Deduction Under Section 35ac

Accordingly the benefit of deduction under section 35ac of the i t.

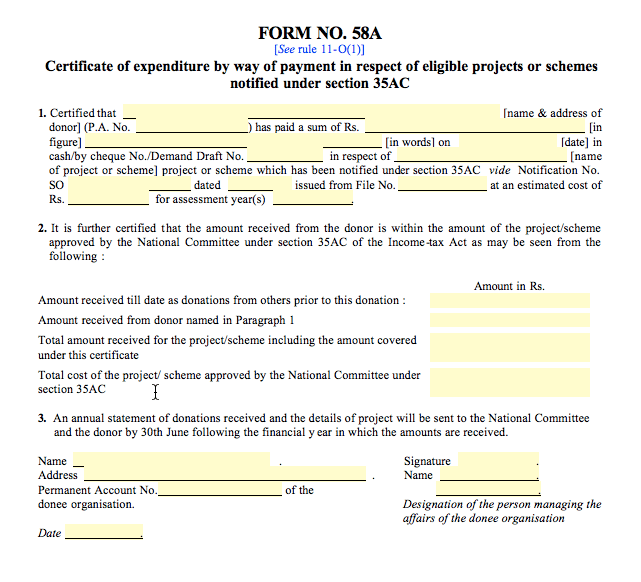

Deduction under section 35ac. 5 8a under rule 11 1 of income tax rules. Deduction under section 35ac. Sections 35ac and 80gga have something in common with regards to income tax deductions.

Section 80gga is a. It may be noted that requests received after december 31 2016 for the grant modification extension of approval beyond. Insertion of new section 35ac.

Act is available only up to previous year ending 31 03 2017 assessment year 201 7 18 in respect of payments made to association or institution already approved by the national committee for carrying out any eligible project or scheme. Therefore for the assessees who do do not have income from business or profession section 80gga provides for deduction on donations made to eligible projects under section 35ac. Consequences of claiming deduction under section 35ad the following consequences should be noted if deduction is claimed and allowed under section 35ad the assessee shall not be allowed any deduction in respect of the specified business under the provisions of chapter via under sections 80hh to 80rrb or under section 10aa for the same or any other assessment year.

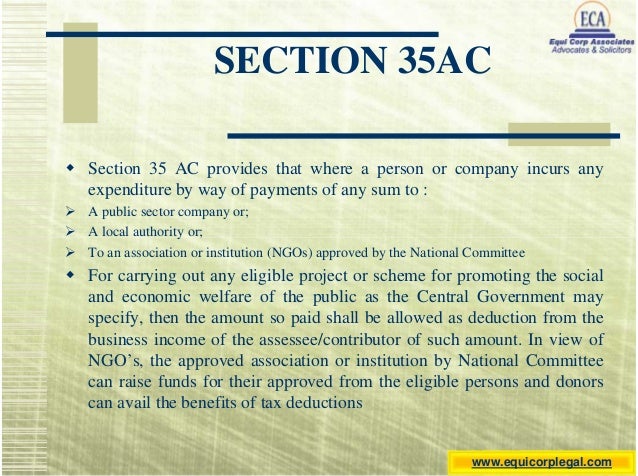

Government today said the benefit of deduction under section 35ac of the it act will only be available till march 31 in respect to the payments made to association or institution approved by the national committee for carrying out any eligible project or scheme. After section 35ab of the income tax act the following section shall be inserted with effect from the 1st day of april 1992 namely. Deduction under section 35ac and 80gga.

But this section provides benefits to only those assessees who have income from the head business or profession under section 35ac organisations having income from business or profession can get 100 per cent deduction. Section 35ac is one of such sections. Charitable organisations can get registered themselves u s.

Section 35ac is available to assessees who have income from the head business or profession. Section 35ac of the income tax act permits deduction of whole of the amount of donation to a trust or fund or institution approved by the national committee for carrying out any eligible project or scheme such deduction is allowed on furnishing of a certificate for such payment in the prescribed form no. Deduction to a trust u s 35ac.