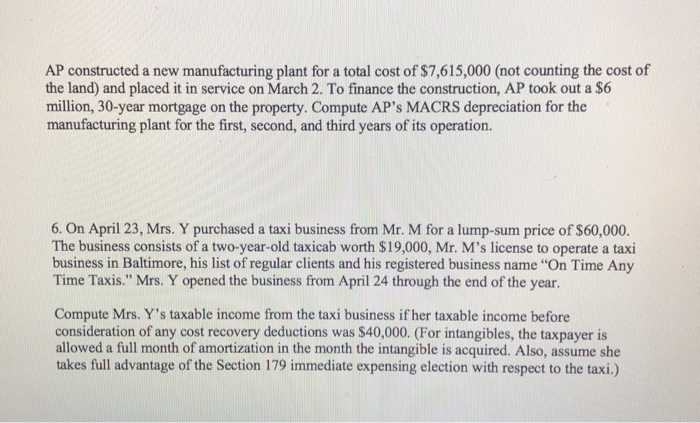

Section 179 Intangibles

Prior to amendment text read as follows.

Section 179 intangibles. Intangibles internal revenue service skip to main content. Any asset written off under section 179 must be used more than 50 percent in a trade or business and only the business percentage is written off. Section 197 intangibles are certain intangible assets acquired after august 10 1993 or after july 25 1991 if chosen in connection with the acquisition of a business which must be amortized over 15 years from the date of acquisition regardless of the assets useful life.

The irs allows businesses to write off the entire cost of an eligible asset in the first year. Every dollar you deserve. You buy finance or lease qualifying equipment vehicles and or software and then take a full tax deduction on for this year.

Assets used 50 or less by your business. For purposes of section 197 intangible assets include. For purposes of this section the term section 179 property means any tangible property to which section 168 applies which is section 1245 property as defined in section 1245 a 3 and which is acquired by purchase for use in the active conduct of a trade or business.

That s why almost all types of business equipment that your company buys or finances will qualify for the section 179 deduction. To give you an estimate of how much money you can save here s a section 179 deduction calculator to make computing section 179 deductions simple. What are section 197 intangibles.

It includes things such as. To qualify for a section 179 deduction your asset must be. Real property e g land building sidewalks landscaping parking lots.

For tax years beginning after 2017 the tcja increased the maximum section 179 expense deduction from 500 000 to 1 million. Used more than 50 in your business. All businesses need equipment on an ongoing basis be it machinery computers software office furniture vehicles or other tangible goods.