Section 4b Income Tax Act

Amount associated deduction estate income income year land leasehold estate own.

Section 4b income tax act. 5 1 interest income under paragraph 4 a of the ita. In other words the interest payable for the year is allowed as deduction whether. The provisions contained a number of anti avoidance provisions whose purpose was to counter possible abuse by non resident owners or the opportunity for resident owners to convert amounts taxable as ordinary income into capital gains.

Non business income. Apportionment of income between spouses governed by portuguese civil code. Section 139 4b of income tax act.

Subsections 4 5 and 5b override subsection 3. Such deduction is allowed on accrual basis not on paid basis. One of the provisions permitted a tax neutral transfer of assets between companies forming part of the same group of companies or intra group transactions.

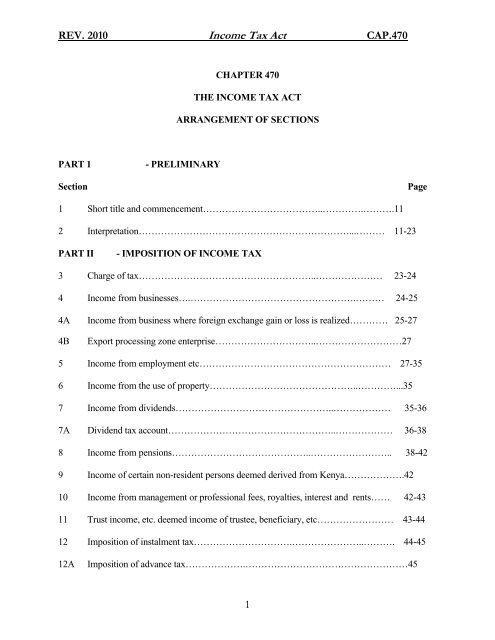

Section 139 4b requires political parties to file income tax return in case the total income exceeds the maximum allowable tax exempt limit. 1961 income tax department all acts income tax act 1961. 1 short title 2 part i income tax 2 division a liability for tax 3 division b computation of income 3 basic rules 5 subdivision a income or loss from an office or employment 5 basic rules 6 inclusions 8 deductions 9 subdivision b income or loss from a business or property 9 basic rules 12 inclusions 18 deductions 22 ceasing to carry on business.

The chief executive officer whether such chief executive officer is known as secretary or by any other designation of every political party shall if the total income in respect of which the political party is assessable the total income for this purpose being computed under this act without giving effect. For the purpose of section 4 gains or profit from a business shall not include any interest that first becomes receivable by a person in the basis period for a year of assessment other than interest where subsection 24 5 applies. The income tax department never asks for your pin numbers.

Inserted with effect on 1 april 2013 and applying to an amount that is incurred or derived on or after that date in relation to a lease or licence entered renewed extended or transferred on or after that date on 17 july 2013 by section 48 1 of the taxation livestock valuation assets expenditure and. Scope of total income. Section 24b of income tax act allows deduction of interest on home loan from the taxable income.