Hra Exemption Under Section 80gg

Thus an individual can claim a deduction for rent paid even if he or she does not get house rent allowance.

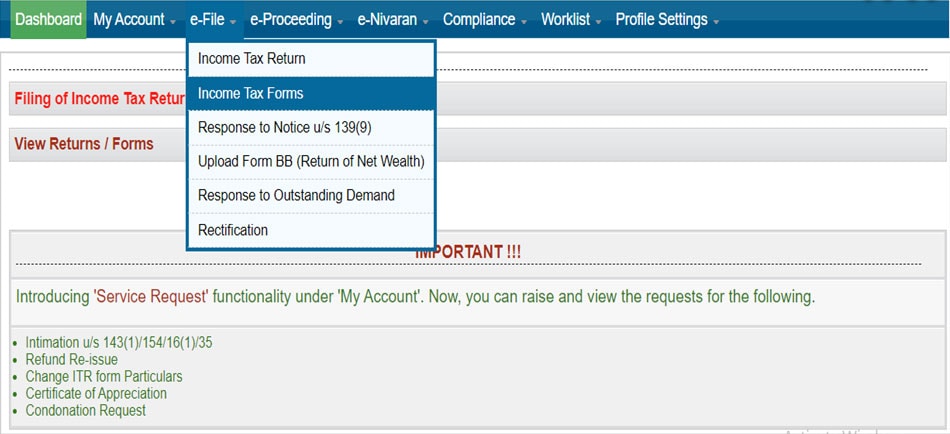

Hra exemption under section 80gg. Section 80gg provides deduction in respect of rent paid by an assessee for an accommodation occupied for residential purpose who is not in receipt of hra qualifying for exemption u s 10 13a some distinguish point between hra exemption deduction u s 80gg are a follows. And in the salaried job individual must not be entitled to receive any hra for that assessment year. Submit the rent receipts to your employer and this will be included in your form 16.

For more information read this article on on section 80gg. Exemption on hra is available under section 10 13a. If you are salaried and receive hra you cannot claim this deduction.

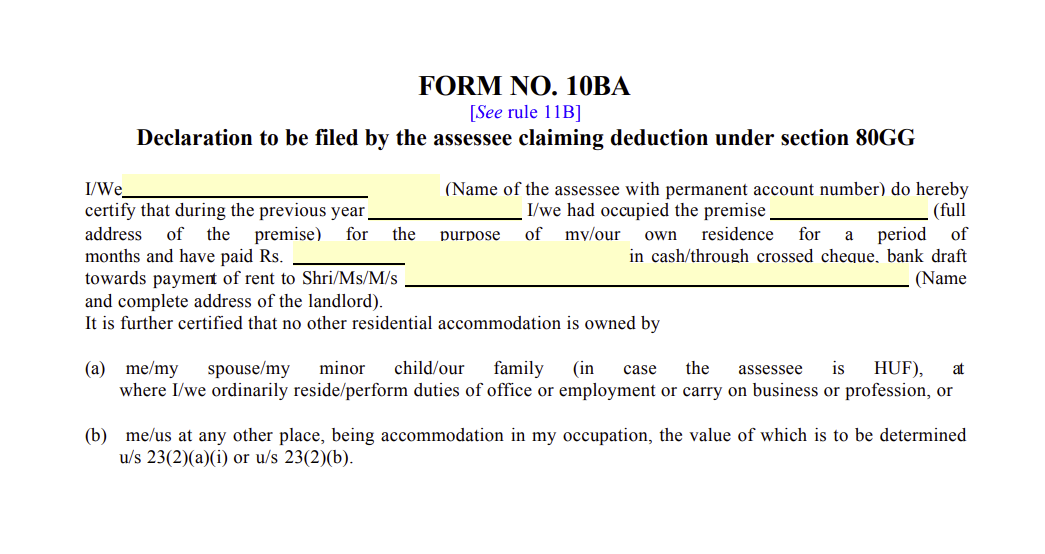

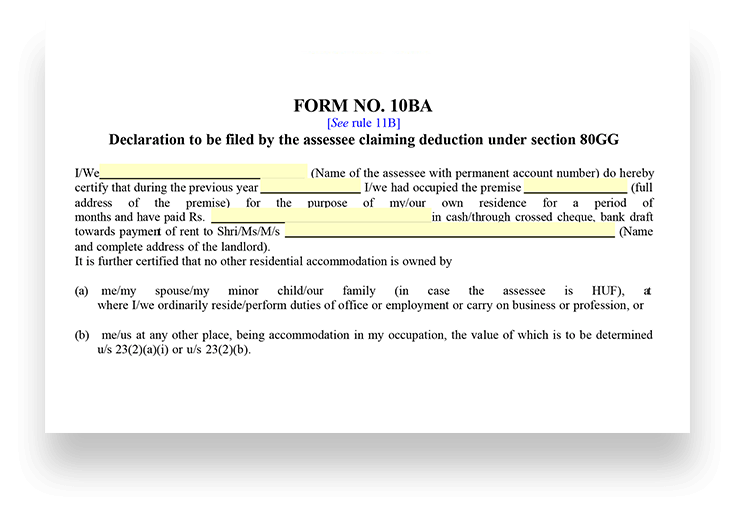

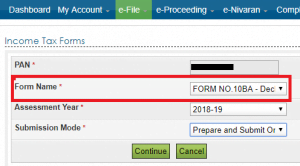

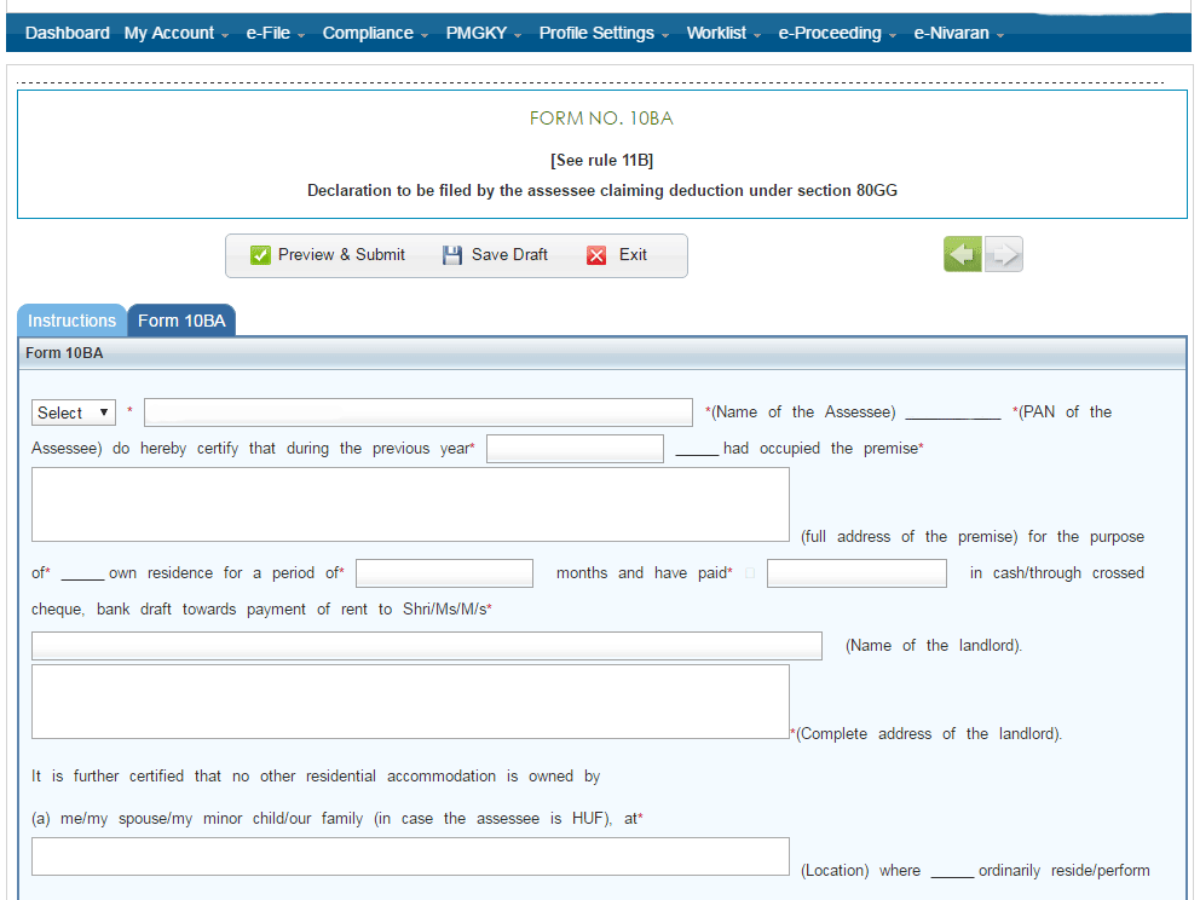

In case you are not in receipt of hra and you are paying rent then you may claim tax deduction under section 80gg of it act 1961 subject to certain deductions. What is section 80gg. If you do not receive hra from your employer and make payments towards rent for any furnished or unfurnished accommodation occupied by you for your own residence you can claim deduction under section 80gg towards rent that you pay.

Deduction under section 80gg. Here are a few conditions that must be fulfilled. Under section 80gg the lowest amount of the following is tax exempt.

Under section 80gg an individual can claim deduction for the rent paid even if he don t get hra. How to calculate deduction u s 80gg. The deduction under section 80gg is given to the least of the following.

Section 80gg allows the individuals to a deduction in respect of house rent paid by him for his own residence. 25 of the total income excluding long and short term capital gains actual rent paid minus 10 of total income rs 60 000 a year rs 5 000 per month. Deductions is respect of rents paid.