Winding Up Of Section 25 Company

Preserve the limited liability company s business or property as a going concern for a reasonable time.

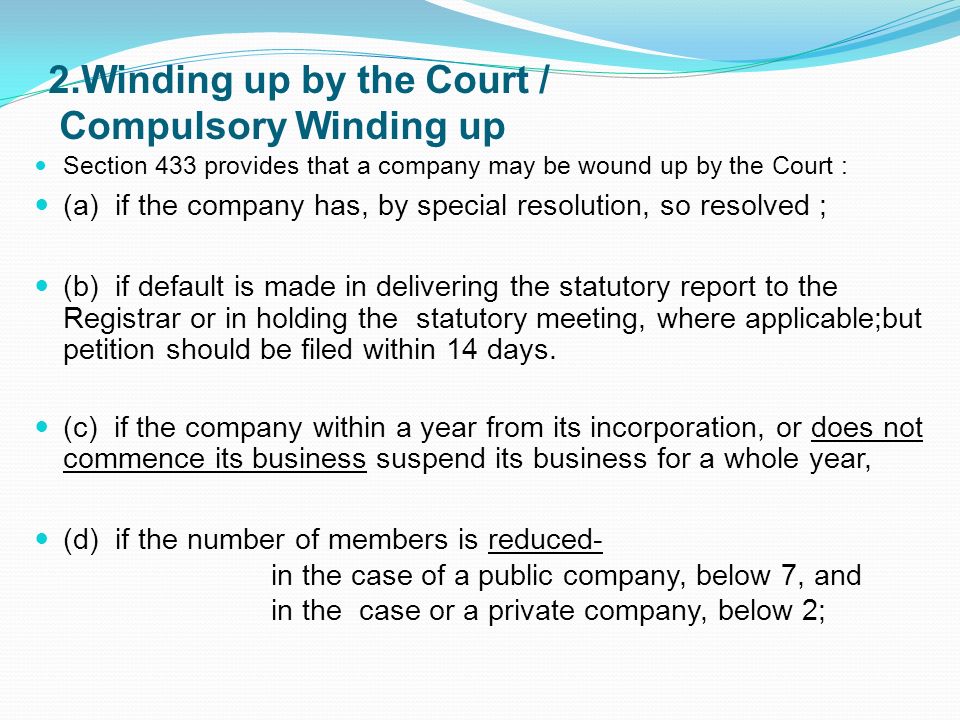

Winding up of section 25 company. Prosecute and defend actions and proceedings. Number of members has reduced below 7 for a public company or 2 for a private company respectively. Non commencement of the company in business within one year of incorporation.

The surplus assets if any may be given to a similar charitable concern. Winding up of the company section 25 company can be wound up if the objects for which it had been established are fully achieved. It should be noted that in such a case secs.

Aâ partnership firm is allowed to be a memberâ of the section 25 company sub sec 4 inspite of the fact that the law does not recognizes them as a legal person. I need to close or wind up a section 25 company please help me by providing the step by step process with check list as it cannot be done through fte fast tack exit and as first license of section 25 company need to be surrendered i have also prepared a processand a check list but need to consult and re confirm. 508 and 509 shall apply as if the winding up were a creditors voluntary winding up and not a members voluntary winding up.

If in the case of a members voluntary winding up the liquidator finds that the company is insolvent secs. The debts of the company are unpayable by the company. 508 and 509 shall apply to the exclusion of secs.

A may file a certificate of dissolution with the secretary of state to provide notice that the limited liability company is dissolved. Section 25 of the companies act 1956 and enter the word limited or private limited at the end of the name of the company. The only limitation in this regard is that on dissolution of such a firm its membership of the company ceases.