Section 4 6 Of The Securities Act Of 1933

Section 230 506 of title 17 code of federal regulations as revised pursuant to this section shall continue to be treated as a regulation issued under section 4 2 of the securities act of 1933 now 15 u s c.

Section 4 6 of the securities act of 1933. Rule 506 of regulation d provides two distinct exemptions from registration for companies when they offer and sell securities. However regulation d does not address the offering of securities under this section of the 33 act. Promotion of efficiency competition and capital formation section 2a swap agreements section 3 classes of securities under this title section 4 exempted transactions section 5 prohibitions relating to interstate commerce and the mails section 6 registration of securities section 7 information required in registration.

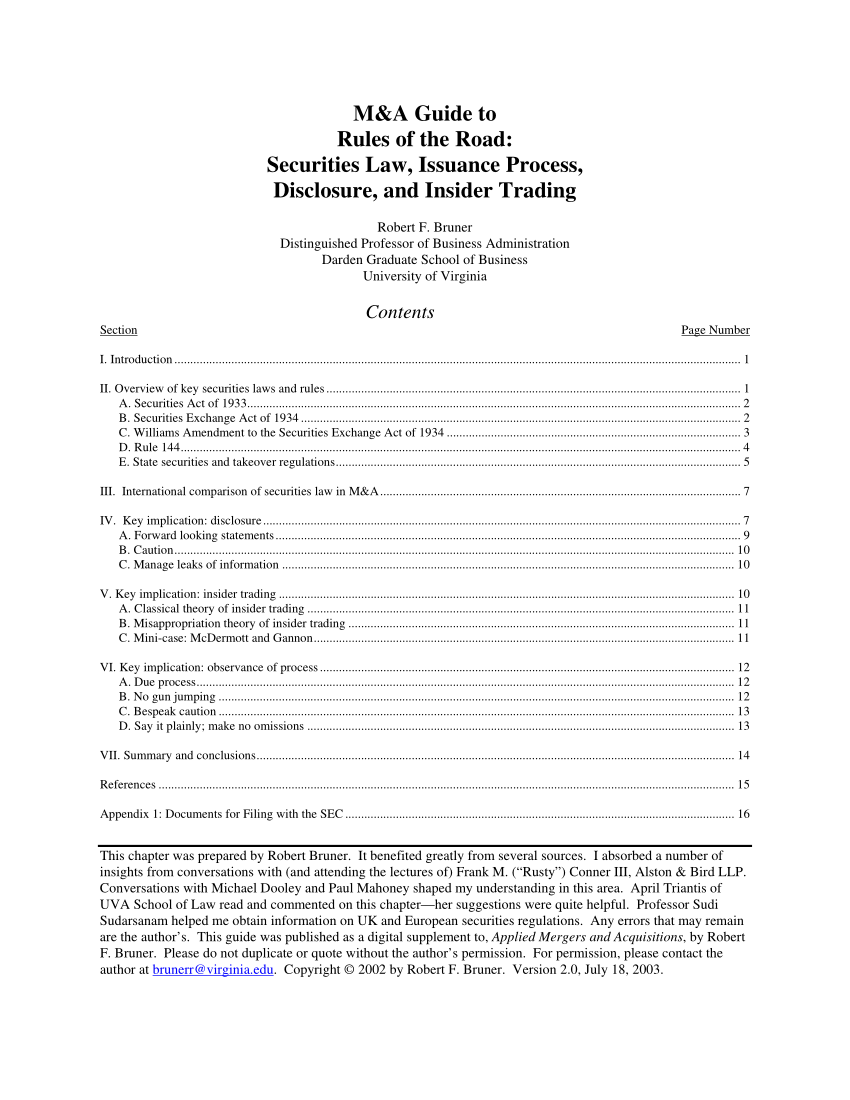

Section 4 1 of the securities act provides an exemption for a transaction by a person other than an issuer underwriter or dealer if the requirements of rule 144 are met the seller will not be deemed an underwriter and will be entitled to rely upon the safe harbor of rule 144 to resell their securities. Rule 506 b of regulation d is considered a safe harbor under section 4 a 2 it provides objective standards that a company can rely on to meet the requirements of the section 4 a 2 exemption. Section 4 a 2 of the securities act formerly section 4 2 but redesignated section 4 a 2 by the jobs act provides an exemption from the provisions of section 5 of the securities act for transactions by an issuer not involving any public offering companies rely on this private placement exemption for a wide variety of transactions including but not limited to initial sales of equity.

Practitioners seeking to rely on section 4 6 should be aware that such securities are not considered federally covered under section 18 of the securities act of 1933 and accordingly in addition to abiding by the federal securities regulations individual state securities laws must be considered. Section 4 a 5 of the 33 act exempts from registration offers and sales of securities to accredited investors when the total offering price is less than 5 million and no public solicitation or advertising is made. Companies conducting an offering under rule 506 b can raise an unlimited amount of money and can sell securities to an unlimited number of accredited investors.

Companies relying on the rule 506 exemptions can raise an unlimited amount of money. The amendments made by this subsection amending this section and sections 78m and 78n of this title shall take effect on october 1 2011 except that for fiscal year 2012 the securities and exchange commission shall publish the rate established under section 6 b of the securities act of 1933 15 u s c. The securities act of 1933 also known as the 1933 act the securities act the truth in securities act the federal securities act and the 33 act was enacted by the united states congress on may 27 1933 during the great depression and after the stock market crash of 1929 legislated pursuant to the interstate commerce clause of the constitution it requires every offer or sale of.