person in the offer or sale of any securities by the use of any means or instruments of transportation or communication in interstate commerce or by the use of the mails directly or indirectly.

230 421 presentation of information in prospectuses. Section 17 a is a key anti fraud provision in the securities act. Platform is compensated by the issuer for publicizing the offering of the issuer s securities.

77e and not to antifraud or other provisions of the federal securities laws. In view of the objective of these rules and the policies underlying the act regulation s is not available with respect to any transaction or series of transactions that although in technical. Securities act of 1933.

/GettyImages-513676272-efd95f82492447f581517b4690d31421.jpg)